Evolution, Not Revolution: Payments Are Undergoing Changes in the United States

Dan Littman, Tasia Hane-Devore

Federal Reserve Bank of Cleveland, 05.24.17

In payments, the term “revolutionary” has surfaced frequently in recent years, reflecting the penetration of personal computers, tablets, and mobile phones into banking. But are we calling this integration of personal computing and banking revolutionary in order to gain commercial attention, or is it an innovation likely to stimulate fundamental shifts in US payments?

The short answer is that current changes in US payments lie between revolution and innovation: The payments system is not undergoing a revolution, but neither is it static. Some of the news we hear about the payments system reflects innovators’ trying to get commercial attention. Some of it reflects facets of slow, longer-term change that will transform the way the payments system works over a period of years.

So why is there so much talk of revolution in payments?

The popular and banking trade press is filled with stories about new ways to make and receive payments. Innovations such as chip-equipped credit cards, contactless debit cards, mobile wallets, and 2-dimensional barcodes carried on smartphones are among the new technologies trumpeted in the press. But new payment methods receive extra attention because they are novelties, not because they are of everyday importance as payment tools.

Part of the confusion arises because few people understand how the payments system really works. A plastic card may be viewed by some consumers as a stand-alone product. The act of swiping that plastic card through a retailer’s point-of-sale terminal may be perceived as the entirety of a payment experience. Yet these cards, whether in the form of a 3½ by 2 inch plastic rectangle or as a virtual object whose data are carried inside a smartphone, are simply points of access to the payments system.

A profile of payments today

Payment tools are consumer products, though the average person might not think of them in quite these terms. But similar to the choices consumers have at the grocery store for detergent or cereal or coffee, consumers have choices about payment products: cash, paper checks, money orders, cards (credit, debit, and prepaid), and ACH (Automated Clearing House) or electronic check processing.

And cash isn’t necessarily king.

Making payments is arguably the most common activity Americans do from stranger to stranger every day, and how we make payments is of significant interest to individuals along with merchants, financial institutions, and payment intermediaries such as the Federal Reserve. According to the latest figures from the Federal Reserve Payments Study 2016, on the average day in the United States in 2015, consumers, businesses, and governments made nearly 400 million noncash payments with a total value of $487 billion.

The Federal Reserve conducts another periodic study, as well, this one including cash payments, called the Diary of Consumer Payment Choice. It focuses on consumer-originated payments only, excluding payments that start with businesses or government entities, and uses a combination of surveys and multiday payment transaction diaries to develop an estimate of consumer payments. Cash remains the largest payment product used by consumers, representing one-third of all consumer transactions in 2015, but cash is declining in relation to other payment types, which collectively make up two-thirds of all payments.

How have payments changed in recent memory?

Payment products and preferences are evolving. For the generations that came of age in the first third of the twentieth century, the most common payment type by far was cash. The overturning of the established order—cash use has dropped from nearly 100 percent to about 33 percent during the past 100 years—may seem to have come about quickly, but it was not an overnight event.

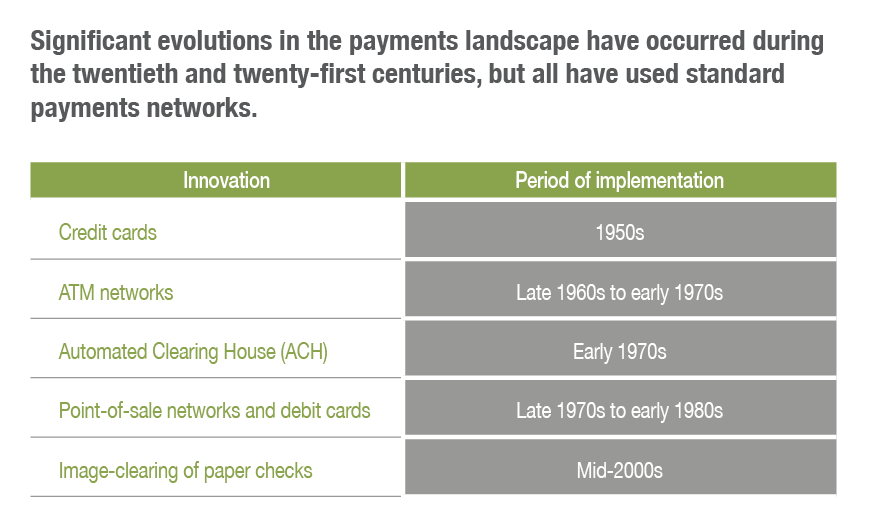

Payment changes occurred with increased speed starting after World War II, when more households opened checking accounts. Credit cards and ATMs (automated teller machines) and their cards gained in popularity soon thereafter. The environment we know today—point-of-sale terminals connected to electronic networks and the wide use of debit cards—began in the 1980s.

Still, paper checks and cash persist as major parts of the payments system.

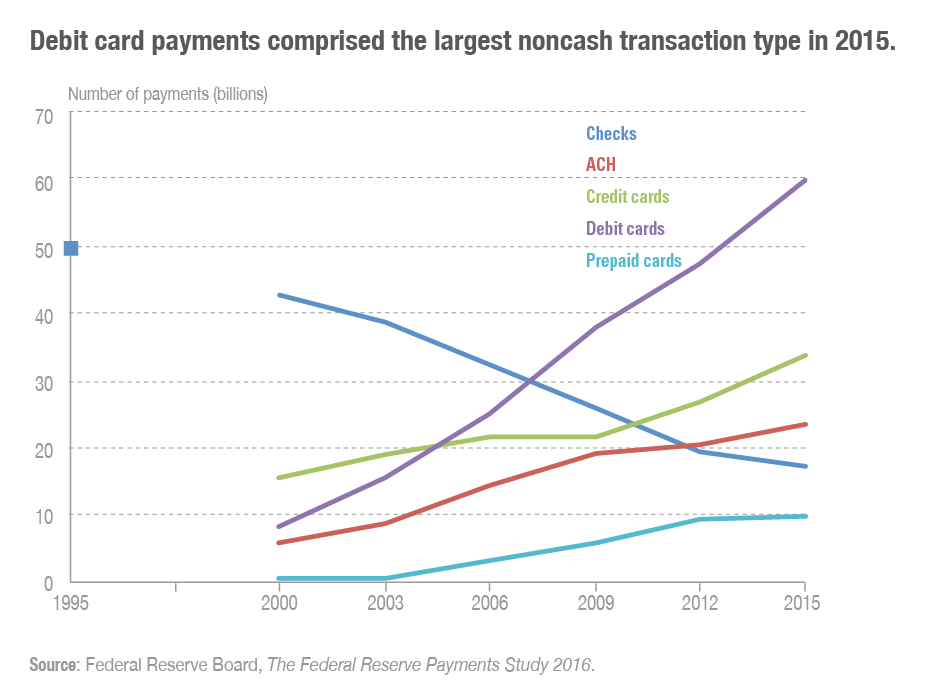

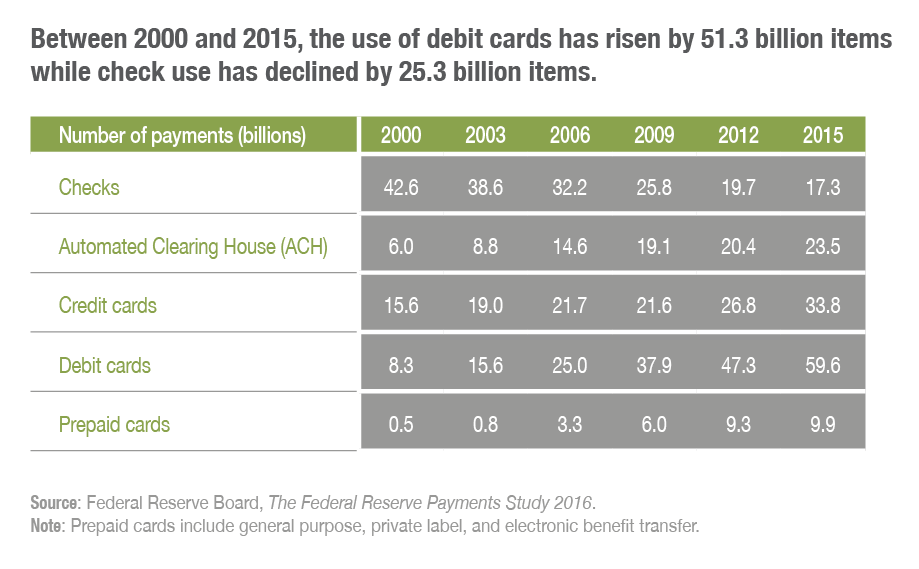

The US payments system has continued to evolve during the past two decades. The most significant changes are in checks and debit cards. The number of paper checks processed declined from a peak of nearly 50 billion per year in 1995 to the 2015 estimate of 17 billion, a more than 65 percent reduction. During this same period, the check collection system in the US went from an entirely paper-centric process to an entirely electronic one, dramatically lowering the cost of end-to-end check processing and increasing the speed of collections.

The number of debit card transactions filled some of that space, rising from about 9 billion in 2001 to almost 60 billion in 2016, a staggering increase of more than 600 percent. During this same period, the use of credit cards and debit cards grew, and prepaid cards made a material appearance, ending 2015 with 9.9 billion transactions for the year. The rise of debit card transactions and the decline in paper-originated check and cash transactions have lowered the cost of the payments system. The conversion of check collection from a processing- and transportation-intensive system to the all-electronic Check 21 system has also reduced the cost.

In 2015, American consumers and businesses had the same set of payment tools they possessed in the 1980s, so it’s not possible to declare that a revolution has taken place. But the payment landscape of 2015 has evolved significantly, becoming unrecognizable to someone accustomed to the check- and cash-rich landscape of the 1950s and 1960s.

Innovations in payment access devices do represent improvements in the payments experience on the part of consumers and businesses, however, and in some cases improvements for merchants or other receivers of those payments. The Starbucks or Apple Pay app on a mobile phone executes payments at the point of sale faster than a magnetic stripe or chip card and faster, too, than a paper check or a handful of coins and banknotes. Mobile app payments are more secure than older methods of initiating payments, as well.

For a merchant, mobile apps can allow tracking of consumer preferences, yielding benefits for both parties. Tracking consumer preferences may facilitate individually targeted offers, leading to increases in repeat business. On the consumer side, such tracking can facilitate special offers and the accumulation of loyalty points toward products.

But while these enhancements improve the transaction experience for both consumers and merchants, they also make use of the existing network infrastructure for payments instructions and payments settlement. Evolution, then, not revolution.

Faster Payments: Not everything made easier is necessarily made better

By virtue of their efficiency and reach, payment networks can be a barrier to entry for new ideas that are perhaps better in functionality than existing methods but not viable because of their cost to implement. Even though an innovation might be more effective than existing types of transactions, its promoters often do not have sufficient influence or funding to change how the core of the network operates.

Occasionally there comes a time when the key stakeholders of the payments system—banks, merchants, processors, standards organizations, and the central bank—realize that the current combination of payment products is preventing the introduction of modernized payment methods, and they work to change the situation. In those times, we’ve experienced an accelerated evolution in payments. Efforts such as those discussed previously paired innovations in payment products with innovations in network technology. The development and deployment of these innovations has required collaboration among US financial institutions, telecommunications networks, technology companies, financial regulators, and, in some cases, the central bank.

In the 1970s, several types of end-to-end payments networks were enabled by the introduction of mainframe computers and telecommunications in the US banking system. ATMs, ACH, credit, debit, and point-of-sale networks took advantage of that technology. That was the last time—40 or so years ago—entirely new end-to-end payment networks directly affecting end users were introduced in the United States.

Around the world, however, a number of countries have implemented some version of a new payment network labeled “faster payments” or “real-time payments.” These are networks that in their purest form allow payments to move in an instant from one party to any other party and, in several cases, operate 7 days a week, 24 hours a day. In the United States, such faster payments networks are now under construction. They should become available to end users by the end of 2018.

While a revolution in payments doesn’t appear on the horizon, the United States is due for continuing evolution. Legacy networks and products will remain. Faster payments will not drive any of the legacy payment products to extinction, but the experience in other countries with real-time payment systems suggests that faster payments will reduce the growth rate of ACH and accelerate the decline of checks and cash. Faster payments will also improve convenience, certainty of payment, and security for end users.

Sum and substance: New payment products have appeared periodically during the past several decades, but none reaches the point of revolutionary development, particularly because they use legacy networks. Nevertheless, a “faster payments” system may accelerate changes in the payments landscape.