Good Sunday ‘morn. Round out your weekend with our reads:

• Why I Fucking Hate Unicorns and the Culture They Breed (Both Sides of the Table)

• The Volatility Lovers (Barron’s)

• How the Superwealthy Plan to Make Sure Their Kids Stay Superwealthy (Bloomberg) see also Old Money’s 7 Essential Ways to Stay Rich (Bloomberg)

• A Tax to Curb Excessive Trading Could Be a Boon to Returns (NYT)

• The smartest economist you’ve never heard of (Washington Post)

• How Some Investors Get Special Access to Companies (WSJ)

• In America, more preschoolers are shot dead each year — 82 in 2013 — than police officers are in the line of duty — 27 in 2013. (NYT) see also The NRA’s profit soars as deaths from gun massacres mount (Marketwatch)

• The House That Could Save the World: The next generation of ultra-efficient houses will redefine how we fight climate change—and how we live. (Politico)

• Kevin McCarthy’s truthful gaffe on Benghazi (Washington Post) see also Pelosi threatens to end Dem participation in Benghazi probe (The Hill)

• Pluto’s Moon Charon Is a Beautiful Mess (Slate)

What are you reading?

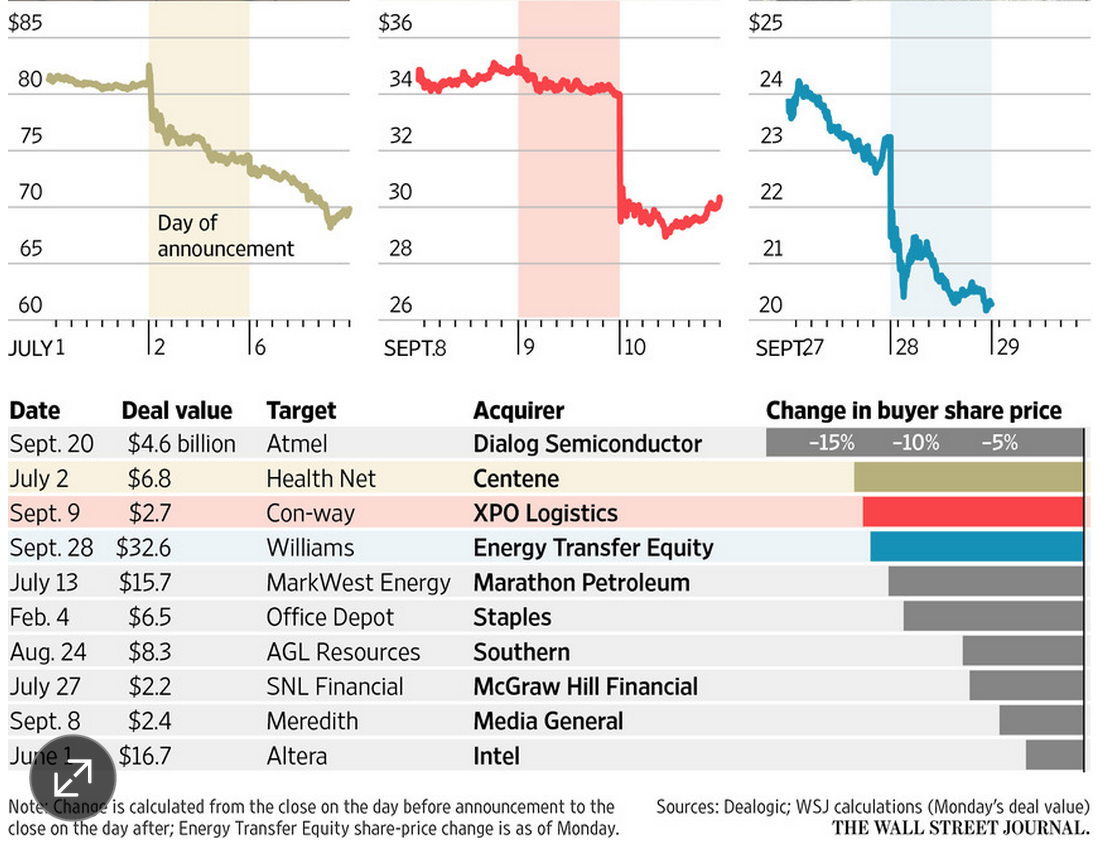

Investors Give the Cold Shoulder to Deals

Source: WSJ

How poverty affects children’s brains (ht EV)

Research in the United States suggests that a $4,000 increase in family earnings during the first two years of a low-income child’s life is associated with remarkable differences in long-term prospects, including higher adult earnings, more hours spent in the workforce and even improved health in adulthood. …

Our clinical trial is designed to provide strong evidence regarding whether and how poverty reduction promotes cognitive and brain development. …

When the main argument for raising rates boils down to “we’ve been down so long it looks like up to us” then there aren’t a whole lot of rationally defensible options remaining.

US Bond Market Week in Review; Did the Window Close, Edition?

A rate hike of at least 25 basis points was a done deal a few months ago. But recent global and domestic events have greatly lowered that possibility. It began with the Chinese equity sell-off followed by the surprise yuan devaluation. Recent Chinese manufacturing weakness adds to the mix. Although some recent US news has been positive, continued price weakness, lower industrial production and a recent employment slowdown show the US is not immune to the slowing international environment. At this point, there are few fundamental reasons to raise rates, leaving the only motivation being the Fed’s desire to begin the process of normalization.

NB: When even a 25 basis point raise risks ‘strengthening’ the dollar further, causing a worsening current account and greater unemployment, then no central bank with a dual mandate and robust sense of mission is going to do it.

But it has occurred to me on more than one occasion that the notion of Fed independence may be moot: The puzzle of new FOMC members becoming hawkish when logic and evidence previously obliged them to dovishness suggests the Fed was cognitively if not actually captured by bankers some time ago. What really raises this above the radar now is an ‘extraordinary’ situation of global demand slack exacerbated by the moral and intellectual collapse of a critical fiscal policy actor (congress). The Fed becoming a de facto fiscal policy actor in compensation strongly implies it not only has a dual mandate it now really does have a dual role. Bottom line, since the dysfunction of congress appears structural (gerrymander), I anticipate monetary conflicts, market ‘distortions,’ and many empty (but oh-so-symbolic) congressional votes continuing for the foreseeable future. JMO

From the ‘smartest economist’ article:

“Twice before [Olivier Blanchard] had been offered the job when Stanley Fisher [sic], his MIT mentor and colleague, was first deputy managing director. And twice he had turned it down.”

Is the Fed’s vice chair, Stanley Fischer, so obscure that the WaPo don’t even know how to spell his name?

BR, it looks like this guy is starting with your chart,

http://www.businessinsider.com/long-term-stock-outlook-2015-10

I can’t say I disagree with him but what my be different this time around is that there are a lot of people looking to retire and if the Feds just let the market crash that takes out the pension systems. My bet is that they are going to do something. The question is what will our dysfunctional government try and do? Maybe Gary Shilling has it right fiscal stem.. What ever happened to all those shovel ready projects…?

He is quoting Hussman.

EOM

Paul Theroux does an opinion piece looking at corporations offshoring jobs and then donating their resulting wealth to charities that support Third World aid. The result is American poverty and the gutting of many communities.

http://www.nytimes.com/2015/10/04/opinion/sunday/the-hypocrisy-of-helping-the-poor.html?_r=0

Meanwhile, the Koch Brothers are quite adamant that communities should not try to repair their infrastructure using taxes. Instead, the towns should be able to find the money without using taxes. I assume that the Koch Brothers are in the process of patenting a money tree that you can plant what grows $100 bills as seed.

http://www.washingtonpost.com/politics/the-potholes-of-colorado-springs-draw-the-attention-of-koch-brothers-group/2015/10/03/7bd7d64a-566c-11e5-8bb1-b488d231bba2_story.html

Bernanke says that he thinks people should have gone to jail for causing the financial crisis. I wonder if he was lobbying Eric Holder for investigations? Its good to see that lots of these people at the top of the totem pole for financial regulation realize this now that the statute of limitations has passed for just about everything related to the financial crisis. Oh well, there will always be another time – I suspect the financial firms are currently loading up lots of legal improprieties in case anybody ever looks.

http://www.usatoday.com/story/news/politics/2015/10/04/ben-bernanke-execs-jail-great-recession-federal-reserve/72959402/