From Torsten Sløk, Ph.D.:

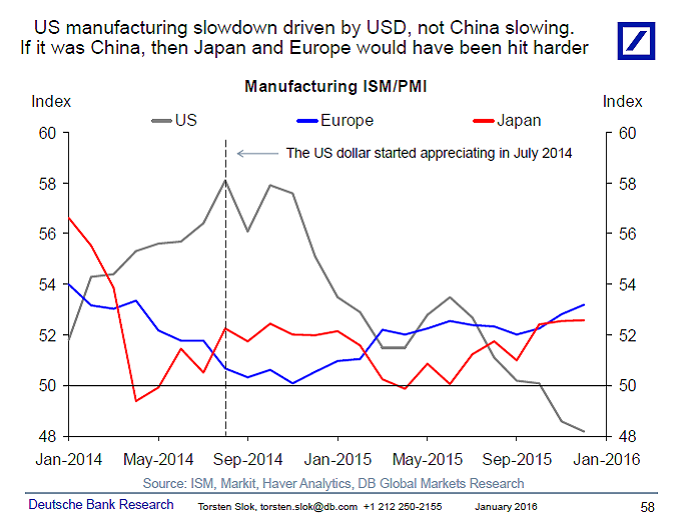

In some of my client conversations I have debates as if we are already in a global recession. Yes, ISM below 50 is getting a lot of attention but looking at the manufacturing sectors in Europe and Japan shows a very different picture, see chart below. The fact that Japan and Europe are looking so much better tells us that the source of the decline in US manufacturing is not slowing growth in China but rather the significant appreciation of the US dollar. I continue to believe that we have the worst behind us in terms of dollar appreciation, in particular when you look at EURUSD, which has been moving sideways since March 2015.

Source: Torsten Sløk, Ph.D., Deutsche Bank Securities