China’s markets set the tone for the day (and perhaps the week) with an 8.5 percent blood-letting. Global stocks followed suit, which came after last week’s 5 percent tumble.

Rather than tell you that markets are oversold — you already know that anyway, and oversold markets can become even more oversold — I want to bring a few interesting data points to your attention.

Let’s begin with China’s markets. That is where much of the turmoil seems to be originating. A little context will go a long way.

One year ago, the Shanghai Stock Exchange Composite Index stood at 2209.46; i’ts now 3209.91. It closed last year at 3234.67, and peaked this year at 5166.35. To put those returns into percentages:

One year: +45.28 percent

Year to date: -0.77 percent

Year to date peak: +60.95 percent

Peak to trough: -37.87 percent

It is amazing that China is little changed for the year, down less than 1 percent. That gives you some idea of how absurdly inflated its markets had become in a very short time. Its easy money policies and encouragement of middle-class stock speculation (Why does that sound so familiar?) inflated a market boom that (Surprise!) is now unwinding. What those number show is quite telling.

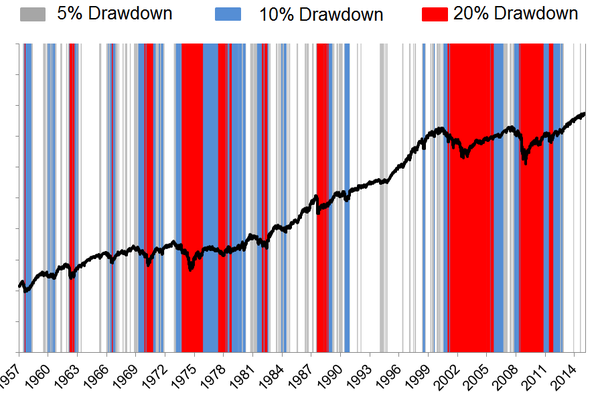

Next, let’s move to U.S. The chart below is courtesy of my colleague Josh Brown. It looks at the 5 percent, 10 percent and 20 percent decline in the Standard & Poor’s 500 Index since its inception in 1957. There are several fascinating aspects to this data series.

S&P 500 1957 to present

Source: The Reformed Broker

Continues here: Just How Sick Is the Stock Market?

Quelle suprise: “market” falls into correction for a nanosecond, and then a miracle pump arrives to bring it out of one. Time to rally to new highs now?

The joke continues…

> Time to rally to new highs now

Uh, no, I don’t think so. Deflation, not inflation, is the reality for the global economy. Buckle up, it’s going to be a bumpy ride.

Good post. Leads to two thoughts on my part:

1. 38%+ declines before Glass-Steagal and after its repeal. Nothing even close in between (the overall market 1974-82 was pretty brutal during a period of sky-rocketing interest rates but didn’t seem to threaten the world’s financial system and played out over many years). I assume the Chicago-Austrian school will view this as irrelevant.

2. It seemed that with corporate revenue flat in the US and a determined effort to transfer work from the US to other countries, much of the focus for growth of the large corporations was overseas. Do we need a recession in the US to see a sea change in expected earnings growth rate? If economies overseas are in recession and labor costs are rising in the US, then we could get a large corporation earnings recession without having an a recession that the average person would see. There was a small recession in the middle of the 2000-2002 bear market but that certainly did not explain the massive drop in the S&P 500 and NASDAQ which was much more to do with crazy valuations for tech firms. Quite a few old-school companies cruised through that bear market without their stock prices doing more than a run-of-the-mill correction. Could we see a repeat of a 2000 bear market without a significant US economy hiccup?

China is a “market” the way the Apple store is a market.

Prices are set, protected for the leadership who steals assets as their own. Their failure is the failure of Socialism. When people want to buy something else, businesses should be there to sell it, not China’s ridiculous rules-based slow-go “openings.”

Remember when George Bush stopped people from travelling and stopped the markets from trading? It’s the same.

lol, socialism? Give me a break. I see none of that.

Markets are markets. They exist because the state says it so. Much like Private Property statism. You only “own” a property because the government says so. Prices have been fixed, set and manipulated ever since the materialist started bringing their “creed” into society(roughly about 1630’s Amsterdam).

Putting on my ideologue hat here: You don’t actually own the property if you must pay property taxes regularly. You are simply renting the property from the government.blechI’m not condemning property taxes per se, more just throwing out a philosophical view.

Speaking of taxes… for people who want to abolish them, they should know that there were no taxes under communism. Food for thought.

I did mention the ideologue hat!

Just rebalanced – am I toast? or lightly browned golden and crisp?

You’re a pocket pita.

Your pocket though will get more loaded down with coin of the realm.

Rebalancing an asset allocation is the only investment process that makes sense

Well as long as I don’t lose my shorts I will be OK (or at least not naked).

Fed gets new excuse to not raise rates

http://www.usatoday.com/story/money/markets/2015/08/24/fed-excuse-not-raise/32272705/

If the markets are telling the Fed not to raise rates then why do the right wingers want the Fed to raise rates so badly? In fact, why do they think the Fed is so horrible if the Market wants the Fed to keep doing what they’ve been doing, that the Right wingers hate so much?

First of all, criticism of the Fed isn’t confined to “right wingers”. Far from it.

Second, the “markets” will always tell the Fed not to raise rates, because lower rates are great for fueling asset bubbles as the last two decades have taught us. Wall Street loves asset bubbles, because they’re protected by the public purse on the downside and reap the massive rewards on the upside (i.e. the frequently used phrase “socialize the losses, privatize the profits”).

In my opinion, monetary policy is losing some of its lustre in the market’s eyes. Oh sure, we’ll probably see no interest rate cut or more QE’s to infinity and beyond, but these have shown diminishing returns to scale. And really, there’s only so much AAPL stock to go around among the central banks of the world.

Dare I say it, but what this country needs is a healthy dose of Bernie Sanders fiscal policy. That is, huge infrastructure spending, breaking up the big banks, not saddling our young people with massive debts at the start of their lives, and generally promoting the well-being of the middle class. Maybe Clinton – the definition of an establishment candidate – will be sufficiently hurt for Sanders to get the nomination. Unlikely, but increasingly possible.

And by Clinton being hurt, I am referring to the ongoing e-mail scandal.

Morgan Stanley: ‘Buy! Buy! Buy! Buy! Buy!’ | FT Alphaville

http://ftalphaville.ft.com/2015/08/24/2138215/morgan-stanley-buy-buy-buy-buy-buy/

No, no, no, no, no. Not with Obama in the White House!

Anyone remember value? Even with this correction the S&P is still above its long term valuations. Maybe this time it is not so different. My guess is that we have some more correcting to do maybe we will get a chance to buy the S&P 17x or maybe the mass exodus of baby boomers will drive it down below 15x.

Like BR said in a previous post time to look to take on suitable risk not to run for the exit. Glad I have cash :-)

I very much remember value. I’ve been harping about excessive valuations for years, only to be ridiculed at pretty much every turn as the diagonal-up rally continued unabated. It was different this time, I must have been a Tea Partier, I must be bitter due to not participating, etc.

It amazes me how many “experts” are talking about how stocks, now that they’ve fallen ~10% or more, are bargains. Just because a price falls doesn’t mean the new price constitutes a bargain. It just means the product is cheaper than it was before.

I would argue fair value for US stocks is significantly below today’s close. I still don’t expect to be able to buy stocks at fair value for a long, long time, if ever again.

Futures up tomorrow but @19X earnings the S&P hardly seems like that fat pitch you need go after. To your point fair value is probably a long ways away but we are in an asset deflationary cycle so never say never. How assets are deflating with all the easy money is the question of the moment.

Concerned Neighbour: then why not trade a bit, gamble, harvest profits, etc.?

Oh my, the Dow lost another 590. What happens when the trillions in QE begin to unwind?

@Concerned Neighbor

Your closing comment makes good sense.

I suspect, also, that demographics will play more of a part than in the past. A very large cohort of Baby Boomers, already concerned about their ability to retire, have a significant part of their wealth in equities. Thus , their situation is even more dire and their willingness to “buy stocks at fair value” may be gone forever.

> A very large cohort of Baby Boomers, already concerned about their ability to retire, have a significant part of their wealth in equities. Thus , their situation is even more dire and their willingness to “buy stocks at fair value” may be gone forever.

Not to mention their tolerance for buy and hold. Fool me once, shame on you; fool me twice, shame on me.

Oh my, the Dow lost another 250. Now down about 15% from May. What happens when the trillions in QE begin to unwind?