Buyback Burst Seen as Salvation From Goldman’s S&P 500 Decline

- November is S&P 500 companies’ busiest month for repurchases

- Kostin: `Single largest source of demand for U.S. equities’

By David Wilson

(Bloomberg) — Stock repurchases may accelerate enough toward the end of the year to salvage an annual gain for the Standard & Poor’s 500 Index, according to David Kostin, Goldman Sachs Group Inc.’s chief U.S. equity strategist.

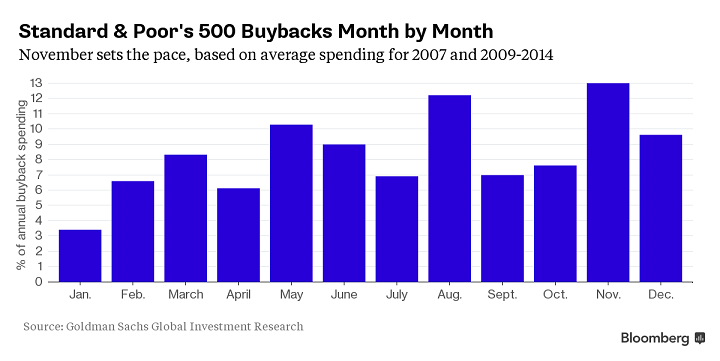

November is the busiest month of the year for buybacks among S&P 500 companies, as shown in the chart below. Thirteen percent of annual spending occurs during the month, according to figures that Kostin presented in a report two days ago. The data is based on averages for 2007 and 2009-2014.

The fourth quarter is the year’s busiest three-month period for S&P 500 repurchases, accounting for 30 percent of outlays, according to Kostin’s data. The total compares with 18 percent during the first quarter, 25 percent in the second and 26 percent in the third. These figures don’t add up to 100 percent because of rounding.

“Buybacks represent the single largest source of demand for U.S. equities,” he wrote, adding that he expects companies in the index to spend more than $600 billion this year on their own shares. “The typical year-end surge in buyback activity could help boost the market above our year-end target.”

Kostin reduced his projection for the S&P 500 to 2,000 from 2,100. Assuming the latest estimate from the New York-based strategist is accurate, the index would post a loss of 2.9 percent for the year.

A return to optimism among investors may also help the index exceed 2,000, according to Kostin. He cited a Goldman sentiment indicator, based on S&P 500 futures trading, that has been at the lowest possible reading for seven of the past eight weeks. That’s the longest stretch in the gauge’s eight-year history, the report said.

What's been said:

Discussions found on the web: