I posted my write up of my podcast with Ned Davis yesterday (hear it on iTunes, Soundcloud, Overcast, and Bloomberg).

I reviewed some of my notes prepared for the interview, and almost forgot about this set of rules from him: Its smart, straight-forward, advice.

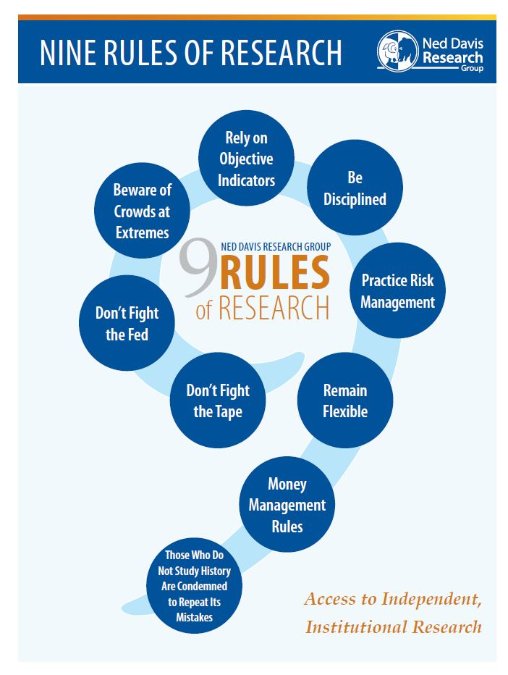

Ned Davis’ 9 Rules of Research

1. Don’t Fight the Tape – the trend is your friend, go with Mo (Momentum that is)

2. Don’t Fight the Fed – Fed policy influences interest rates and liquidity – money moves markets.

3. Beware of the Crowd at Extremes – psychology and liquidity are linked, relative relationships revert, valuation = long-term extremes in psychology, general crowd psychology impacts the markets

4. Rely on Objective Indicators – indicators are not perfect but objectively give you consistency, use observable evidence not theoretical

5. Be Disciplined – anchor exposure to facts not gut reaction

6. Practice Risk Management – being right is very difficult…thus, making money needs risk management

7. Remain Flexible – adapt to changes in data, the environment, and the markets

8. Money Management Rules – be humble and flexible – be able to turn emotions upside down, let profits run and cut losses short, think in terms of risk including opportunity risk of missing a bull market, buy the rumor and sell the news

9. Those Who Do Not Study History Are Condemned to Repeat Its Mistakes

Source: NDR

Good stuff . . .