Source: The Economist

The Plunge in Petroleum

January 8, 2015 11:30am by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

Revisiting PlutonomicsNext Post

Our Upcoming Seattle Trip!

160 for Venezuela? XLent! the devil’s excrement

I find it interesting that all the people who didn’t predict the Arab Spring know the cost of petrol production to the thaler.

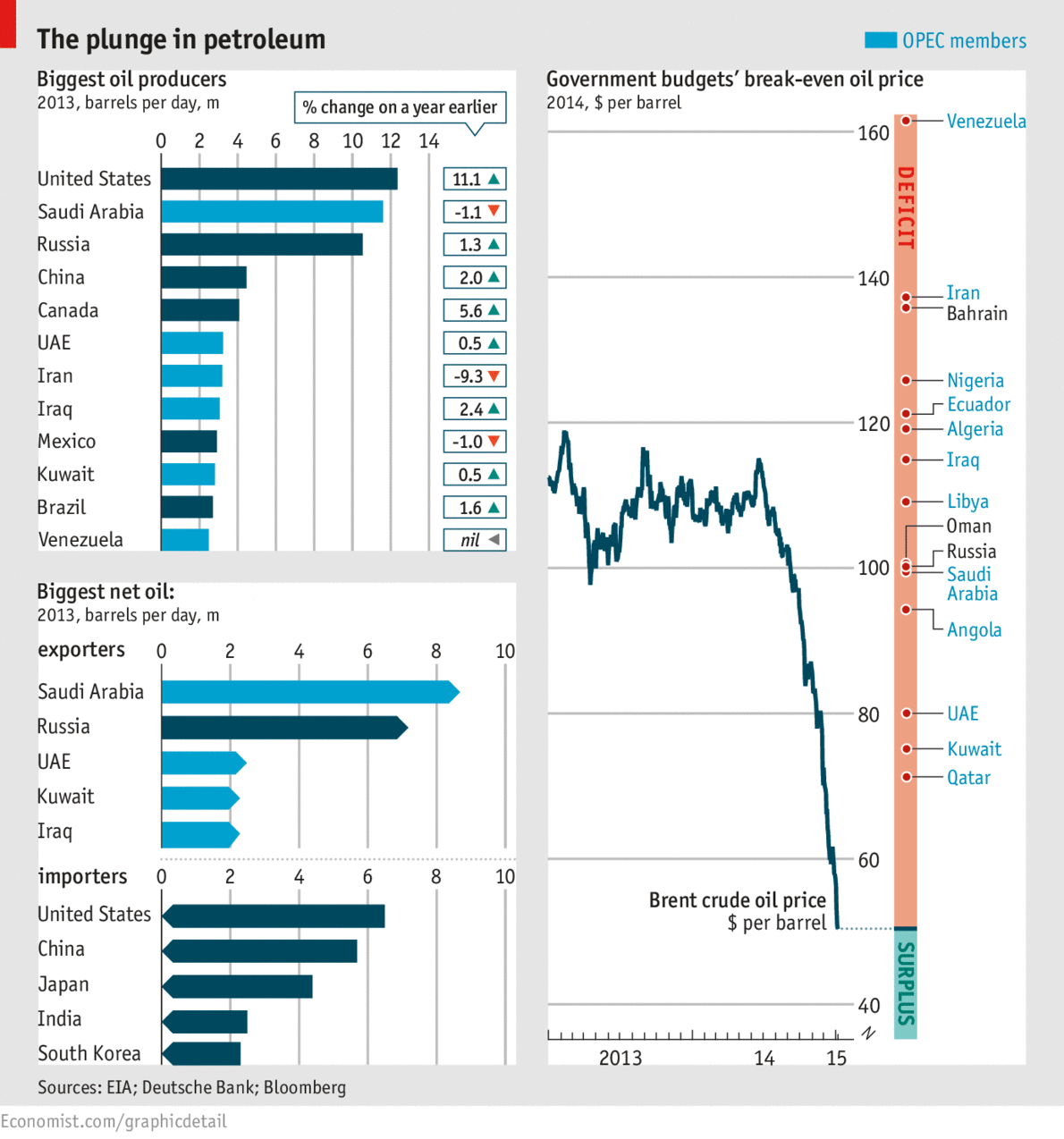

So the 3 biggest net importers are US, China and Japan. They would also be the biggest beneficiaries of the drop in prices.

So what is this, the 3rd financial bubble(even though, you could say 97-06 was one big one, but they had different parts of allocation) that has crashed. This is what happens when wealth doesn’t “trickle down”. You create a big wealth class while everybody else loses wealth. Monetary policy tries to fill in the gaps by manipulating interest rates to boost the economy and that causes rampant speculation where ever the animal spirits feel it.

Even though it would suck, I would print 10 trillion in currency and shove it into economy just to piss the wealthy off.

This isn’t the bubble pop. That could be when the bankruptcies start to hit the frackers. Remember those real estate derivatives? I just heard a phrase the other day that seems apropos, though is escapes me who said it…”All those who have been seeking risk are going to find it.”

The table that no one wants to look at, while cheering the current decline in the price of oil, is the cost of production, by country – and for investors, by oil company.

It looks much more like a price war than anything else. The key tell is going to be, for us, how much production is going to go off line over the next year or so. The era to consider is what happened in the late 1990’s and the aftermath: oil fell to the $10-12 price range, and production, along with new exploration, went do, and prices then nicely rose back up; benefiting mostly the KSA.

In case you ever wondered where many coal company profits come from and how big a subsidy we are giving them when they mine on federal land:

http://thinkprogress.org/climate/2015/01/07/3609210/coal-companies-selling-to-themselves/

US$ unlikely to collapse anytime soon.

Have the Saudis and USA secretly conspired to push oil prices lower to crush Russia/Syria, Iran, Venezuela, etc. Just my conspiracy theory.

That is a widely held perception here (GCC).

The Economist leaves out, inexplicably, the biggest net oil importer of all: Europe (mainly Western Europe: Germany, France, Italy, Spain etc. ex Norway and of course Russia) at some 12 million bpd.

So, those low, low income tax rates in Russia hailed by the GOP Media Machine for years now aren’t so workable.

I guess the Republican thought leaders will come out and change their minds about low taxes for the lucky rich are always good no matter what.