It has been my position that Sequestration is not that big a deal, it is likely to be eventually resolved with minimal impact, oh, and even if implemented, it is a minor hit to GDP.

If you want the corollaries to this, it is the creation of an incessant media noise machine, initially CNBC but now enjoying the widespread MSM adoption of a congressional sex scandal. Its meaningless in the long run, but it generates page views.

If you want to reveal your ignorance in the matter, just use the phrase “Fiscal Cliff” — its code for “I haven’t any idea what I am talking about, but lets jump on the bandwagon and hope no one notices.”

To wit: the hardening of positions as the supposed deal has fallen apart. Both political parties seem to simultaneously want AND be afraid of a deal. President Obama put Social Security on the table — it has nothing to do with the deficit, and has therefore enraged his core supporters. House Speaker Boehner put tax increases on the table, and suffered a rear guard revolt. His job is in danger, with a few names floated as replacing him. Each side seems to be secretly hoping for a miracle, namely, sequestration occurs, and the other guys get blamed. I guess this is what passes for leadership these days.

Now, with deals falling apart and positions hardening, it means the end of the market rally.

Or does it?

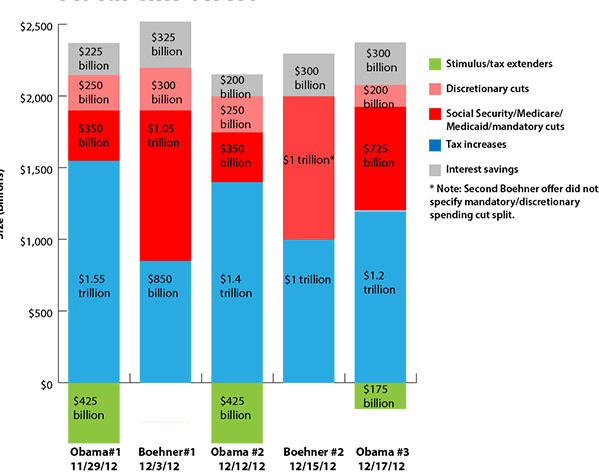

As the chart below shows, myriad deals points have been floated, endorsed, critiqued and rejected. All the while, Santa has come to Wall and Broad. The S&P500 is 100 points higher than where it was a month ago, despite little motion on a deal. Regardless of what your views on the current theater of the absurd in DC, the one thing that is inarguable is that as the compromise deals have fallen apart, the markets have shrugged it off and powered higher.

I have repeatedly stated that day-to-day action is nearly all noise, and most explanations are after-the-fact rationaliztions. Every rally ends, and this one could sputter to an end today. But I am curious as to how the Rise Above clown show will explain the current market action if it continues to power higher in the face of (the horror!) uncertainty . . .

Sequestration Offers and Counteroffers

Source: Wonkblog

What's been said:

Discussions found on the web: