Click through to see the interactive graphics.

Source: NYT

How the U.S. and OPEC Drive Oil Prices

November 5, 2015 12:30pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

Dori Monson Flogs Faulty Seattle Min Wage Data

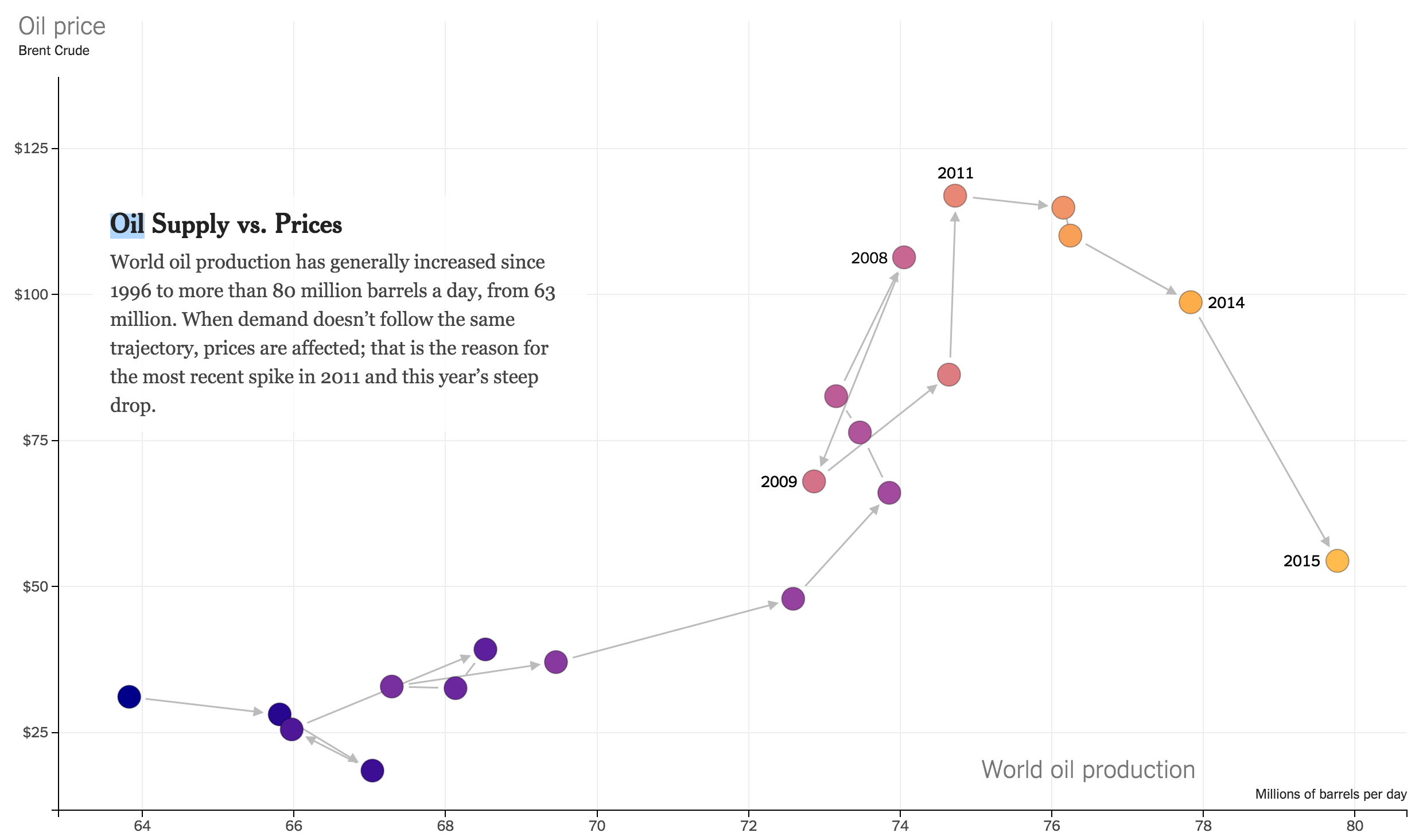

So many people out there are talking about oil and misunderstanding it. It has become highly financialized so every hairdo on CNBC and 14 year old Wall Street analyst tries to plot it like the Dow. Unfortunately, sooner or later, the price of oil is determined by Supply and Demand. And demand is weak for a variety of reasons they don’t understand.

Barry, I did a quick and dirty look at the percentage change in the price of Chevron at its nadir in August of 2015 to where it is today and compared it to USO, the commodity fund. Chevron was still up 29% from that point whereas USO was only up 5% for the same period (similar nadir). That arbitrage seems steep despite the major oil company’s balance sheet and diversified business.There are also pipeline companies with high dividends (and some weak balance sheet but also significant distributable cash flow) that have been taking a beating in anticipation of action by the Fed. Am I a fool for thinking the market has inefficiently priced in supply and demand, Fed policy, and company specific data in the energy industry? Waiting for Godot (Yellen) seems to have caused the Didi and Gogo to repeatedly price in a Fed rate increase effect on share price of energy stocks.