Its time for our Two-fer-Tuesday morning train beach reads:

• Why this bull run is starting to grow legs, as it rapidly approaches the milestone as the second-longest ever (Telegraph) but see A Bear Market in the Shadows (Bloomberg)

• The Most Important Lesson I Learned This Year (Mulloly)

• U.S. retailers at risk of missing modest holiday sales goals (Reuters) but see U.S. holiday retail sales grow a ‘solid’ 7.9 percent: MasterCard (Reuters)

• Fannie and Freddie Give Birth to New Mortgage Bond: Government hopes to get taxpayers off the hook if another mortgage crisis arrives (WSJ)

• Hedge Funds Just Had Their Worst Quarter Since the Crisis (Bloomberg) see also Hedge Funds Struggle With Steep Losses and High Expectations (NYT)

• Want to See Technology Taking Over Finance? Look at China (WSJ)

• The secret to finding the best mobile apps: try everything (Verge) see also 12 Travel Apps Worth Keeping in 2016 (NYT)

• Oil-Producing States Battered as Tax-Gushing Wells Are Shut Down (Bloomberg)

• Michael Burry, Real-Life Market Genius From The Big Short, Thinks Another Financial Crisis Is Looming (NY Mag) see also ‘The Big Short,’ Housing Bubbles and Retold Lies (NYT)

• After a transformative 2015, Taylor Swift joins the ranks of pop music’s all-time greats (Quartz)

What are you reading?

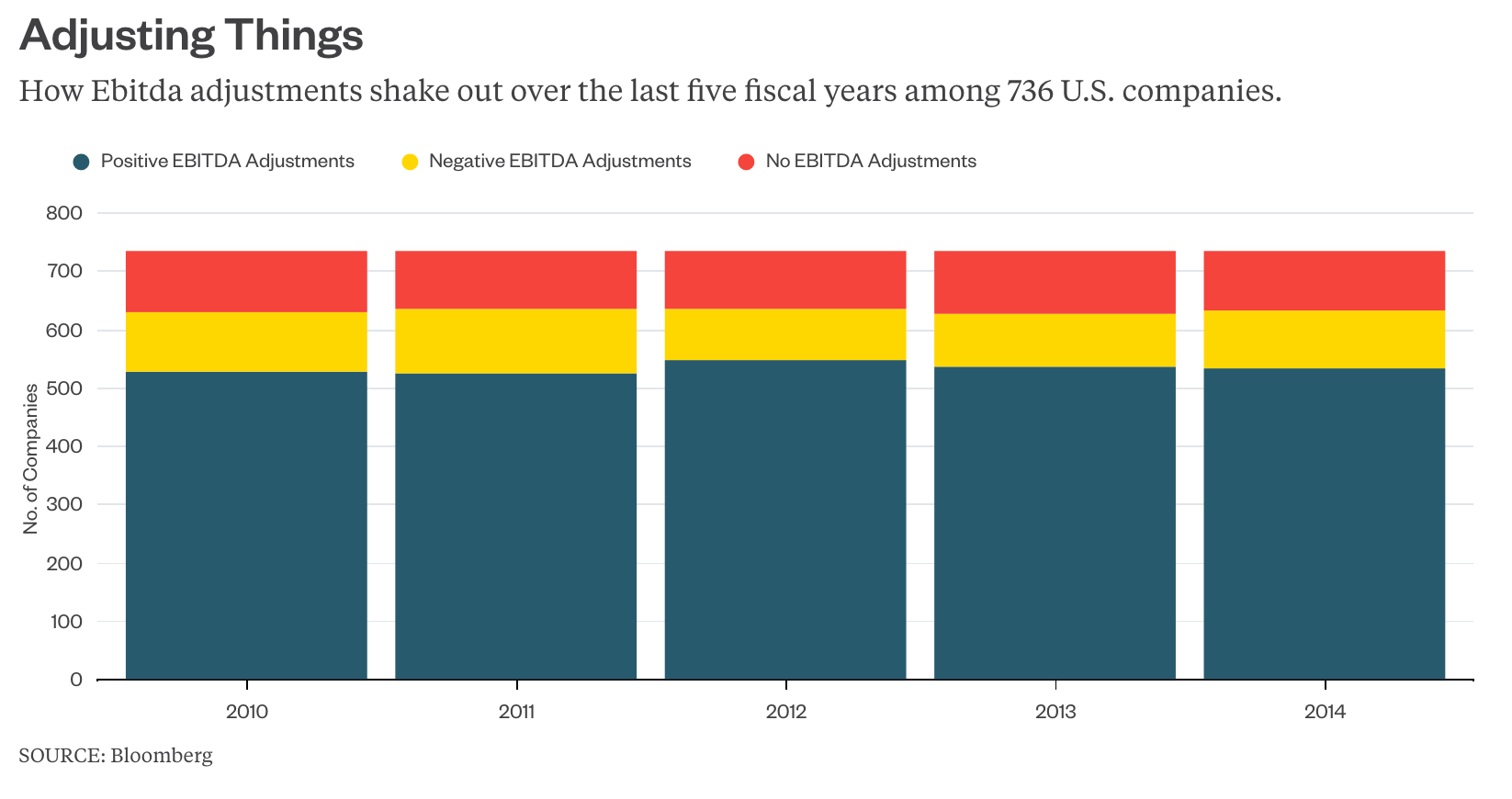

Big Companies Massage Their Earnings

Source: Bloomberg

France Rockets Up List of Countries Most Dangerous for Reporters

Je suis WaPo Cruz Monkey Kids!

http://www.businessinsider.com/reporters-without-borders-2015-report-killed-incarcerated-tortured-2015-12

Trump say US wages too high

http://www.businessinsider.com/donald-trump-wages-are-too-high-2015-11

Trump says US Wages too low

http://money.cnn.com/2015/12/28/news/economy/trump-wages/

Trump: No Proof Putin Killed Journalists

http://www.nbcnews.com/politics/2016-election/donald-trump-says-theres-no-proof-putin-killed-journalists-n483451

Like any good Trump acolyte I can interpret his true meaning… ahem… We need caps here in the US on how many journalists can be killed

Unlike you I’m hoping that with some luck US voters will be smart enough to elect Trump and not any of the ridiculous and dangerous alternatives both in the Republican and the Democrat side.

And a maximum wage for workers.

The Most Important Lesson I Learned This Year:

Something is only a lesson, when there is a willing student,

As a straightforward statistical matter there are millions of people in these United States who should not own or handle a deadly weapon and mental illness is not their problem; incompetence and lack of respect is. These are their stories; every week.

GunFAIL CLXXI

We’ll check in one more time on hunting accidents, to note the decline now that the peak of the season has passed. We were down to just six in the second week of December. But just as we noted during the last installment, there’s no off season for accidentally shooting yourself, family members, or nearby children. Twenty-one people accidentally shot themselves, 11 kids were accidentally shot, and 10 of our original 45 listings ended in fatalities. Three people accidentally fired into the homes of their neighbors, and three accidentally fired guns they were cleaning at the time. Just two accidents involved law enforcement officers and/or members of the military.

All told, it was a pretty unremarkable week, so long as you’re not particularly shocked by double-digit figures for kids being hit, or people being shot to death entirely by accident inside of a 7-day period. ….

Marc Faber takes on Janet Yellen? WTF – Talk about punching above your weight.

tech bubble?

http://www.theverge.com/2015/12/29/10642070/2015-theranos-venture-capital-tech-bubble-disruption

the low interest rates drove a lot bubbles.

like Theranos?

why QE didnt work as some thought it would?

http://www.pragcap.com/the-money-multiplier-and-the-myth-that-just-wont-die/

Seven straight years of market gains. Record GDP. Record corporate profits. Closing in on ten million new jobs.

QE worked.

but

but

the inflation monster is still coming. at least if we elect a democratic president again.

It’s so much fun to parrot back the typical GOP predictions. We’re getting better at it then they are.

Thinning the unicorn herd may be this years crashette.

The fervid blogger claims “…You could flip all of these statements around and it wouldn’t change my lesson for 2015: all of these strategies work in their own way. None of them are always right, and none of them are always wrong. The sooner we can accept this, the better off we will be…”

But buy and hold and rebalance annually ALWAYS “works” by getting you to outperform the average investor by a little bit every year after costs so in the long run you MUST win.

how competition in health care was supposed to work?

http://www.bloomberg.com/news/articles/2015-12-29/the-price-keeps-falling-for-a-superstar-gilead-drug-in-india

course it never will work the way in the US.