The velocity of money measures the number of times a dollar is spent to buy domestically produced goods and services per unit of time. It’s calculated as the ratio of nominal GDP to the average of the money stock. Nominal GDP measures the value of all final goods and services bought by consumers, firms, the government, and foreigners in a period of time; so, it’s used as a proxy for the value of all transactions that occur in an economy in that period of time.

Typically, statistical agencies calculate the velocity of money using one of two measures of the money supply: (1) M1, the supply of currency in circulation, is notes and coins, traveler’s checks (non-bank issuers), demand deposits, and checkable deposits. (2) M2, a broader measure of the money supply, is M1 plus saving deposits, small-denomination (<$100,000) certificates of deposit, and money market deposits for individuals.

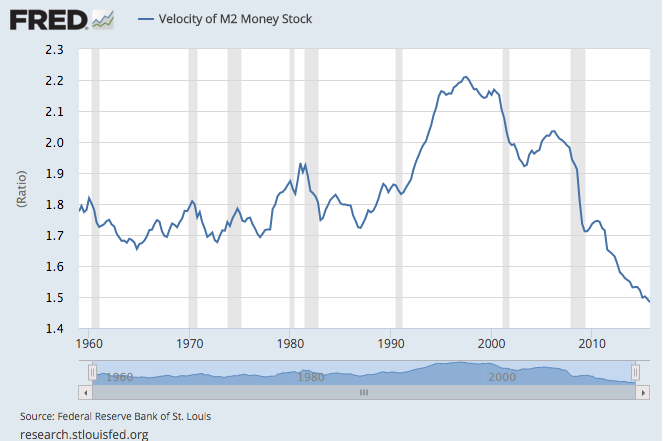

The graph shows the evolution of the velocity of M2 for the United States from 1959 to 2015. During recessions (shown by gray bars), the velocity of money tends to decrease, since the amount of transactions in an economy decreases. Consumers tend to save more and firms tend to invest less—that is, they hoard cash instead of spend it. As the graph shows, this was the case during the “dot com bubble” crisis of 2001 and more recently during the financial crisis of 2007. In general, the velocity of money starts to increase after a recession is over, when confidence is restored. However, since 2007, the velocity of money in the U.S. has been decreasing, which means consumers and firms are still holding onto cash instead of spending it. This behavior, which also reflects a decrease in inflation, suggests that confidence in the recovery is still low. When confidence is restored, we should expect to see a rebound in the velocity of money.

How this graph was created: Search FRED for “M2 Money Velocity” and choose the series “Velocity of M2 Money Stock”, or M2V.

Suggested by Ana Maria Santacreu.