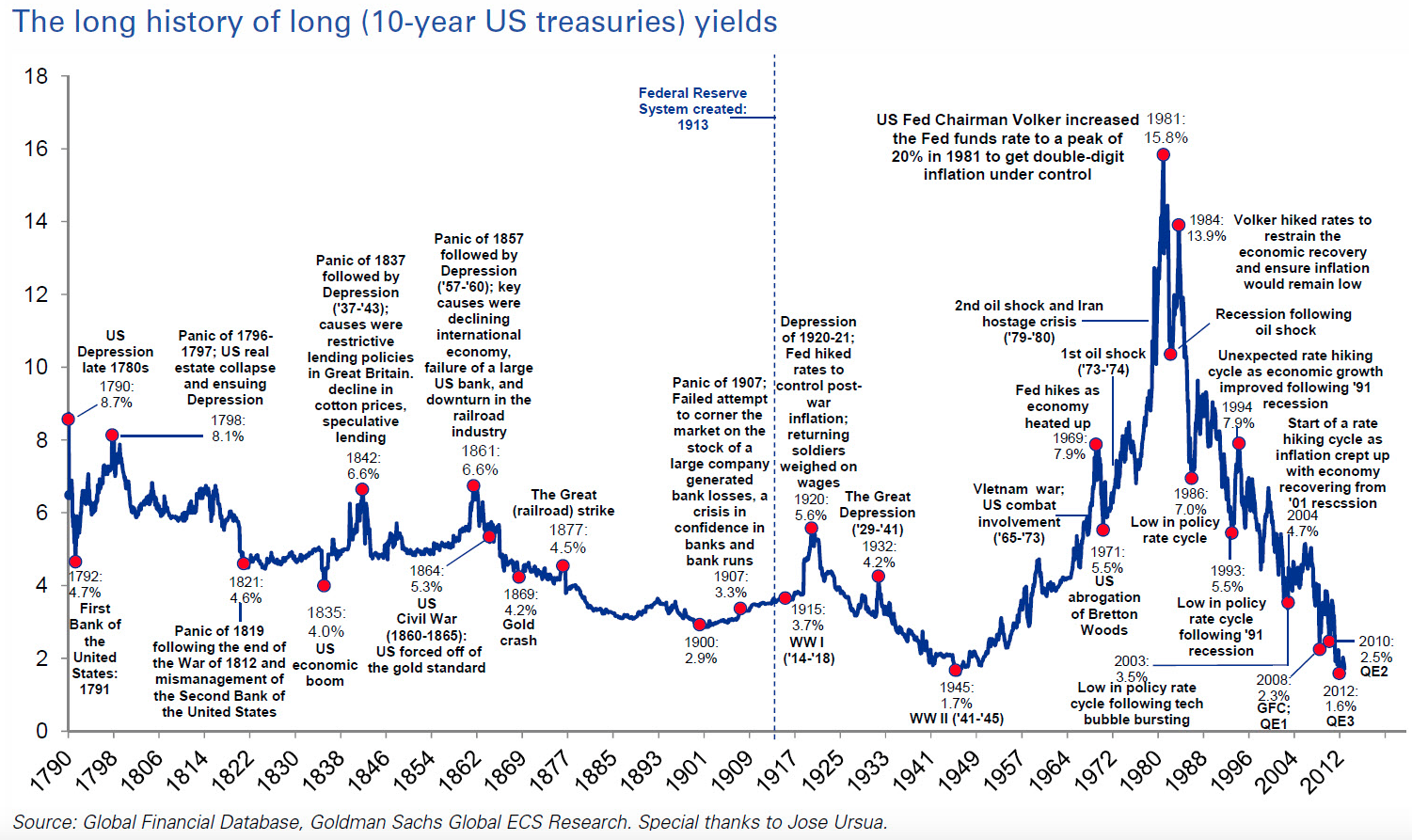

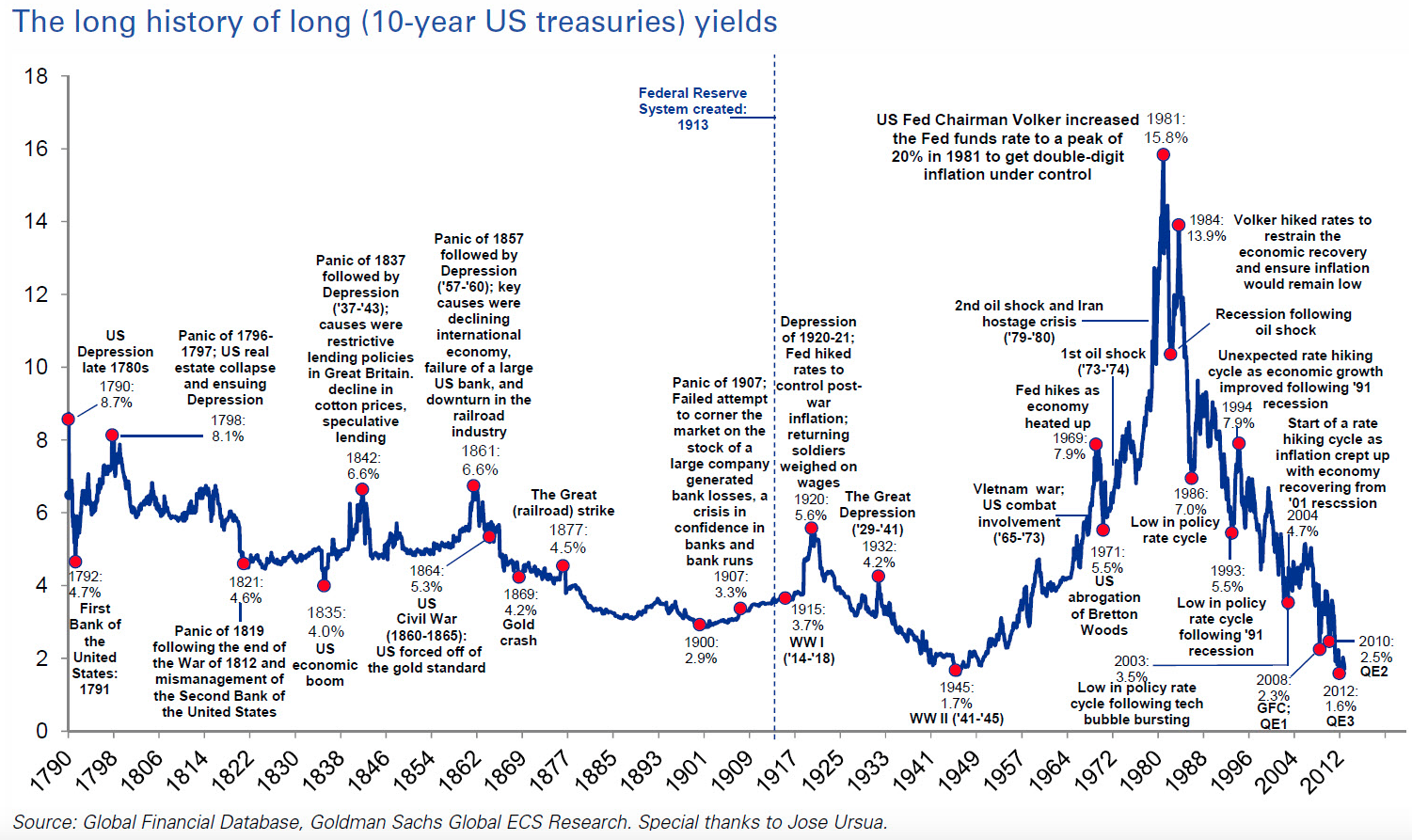

I love this long term chart via Ben Carlson looking at the various behavioral issues that arise around every major Treasury peak over the past few centuries.

click for ginormous chart

Source: A Wealth of Common Sense

I love this long term chart via Ben Carlson looking at the various behavioral issues that arise around every major Treasury peak over the past few centuries.

click for ginormous chart

Source: A Wealth of Common Sense

Get subscriber-only insights and news delivered by Barry every two weeks.

Milton Friedman published “A Monetary History of the United States” in 1963. This was very influential in putting monetary policy front and square in economic circles. Since then, the US has been on a wild roller coaster of inflation and interest rates that is unprecedented in the prior couple of centuries. I have often wondered if the incredible rise in quantitative macro-economic theory over the past 50 years has actually made the economy and monetary system worse than before.

«This was very influential in putting monetary policy front and square in economic circles. Since then, the US has been on a wild roller coaster of inflation and interest rates that is unprecedented in the prior couple of centuries.»

Monetary policy was abandoned in almost all first-world countries 30 years ago. The policy regime in the past 30 years is not quantity-of-money targeting but rate-of-inflation targeting (low) and asset-price targeting (higher, trickle down “wealth effect”).

Because of rate-of-inflation targeting, it and interest rates have been mostly smoothly gliding downwards for 30 years, and what has been impacted have been credit markets, where debt levels have exploded, pushing up asset prices, and wage markets, where median waged have imploded.