Source: Merrill Lynch via Marketwatch

Source: Merrill Lynch via Marketwatch

FactSet notes that the S&P500’s record highs, if the market closes positively for August, will mean six straight months of rising stock prices; if the Dow Jones Industrial Average sees gains in August, that would be 7 consecutive rises in a row.

Here is Bank of America Merrill Lynch’s strategist David Woo:

The GOP is traditionally known as the party of Wall Street, but this year investors, for the most part, are betting against the Republican standard-bearer.

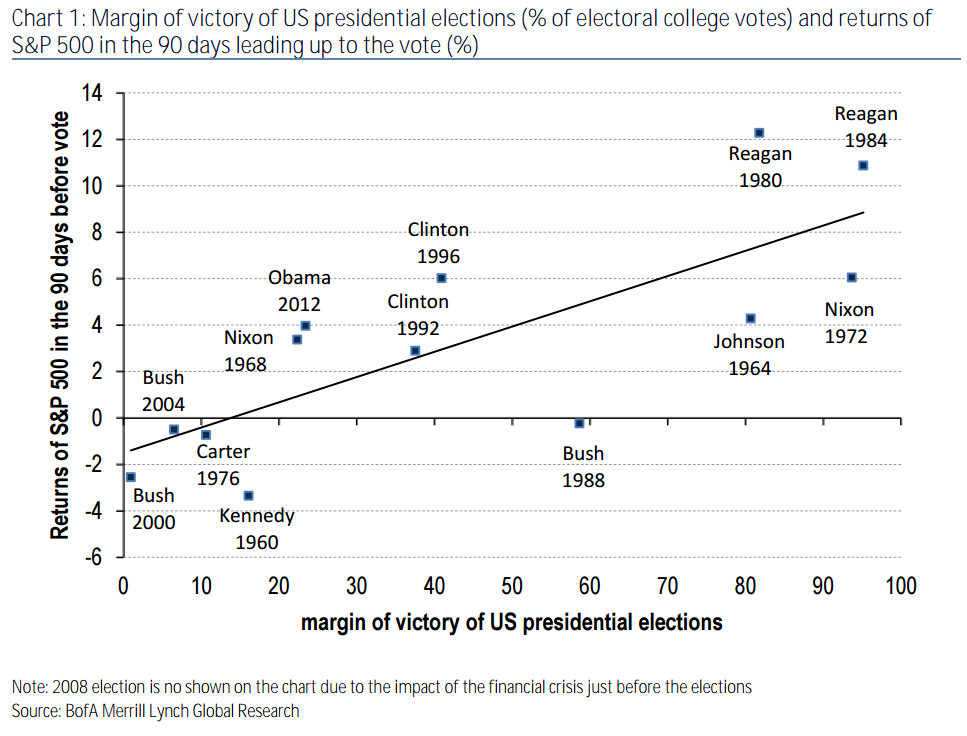

“To us, this implies that the market is expecting Hillary Clinton to either maintain or increase her already sizable lead over Donald Trump in the opinion polls.”

“The market appears to have decided not only that [Hillary] Clinton will win, but that it won’t be close,” David Woo, a strategist at Bank of America Merrill Lynch, said in a report distributed Monday. “Investors like landslide victories.”

Note that Tom Buerkle astutely observed 2008 is missing (“Looking in vain for 2008. Did something happen that year?”). Heh heh — yes, something did happen, but 2008 is consistent with BAML’s thesis — a bad market means lack of success for the incumbent party for both the White House and lost seats in Congress.

As always, we wish we had a more complete data set (it will only take a few more centuries…).