• CNBC – Volcker Says Rule Is Already Changing Wall Street

Volcker told “Squawk Box” co-host Andrew Ross Sorkin that the rule has already been effective. “Banks have stopped their straightforward proprietary trading operation, and they’ve largely cut back on their hedge funds and equity funds,” Volcker said in the interview broadcast Thursday. “And as the managements and the directors finally understand that ‘yes, this is a law that has to be followed,’ they’ll be able to manage their trading desks in what I think is an effective way.”

Comment

In a November 8 post we examined the fact that the general collateral repo rate has been trading through the federal funds effective rate, questioning why a secured rate would have a higher rate than an unsecured rate. We concluded with the following:

In talking to some of the dealer desks, many pointed to the new capital/leverage restraints of the past several years as the main reason they could not capitalize on such an opportunity. Without being able to expand their balance sheets, their cash was already tied up elsewhere. Others pointed to the fed funds market as being a bit dysfunctional. While fed funds volume prior to the crisis normally reached $250 billion a day, current volume is closer to $20 billion a day. Since the banks/dealers have no need to raise funds, the GSEs are the only real participants left in the fed funds market.

While both of these explanations make sense, they have largely been true since the crisis hit full stride in 2008. The GC rate has only materially traded above the fed funds in just the last few months. We believe this latest inversion is yet another market signaling concern over the fiscal cliff.

If Washington fails to come to an agreement on the debt ceiling and U.S. debt gets downgraded, the contracts underlying the majority of repo transactions would basically need to be rewritten. As of now these contracts require AAA Treasury securities as collateral, so a downgrade by a second rating agency (S&P already downgraded U.S. debt to AA+) would be problematic as the majority rating would no longer be AAA.

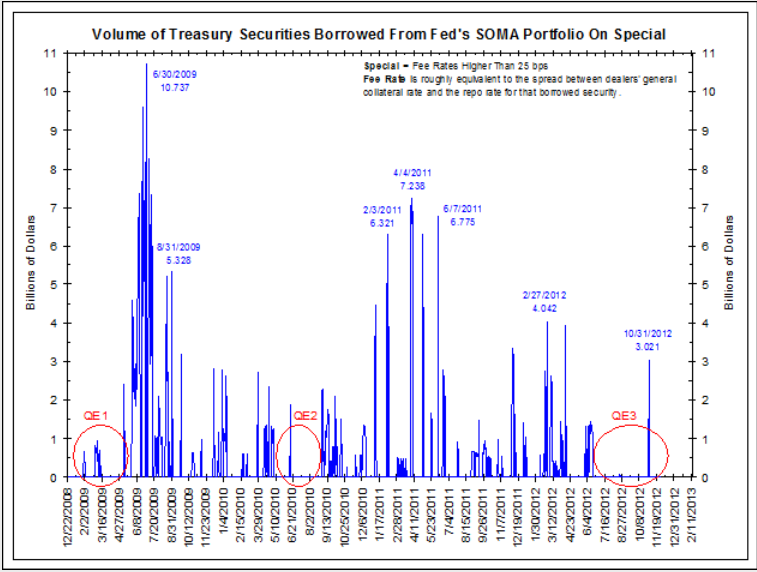

In a post last week we highlighted yet another possible explanation for such a disconnect in the markets. As Alhambra Investment Partners pointed out, there have been very few securities borrowed from the Federal Reserve’s SOMA portfolio on special since June of this year.

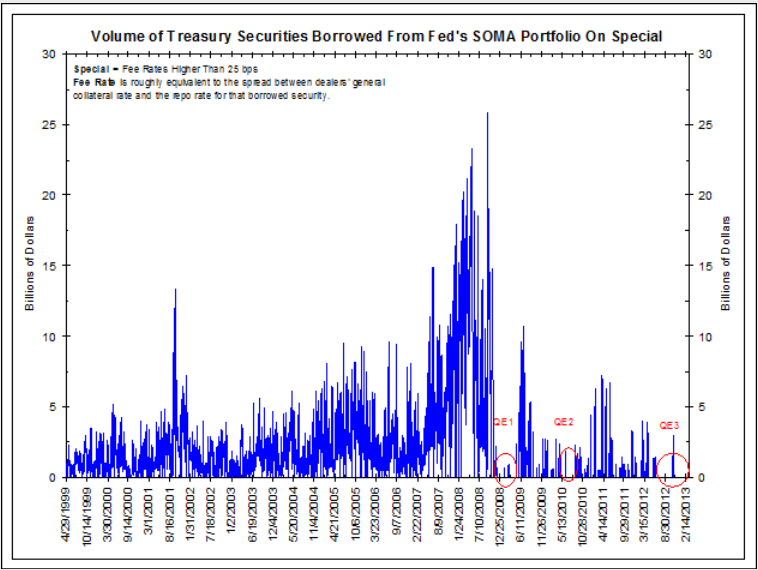

Using data from the New York Federal Reserve, we managed to construct the same chart as Alhambra Investment Partners, taking the data back even further. What we find particularly interesting is the lack of specials prior to the announcements of QE1, QE2, and QE3, highlighted by the red ovals.

For the purposes of this chart, a Treasury security is considered to be on special if the fee rate is 25 basis points or more. The fee rate is roughly equivalent to the spread between the dealers’ general collateral rate and the repo rate for that borrowed security. So, a security on special is one that trades 25 basis points or more below the general collateral repo rate.

Why is the lack of specials notable? As Alhambra Investment Partners explains:

In a crude way, the amount or volume of “specials” in the repo market tells us something about the willingness of credit market dealers and speculators to short US treasuries. An elevated volume or number of special repo securities would indicate that there are a lot of short positions in the liquid markets. Conversely, a dearth of specials might indicate a lack of short US treasury positions.

As of November 28, the Federal Reserve held $1.64 trillion of Treasury securities. If a dealer were looking to borrow a Treasury security in order to short it, the Federal Reserve and its massive portfolio would be an obvious counterparty. It is worth noting the lack of specials since late July (the October 31 squeeze was a technical issue due to Hurricane Sandy shutting down many NYC dealers).

How unusual is it to go so long without any specials? Data from the New York Federal Reserve goes back to 1999 and the current period is by far the longest such period ever seen. The periods before QE1 and QE2 were the next longest periods.

We believe this dislocation is occurring for two reasons – the various rounds of quantitative easing and the Volcker Rule. As the charts above highlight, the periods showing the fewest Treasury securities being borrowed on special tend to occur prior to anticipation of new rounds of QE. In short, nobody wants to short Treasuries during these periods and get run over by the Federal Reserve.

Additionally, as the story above suggests, the Volcker Rule is already changing the landscape of Wall Street. The simple fact that banks must reign in their prop desks means the demand for Treasury securities for shorting purposes is decreasing.

Conclusion

If dealers are either afraid to short because of the Federal Reserve or cannot short because of the Volcker Rule, rates may stay low for much longer than many anticipate. The Volcker Rule is highly unlikely to be repealed anytime soon (it only went into effect mid-year), leaving the Federal Reserve as the only variable in this equation that could change. However, they would only do so if inflation expectations rose to a level that forced them to bring an end to their current open-ended QE.

The fact that dealers are unwilling and unable to short the Treasury market is nothing new. The lack of specials in the repo market is just another graphical representation of the dislocation occurring because of the Federal Reserve and the Volcker Rule.

Source: Bianco Research

What's been said:

Discussions found on the web: