Click to enlarge

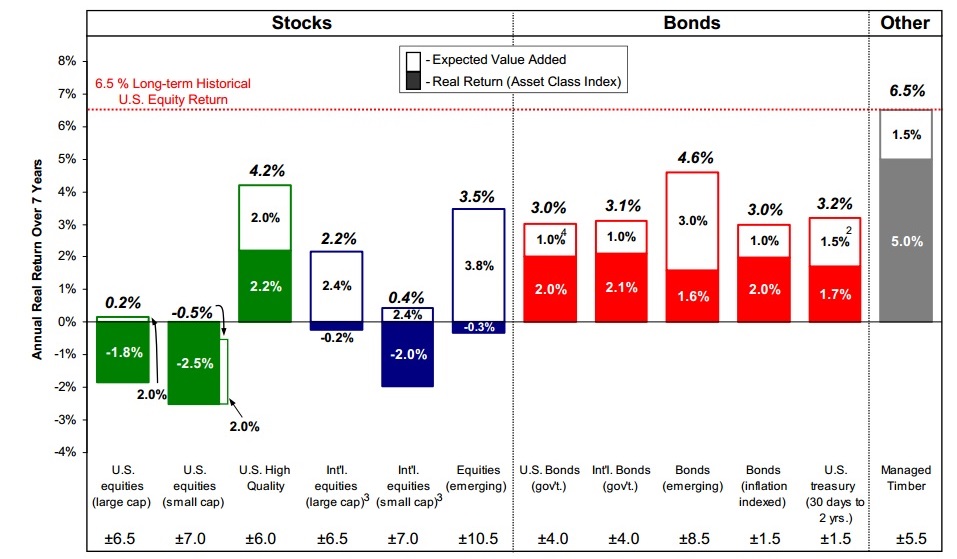

GMO 7-Year Asset Class Real Return Forecasts: 2007

Have a look at the charts above and below. They are from James Montier’s GMO Quarterly Letter, July 2013, titled The Purgatory of Low Returns; you can download the full PDF here (registration may be req’d).

(Note to Josh: This quarter, Ben Inker and Montier filled in for the big dog in the quarterly letter. Even Grantham misses a letter deadline sometimes! )

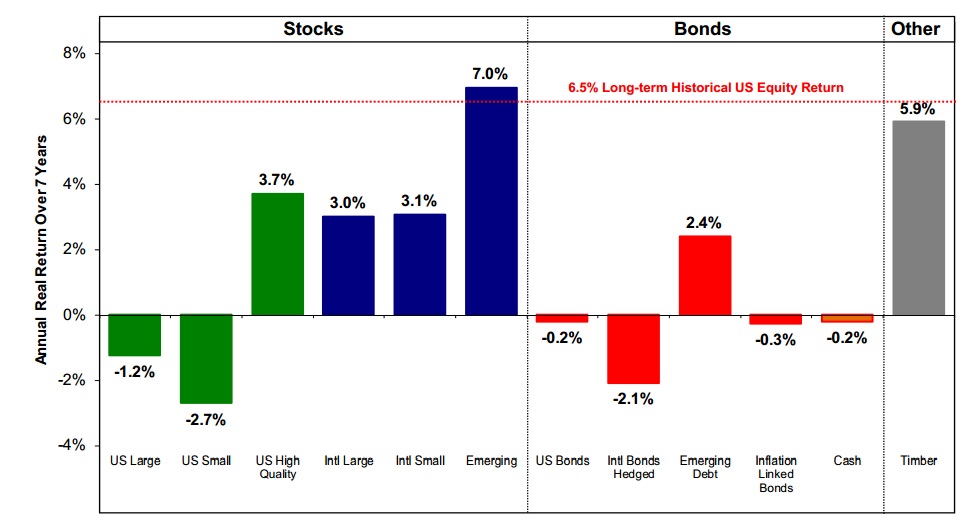

The chart above is forward 7 year asset class return expectations from 2007. The chart below shows the same forward 7 year asset class return expectations from 2013.

Notice where the potential best returns are: For long term and patient investors, the opportunities for the best return on investment are places that may be somewhat uncomfortable today: Emerging Markets, which have been shellacked and are widely reviled following that collapse; International large and small cap, which means in no small measure Europe. And lastly, US high quality companies — which many people insist are on the verge of rolling over.

Whether you agree with these views or not, you must recognize that Grantham’s methodology is sound and that his long term track record is outstanding. He tends to be early, but that’s no surprise when you think in terms of investment arcs of 7 years.

If you run an asset allocation model (as we do), you should think about increasing your exposure to EM and Europe — but only if you (and/or your clients) are patient investors.

Many people believe they are patient investors, but few actually behave that way.

GMO 7-Year Asset Class Real Return Forecasts: 2013

Source: GMO

Source:

The Purgatory of Low Returns

James Montier

GMO Quarterly Letter, July 2013 http://www.gmo.com/websitecontent/GMO_QtlyLetter_ALL_2Q2013.pdf

What's been said:

Discussions found on the web: