From Dealbook:

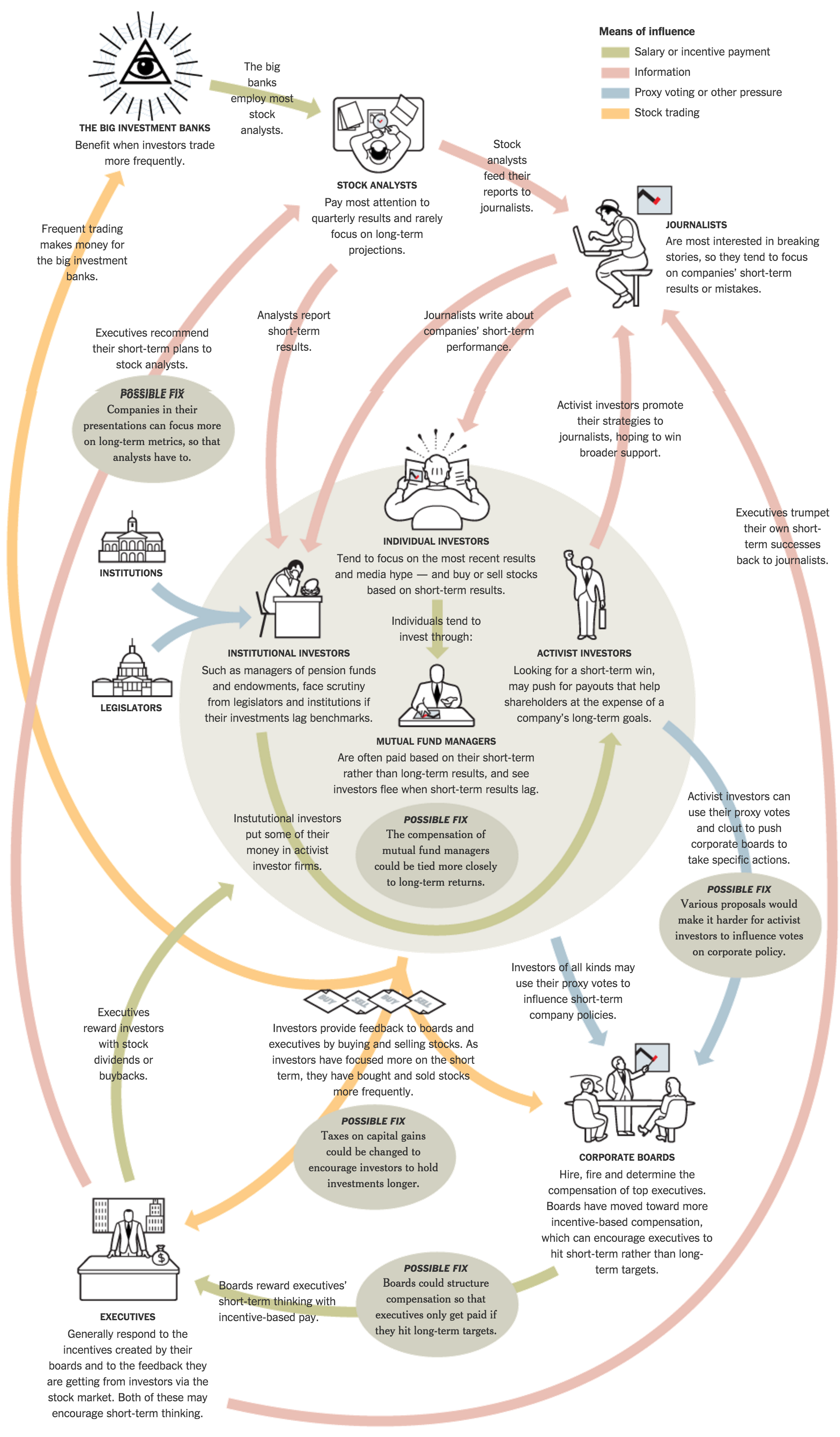

From Wall Street to Washington and in the towers of academia, people are buzzing about what some say is the pernicious focus in corporate America on short-term profits. To understand the debate, it helps to understand the various forces that contribute to the pressures on companies to focus on short-term financial results. Those pressures are not just a product of one bad actor. It turns out that nearly everyone in the investment world plays a role in creating the challenges companies face in setting their sights on the far horizon.

Source: Dealbook

In the last generation we’ve seen a major shift toward compensating executives with substantial quantities of stock options to provide incentive but we’ve apparently incentivized them in the wrong direction. “C” level executives should be compensated for their long-term performance, not this year’s and certainly not this quarters. Executives at that level are supposedly being selected for their global smarts – the ability to identify the long-term paths and strategies their firms need to take and for selecting the succeeding staff to make it so. Why isn’t at least 90% of their stock option grant being set with a minimum of a five-year vesting horizon, preferably at seven years for the biggest corporations. If they leave or get booted before that time, they abandon the options too. If compensation drives behavior for the peons, it drives it for the executives, who, let’s admit it, are just high-paid peons according to the doctrine of limited liability corporations.