Time for an important lesson with someone else picking up the tuition costs:

It is the Meredith Whitney story, and it is instructive to those of us who work in finance and occasionally engage the media. Any of you who might think an outrageous call is the way to achieve lasting fame and fortune on Wall Street, Ms. Whitney’s story might be an instructive tale of warning.

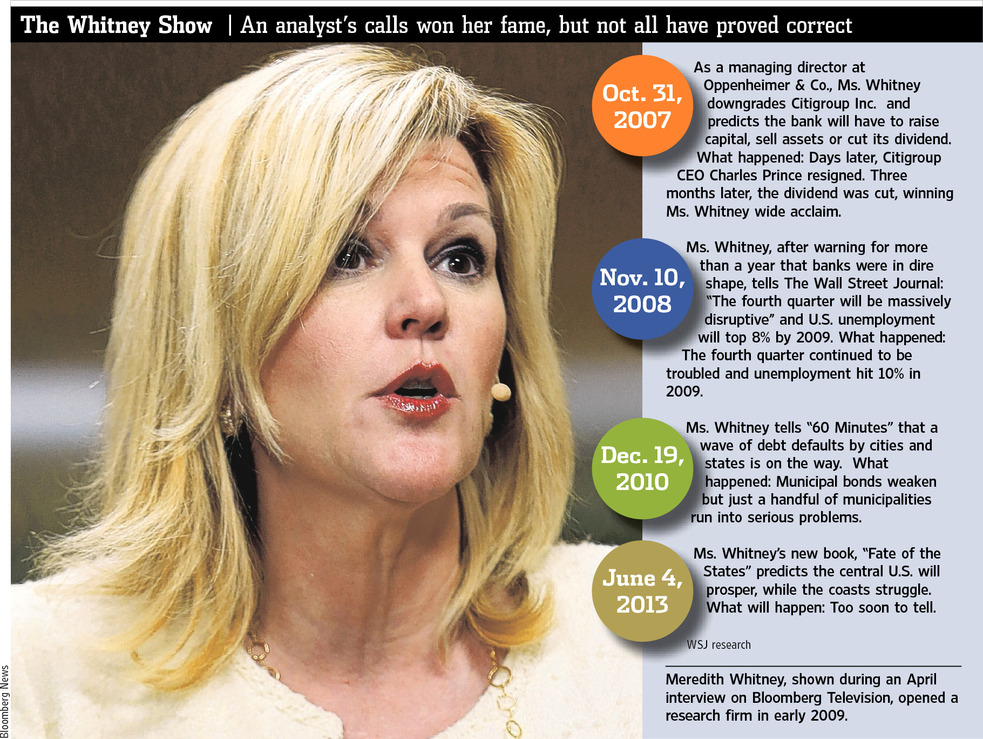

After a good (but far from unique) downgrade on Citigroup in 2007, Ms. Whitney found herself thrust into the spotlight. The former Oppenheimer analyst launched the Meredith Whitney Advisory Group two years later, with a full staff and 30 top tier blue chip clients. Less than 5 years later, she has lost half her client base, is down to 1 full time employee, and won’t comment to Greg Zuckerman of the WSJ in a story that is about her.

I don’t want to pile on — at this point, it would just be cruel — but it might be instructive to see where things went amiss. Anytime we have an opportunity to learn from someone elses mistakes, it is incumbent upon us to do so.

What can we learn from Ms. Whitney story? I see five lessons that I would take from her unfortunate experiences:

1. Leveraging a call into a new business is challenging: History is replete with examples of one hit wonders who never turned out any thing beyond that pop song. There are too many to list here in music (Wikipedia arranges them by decade).

In finance, some of the names who made a great call, but then failed to follow that are well known. The poster child is Elaine Garzarelli who improbably called the 1987 crash*, only to never repeat that feat or anything like it. Others might put Nouriel Roubini in that camp, but he has created a firm that seems to operational, and regardless seems to have a career otherwise. And who was that copycat analyst who forecast QCOM running to $2000? He tried to take a page from Henry Blodget’s playbook of calling Amazon to $400 — and failed.

2. Media buzz is not a business model: Regardless, these outrageous calls (right or wrong) are not what the VCs would describe as “a sustainable business model.” It generates some buzz, some attention, some media headlines. But the attention span of the American public (and therefor the media) is notoriously short. It’s like a drug with a fast developing tolerance. If you want to stay in the spotlight, you have to take bigger and bigger doses, which in media terms translates into more and more outrageousness. That increases the odds that you will eventually blow up spectacularly.

3. Stick to what you do best: Whitney was a bank analyst, and she (somehow) believed that qualified her to discuss municipal bond finances. Her December 19 2010 call on 60 Minutes — predicting “hundreds of billions of dollars” of municipal defaults within 12 months — failed to pan out. Instead, defaults fell. Bt she rocked the muni bond market, caused headlines for months — even as the prediction was falling flat on its face. She was apparently operating outside of her comfort zone, in a huge market she had little expertise in.

The response was not swift but it was savage: Professionals questioned her analysis as well as her motives. (In our ThinkTank, David Kotok repeatedly called her out on her sloppy, sensationalistic non-analyses). Well established muni bond players were deeply offended by her blase disruption of a serious market. She failed to consider that Munis pay for things like roads, and bridges and hospitals and schools.

Perhaps a corrollary lesson is “Be wary who you piss off .”

4. Make sure your firm is filled with happy workers: Some of her former staff’s comments in the WSJ article are catty. They complain about her work habits; They note she often is “working” from Bermuda where she owns a home on a resort. These sorts of reveals usually come from an angry and underpaid staff.

The people who work for you are the ones who make you look good. If you don’t treat the right, don’t be surprised if they respond in kind (karma is a bitch).

5. Add value to your clients: But the bottom line is her $100,000 annual fee simply did not pay for itself. Not only is that on the high end — more than double what shops like Ned Davis Research charges — it did not seem to create much in the way of actionable or value added work product.

Pricey, seemingly useless research is not what the Street needs more of . . .

Developing a sustainable, scalable finance model that adds value to clients should be job one for all new finance start ups.

Source:

Clients Come, Go at Research House

Greg Zuckerman

WSJ, July 7, 2013

http://online.wsj.com/article/SB10001424127887323689204578570354180830628.html

See also:

How Meredith Whitney Deals with Haters (TRB)

______________

* I am aware that there is a contingency who believe that even that call is suspect.

What's been said:

Discussions found on the web: