Comment

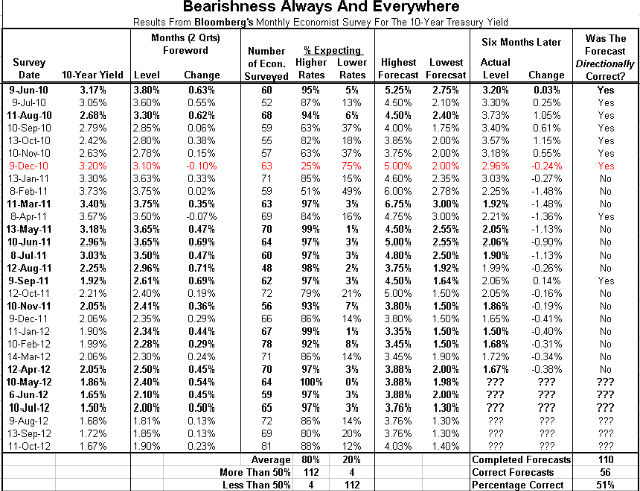

We last detailed our laundry list of bond haters earlier this year. The list is long and includes some very impressive names. We have also highlighted the table below which currently shows 88% of economists surveyed (71 of 81) expect higher rates in the next six months. Back in May, when the 10-year was 2.40%, 100% of economists surveyed (64 of 64) thought rates would be higher in six months. As of this writing the 10-year is at 1.75% and November is just two weeks away.

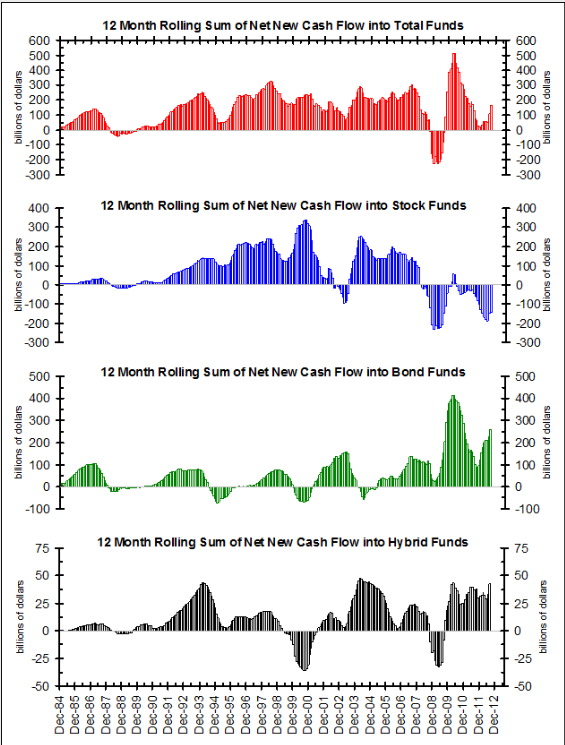

Despite this bearishness, many investors are still throwing money into bond mutual funds. The chart below bears this out. The second panel in blue shows continued outflows from all stock funds while the third panel in green shows hefty inflows into all bond funds.

The bears will often scratch their head at these flows and assume the public is making a huge interest rate bet. However, this is not necessarily the case.

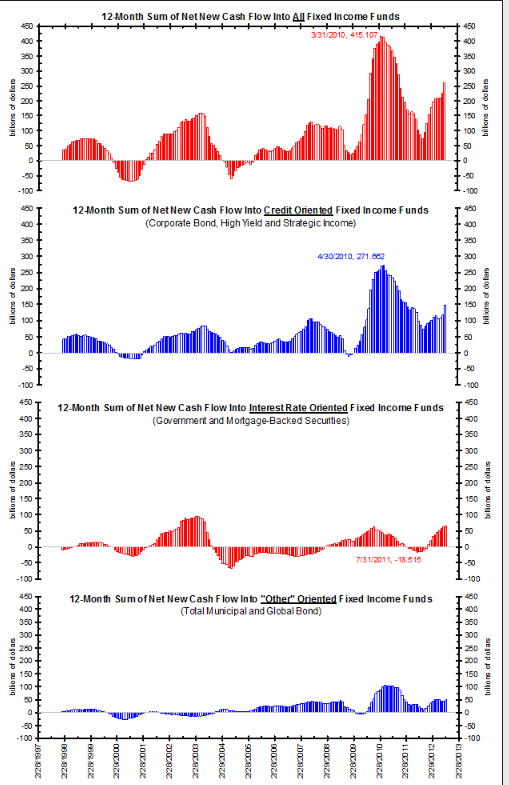

As the chart below shows, the public’s inflows into bond funds peaked in March 2010 and has since pulled back significantly. Of the $261.15 billion in flows into bond funds over the past year:

Over half of these flows ($146.86 billion) are going into credit focused funds. This group includes corporate bonds, high yield, and strategic income.

Flows into muni and world funds (bottom panel in blue), which are tax plays or currency bets, are getting another $49.19 billion of the public’s flows.

The pure interest rate bet of government and mortgage funds are getting less than 25% of all inflows ($65.11 billion). These funds were getting outflows less than a year ago.

Add it up and we do not see a big interest rate bet being made by the public. We see tax plays, currency bets and a big bet in corporate bonds, which can also be described as a low-beta stock market bet.

Treasuries are bought by the Chinese central banks, the Japanese central bank, the Federal Reserve, and dealers/banks capitalizing on carry trades thanks to the Federal Reserve’s 2014 low-rate guarantee. That’s it! Because the Federal Reserve is unlikely to take back this low rate pledge, we do not expect this list of buyers to drastically change over the next couple years.

So what hurts the bond-buying public? Since they are making a big credit bet, one could argue a big correction in equities that dramatically widens credit spreads would be more harmful than a rise in interest rates.

Source: Bianco Research

What's been said:

Discussions found on the web: