Source: Irrelevant Investor

Mike Batnick writes:

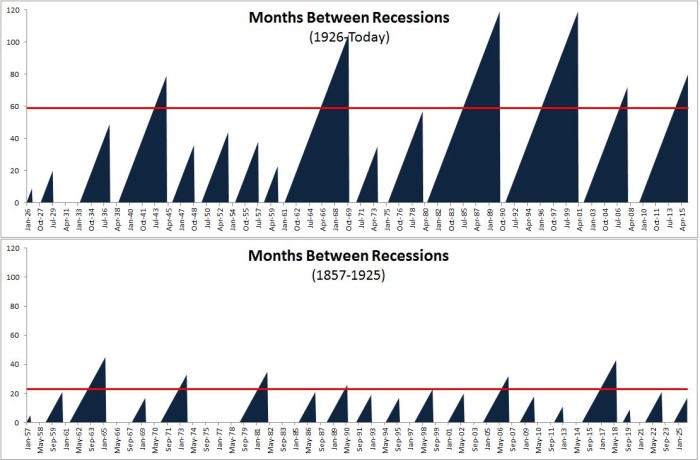

“Since 1926, recessions have happened on average every 59 months. We’re currently 80 months removed from the last recession.

Are we due in the sense that stocks have gone too far? Sure. The S&P 500 has risen on average 111% in between recessions; currently stocks are up 142% since June 2009.

Are we due in the sense that the economy is overheating and we need a good flush of the excess? No. Quite to the contrary, people are worried that there is hardly any growth at all, and with this amount of debt in the system, perhaps it wouldn’t take much for it to all come crashing down. With the memories of 2008 fresh in our mind, it’s understandable that people might feel this way. But not every recession ends in massive unemployment and a collapse in the equity market. In fact, in recessions since 1926, stocks have risen as often as they have fallen.”

Go read the entire thing right now . . . its terrific.