Good Sunday morning. I am still on NY time, even though I am in sunny California, working my way through Napa on the way to San Francisco and Silicon Valley. That hasn’t stopped me from putting together some morning reads:

• 3 reasons investors still buy actively-managed funds (MarketWatch)

• How Tesla’s Batteries Will Power Your Home (Wired) see also Tesla’s Powerwall Event: The 12 Most Important Facts (Bloomberg) and see Elon Musk’s Grand Plan to Power the World With Batteries (Wired)

• Why the NFL Decided to Start Paying Taxes (The Atlantic)

•Back to Basics: Why G.E. Ditched Finance (New Yorker)

• Andreessen Horowitz, Dealmaker to the Stars of Silicon Valley (The Upshot)

• So You Want to be a Top Caller? (A Wealth of Common Sense)

• Want a Steady Income? There’s an App for That (NYT)

• 7 of the biggest ‘facts’ about unhealthy food that actually aren’t true (WonkBlog) see also How the gluten-free movement is ruining our relationship with food (WonkBlog)

• Anonymous Activist Gets Potholes Fixed By Drawing Giant Penises Around Them (FastCo Design)

• No Sharp Rise Seen in Police Killings, Though Increased Focus May Suggest Otherwise (NY Times) see also The Prosecutor Who Could Save Baltimore: Marilyn Mosby, who is black and from a family of cops, has charged several police officers in the case of Freddie Gray’s arrest and death. (Daily Beast)

Whats for brunch?

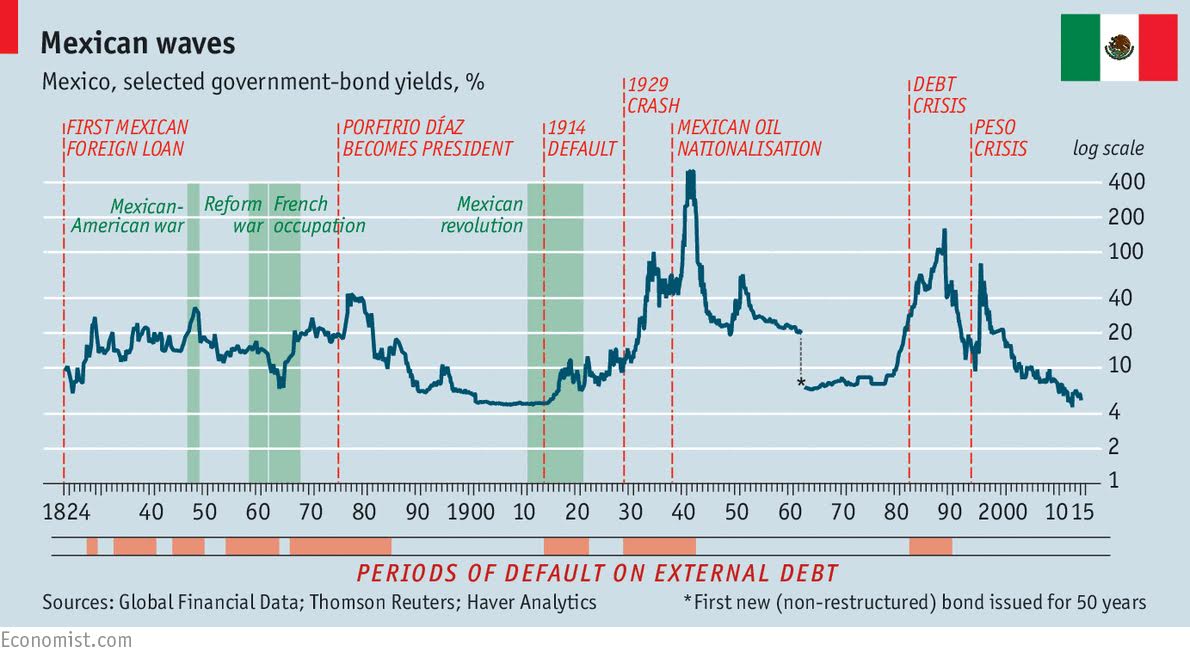

Investors take a century-long bet on boom-and-bust Mexico

Source: The Economist

US External Debt: A Curious Case

…the U.S. net international investment position — the difference between US assets abroad and foreign claims on the US — has moved substantially deeper into the red in recent years …

The answer, I believe, is that we’re looking at the differential performance of stock markets. …the value of foreign holdings of US equities (and the imputed equity component of foreign direct investment) has surged along with the Obama stock market, while US holdings abroad have seen no comparable boost.

Curiouser and curiouser.

Dark Matter or Base Erosion & Profit Shifting?

Exhibit A: “…the latest from the BEA which indicates that the U.S. holds $24.6 trillion in foreign assets while foreigners hold $31.6 trillion in our assets. So we have net debtor position equal $7 trillion at these recorded values. BEA’s Table 4.1 – Foreign Transactions in the National Income and Product Accounts – shows that we received $0.8 trillion in income on our holdings of foreign assets while foreigners receive only $0.6 trillion. What to make of this fact that the return on our holdings of foreign assets is 3.25% while foreigners receive only a 1.9% return?”

Exhibit B: “Ricardo Hausmann and Frederico Sturzenegger took the income flows reported by BEA and discounted them by 5%, which was the long-term government bond rate back then. If we updated their Dark Matter story using a 2% government bond rate representing current market conditions, the value of our holdings of foreign assets would be $40 trillion whereas the value of the U.S. assets held by foreigners would be only $10 trillion. In other words, they might argue that this is $17 trillion in Dark Matter. “

NB: According to a Ricardo Hausmann and Frederico Sturzenegger, “There is a large difference between our view of the US as a net creditor with assets of about 600 billion US dollars and BEA’s view of the US as a net debtor with total net debt of 2.5 trillion. We call the difference between these two equally arbitrary estimates dark matter, because it corresponds to assets that we know exist, since they generate revenue but cannot be seen (or, better said, cannot be properly measured).”

“I often say that when you can measure what you are speaking about, and express it in numbers, you know something about it; but when you cannot measure it, when you cannot express it in numbers, your knowledge is of a meagre and unsatisfactory kind; it may be the beginning of knowledge, but you have scarcely in your thoughts advanced to the state of Science, whatever the matter may be.” –Lord Kelvin

Or — all those dollars flowing to China to buy goods formerly made in America have to go somewhere and the Chinese aren’t dumb enough to sink it all into T-bonds. We’ve read plenty about Chinese individuals and companies buying West Coast real estate. It’s not a stretch to think they may be also investing in US companies. Although manufacturing (true manufacturing, not McDonald’s phony manufacturing) is in a long term tailspin, wholesalers and retailers should be doing well as well as (until recently) oil stocks.

Boehner: Special Interests, Money in politics, gerrymandering are not problems.

http://www.nbcnews.com/meet-the-press

Thanks GOP.

Iran to build F1 circuit

http://thejudge13.com/2015/05/03/f1-circuit-to-be-built-in-iran/

Comment so far are worth the time sink.

I’m supposed to be coordinating with my sister to manage my mother’s finances. I’m an indexer obsessed with low fees and just want to rebalance as needed.

Sister and bro in law are guilty of both one and two of MarketWatch article. They think active will out perform index and willing to pay fees to do that. They buy according to Morningstar ratings.

And yes, its not working.

Alan Levinovitz, who teaches philosophy and religion at James Madison University is anti-anti-Gluten

http://www.washingtonpost.com/blogs/wonkblog/wp/2015/04/24/how-the-gluten-free-movement-is-ruining-our-relationship-with-food/

This is like Republicans talking about Science. Thanks religion prof. GO Pray on it.

GOP = GO Pray on it if it doesn’t fit your funding source, lobbyists, and special interest supporters.

Reading this religion prof’s article is like reading the WSJ opinion page.

People thought gluten caused autism, we found it didn’t, therefore… it is ruing “our” relationship with food??

Huh?

Ringworm doesn’t cause the flu, therefore it’s good?

How does WaPa not slam this asshole?

Got to weigh in on the GMO article. The piece does little to illuminate the conversation and the commentary that follows contains no understanding. The phrase “scientists say GMO’s are safe” is repeated several times. No one seems to have a real picture. So far GMO’s are about growing food. There is nothing inherently safe or un-safe except by testing, the same as a pharmaceutical. That is, it would be perfectly possible to splice the code for hydazine from a fungus into corn and make corn that would destroy your liver. It hasn’t been done because there is no incentive to make toxic food.

Time for Catholics to dump their socialist leadership and embrace the religion of tax cuts cure alls!

http://www.chicagobusiness.com/article/20150502/ISSUE05/305029996/cupich-and-rauner-have-different-views-of-governments-moral-mission

The new Roman Catholic archbishop of Chicago has been on an introductory tour and had just returned from Springfield, where he met with legislative leaders and Gov. Bruce Rauner. “We just wanted to put a face on this for (lawmakers) as they continue their discussions,” he says, “this” being all the people who depend on the state for health, education, family support and other social benefits. “The safety net has got to be there.”

Tax cuts above all else. Low taxes work in Burundi and Sudan! Just look at the Gobi desert. And Wyoming.

Some of the arguments in the Wapo article about nutrition are pretty sketchy, especially when it comes to the more “man-made” ingredients they’re referring to. You could’ve used the same argument a century ago that there was no proof that cigarettes were harmful for your health by the science at the time – and we all knew how that turned out.

“If there is something in nature you don’t understand, odds are it makes sense in a deeper way that is beyond your understanding. So there is a logic to natural things that is much superior to our own. Just as there is a dichotomy in law: ‘innocent until proven guilty’ as opposed to ‘guilty until proven innocent’, let me express my rule as follows: what Mother Nature does is rigorous until proven otherwise; what humans and science do is flawed until proven otherwise.”

― Nassim Nicholas Taleb, Antifragile: Things That Gain from Disorder

Three Babies Lives Saved With 3D-Printed Growth-flexible Implants

http://www.themarketbusiness.com/2015-05-03-three-babies-lives-saved-by-3d-printed-implants

Boehner, McConnell and the Republicans told us science would come to a dead halt under the ACA.

What happened to the GOP’s grand future predicting skills that got it all right on how tax cuts for the rich create jobs and cut deficits? Oh, those were wrong too.

Why does anyone listen to Republican’s who claim they can predict the future?

Buffett celebrates 50th year at Berkshire, faces tough questions

http://www.reuters.com/article/2015/05/03/us-berkshire-buffett-idUSKBN0NN0JH20150503

Ever since he had the nerve to suggest rich should pay the same rate as the workers, THEY’RE LIVID AT HIM!

Buffet’s message get so muddled by the right wing media machine you’d think the guy wants to nationalize auto insurance.

Boko Harem are evil

http://www.telegraph.co.uk/news/worldnews/africaandindianocean/nigeria/11580360/Women-taken-hostage-by-Boko-Haram-forced-by-the-terror-sect-into-acting-as-conscripts.html

But Baltimore rioters are freedom fighters.

http://www.slate.com/articles/news_and_politics/crime/2015/05/baltimore_riots_it_wasn_t_thugs_looting_for_profit_it_was_a_protest_against.html

ROFL! Left wing nonsense.

Marilyn Mosby indicting cops is cheaper than:

keeping the clubs and liquor stores closed, billeting and overhead for 2000 national guard troops (called back when the grand jury does that Wilson thing), ending racism, fixing any of the economic issues that keep US ghettoes the focus of “experiments in policing”.

Baby princess still unnamed as relatives visit

http://www.usatoday.com/story/life/people/2015/05/03/baby-princess-still-unnamed-as-grandparents-visit/26830613/

Name her Shatica. Don’t tell her she’s a princess until she’d thirty-five. Send her to the worst schools you’ve got, and let her fend for herself and see what kind of low class scullery maid you have for queen you… you… stupid British Royalists.

http://www.usatoday.com/story/life/people/2015/05/03/baby-princess-still-unnamed-as-grandparents-visit/26830613/

Interesting read about Tech types that are frugal. Spending money doesn’t motivate these folks.

http://www.businessinsider.com/11-frugal-tech-executives-2015-4?op=1

Didn’t see in the New Yorker article a mention of GE Capital’s utility in massaging the numbers. The ability to change loan loss estimates and reserves based on ‘judgement’ can be pretty amazing. Something to think about with other ‘industrial firms’ that are 50% to 67% financials (say Ford, GM, etc.).

If someone can post a link to the eps volatility during Welch and after, it is a pretty damning chart.