Note: Following my recent debate on stock valuations, I thought this discussion about a foodstuffs, the CRB food index and other agricultural commodities was worth sharing. Enjoy

~~~

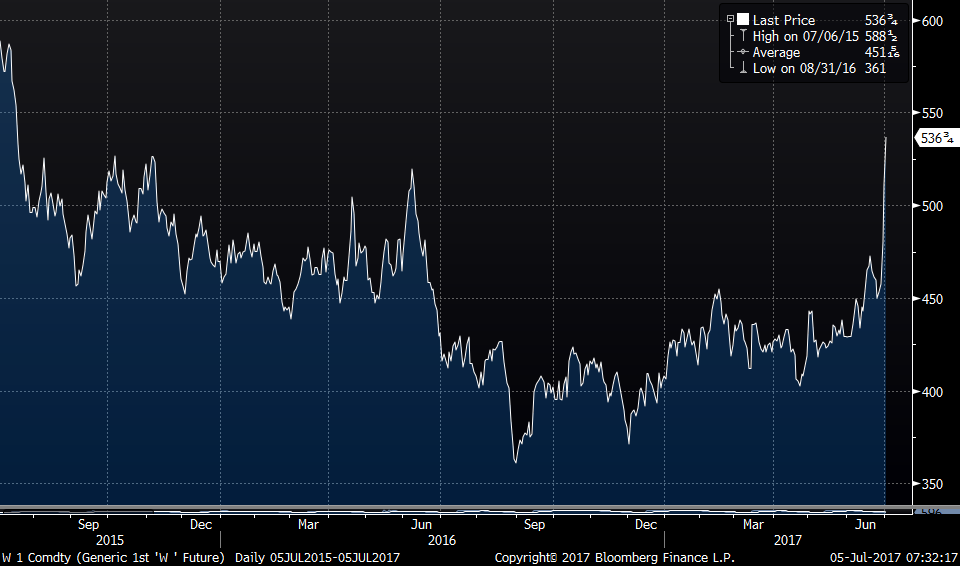

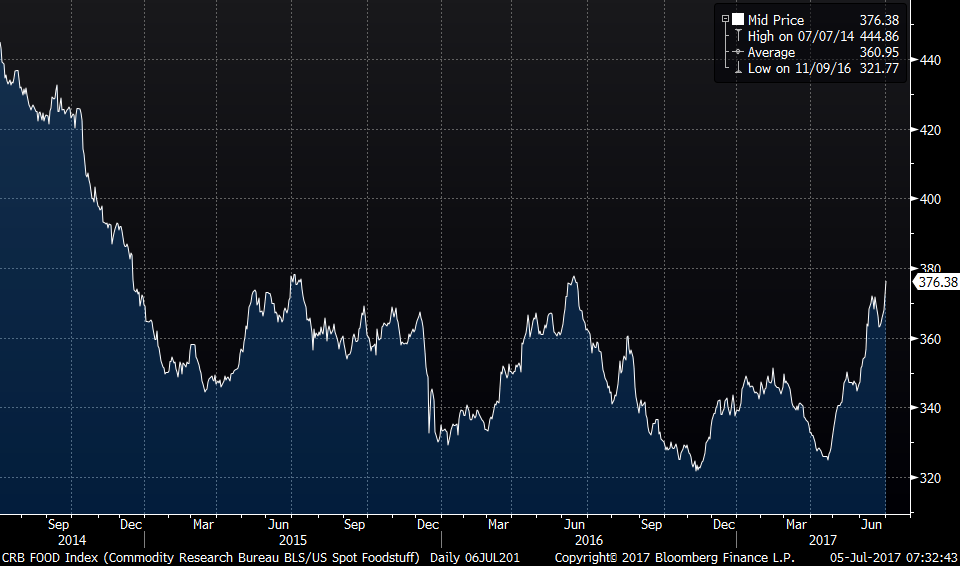

After the announced Amazon-Whole Foods deal all we heard was about food deflation at the same time the CRB food index was breaking out to a one year high which I’ve pointed out a few times over the past few weeks. Well, in case you’ve missed the activity over the past few days, this index is just 2 pts from touching its highest level since December 2014 as wheat has busted higher, corn is near a one year high and the price of soybeans is up 7% in the past 7 trading days.

I reiterate my positive stance on agriculture stocks as they have completely missed the bull market since 2011 and I believe it’s one of the last areas of the market that present good value. I particularly like the fertilizer names. Dry weather has been a big factor in the recent move but the USDA’s June estimate for ending stocks for wheat is just off the lowest level since December 2015 and with corn it sits at the lowest level since October 2015. They are still high historically because of the incredible harvests over the past few years however but be on watch for a trend change here.

We did hear today from BoE member Michael Saunders who wanted a rate hike last month and he put words behind his vote. “Households should prepare for interest rates to go higher at some point” after saying that “Our foot is pretty much on the floor with the accelerator.” Because he is now a known ‘hawk’ relatively speaking, short end Gilt yields are little changed but the 10 yr yield is rising 3 bps to near a 5 month high while the pound is down slightly as it is focusing on the June UK services PMI index which fell to 53.4 from 53.8. It’s down for the 2nd month and sits at a 4 month low. The estimate was 53.5. New orders fell to a 9 month low but employment rose to a 14 month high while business optimism dropped to the 2nd weakest since December 2011. Also, “June data pointed to a sharp and accelerated increase in average cost burdens…Greater operating costs were linked to a combination of rising staff salaries and increased raw material prices (particularly food and imported items).” Profits though are getting squeezed as “survey respondents noted that intense competition for new work continued to place pressure on pricing power.” Herein lies the BoE conundrum, dealing with stagflation. If history is any guide on this, they should focus first on taming inflation and at least take back the rate cut after Brexit where the BoE estimates thereafter were completely wrong.

The rest of the eurozone also saw a moderation in their final read of services PMI for June as well as it fell to 55.4 from 56.3 in May but that was better than the estimate of 54.7 which was the preliminary number. This brings the manufacturing and services composite index also to a 4 month low but Markit said “The dip in the PMI in June certainly doesn’t look like the start of a slowdown. Growth of new orders accelerated very slightly to reach the 2nd highest in just over 6 years, and companies are struggling to satisfy this increase in demand.” As to the ECB focus on generating higher inflation, “Rising demand is also boosting firms’ pricing power, both for goods and services. While price pressures have cooled since earlier in the year, linked mainly to lower global commodity prices, this is still the strongest period of inflationary pressure that the region has seen for six years.” The euro is down slightly in response while European sovereign bonds are little changed. The German 10 yr bund yield in particular sits just 1.5 bps below the highest level since January 2016. European bonds remain a train wreck that just maybe is on the cusp of happening. European stocks are still attractive but I can’t help but be on the lookout for a negative response if yields really move higher from here. I guess can they decouple is the question.

ECB Executive Board member Benoit Coeure said “the Governing Council has not been discussing changes in our monetary policy, that may come in the future, but it hasn’t come yet.” I think Mario Draghi was as clear as a bright blue sky last week when he hinted at an upcoming change in policy and all we’ve heard since from his colleagues is this hemming and hawing nonsense all because the market had a move they weren’t anticipating. Their current QE program is scheduled to end in December. As we know there is zero chance it actually does, if Coeure is being honest in saying they haven’t as a group discussed it, WTF are they waiting for? Mario most importantly seems ready to.

The Chinese private sector weighted Caixin services PMI for June fell by 1.2 pts to 51.6. That’s the 2nd lowest print since May 2016 and puts their combined composite index to the lowest level since June 2016 at 51.1 and thus barely above the breakeven line of 50. For services, new orders fell to the lowest level in more than a year. Backlogs were little changed while employment fell. There was optimism about a business pickup as the outlook improved to a 5 month high. Caixin bottomed lined the report by saying “Even though the impact of slowing expansion in China’s service sector was cushioned by a slight rebound in manufacturing activity, the downward trend in the economy remains entrenched.” Looking at the first 3 days of the week, the Shanghai comp is up a bit less than .5% on the heels of the mixed PMI numbers seen. Chinese authorities continue with the balancing act of trying to delever their economy (or at least slow the rate of debt growth) while sticking obsessively to their 6.5% GDP growth rate target.

We also saw other PMI’s elsewhere in Asia. Singapore’s fell .7 pts to just above 50 at 50.7. That’s the weakest in 8 months. Japan’s composite index fell .5 pt to 52.9 off its best level in a few years. Hong Kong’s PMI rose up by .6 pts to 51.1 which is barely above 50 for a 3rd month. India’s composite index was up .2 pts to 52.7, the best in 8 months as they digest demonetization and prep for the big change of a new goods and services tax. It remains one of my favorite markets.

The Reserve Bank of Australia held rates unchanged at 1.5% and purposely did not lean in any one direction on its rate intention and why the Aussie$ and Aussie bonds are little changed. An RBA board member said that there was no need “to scare the horses” by leaning toward a rate hike. The RBA said they did not feel the peer pressure that other central bank tightening might be causing.

Peter Boockvar

Co-Chief Investment Officer

Bookmark Advisors