Source: Safal Niveshak

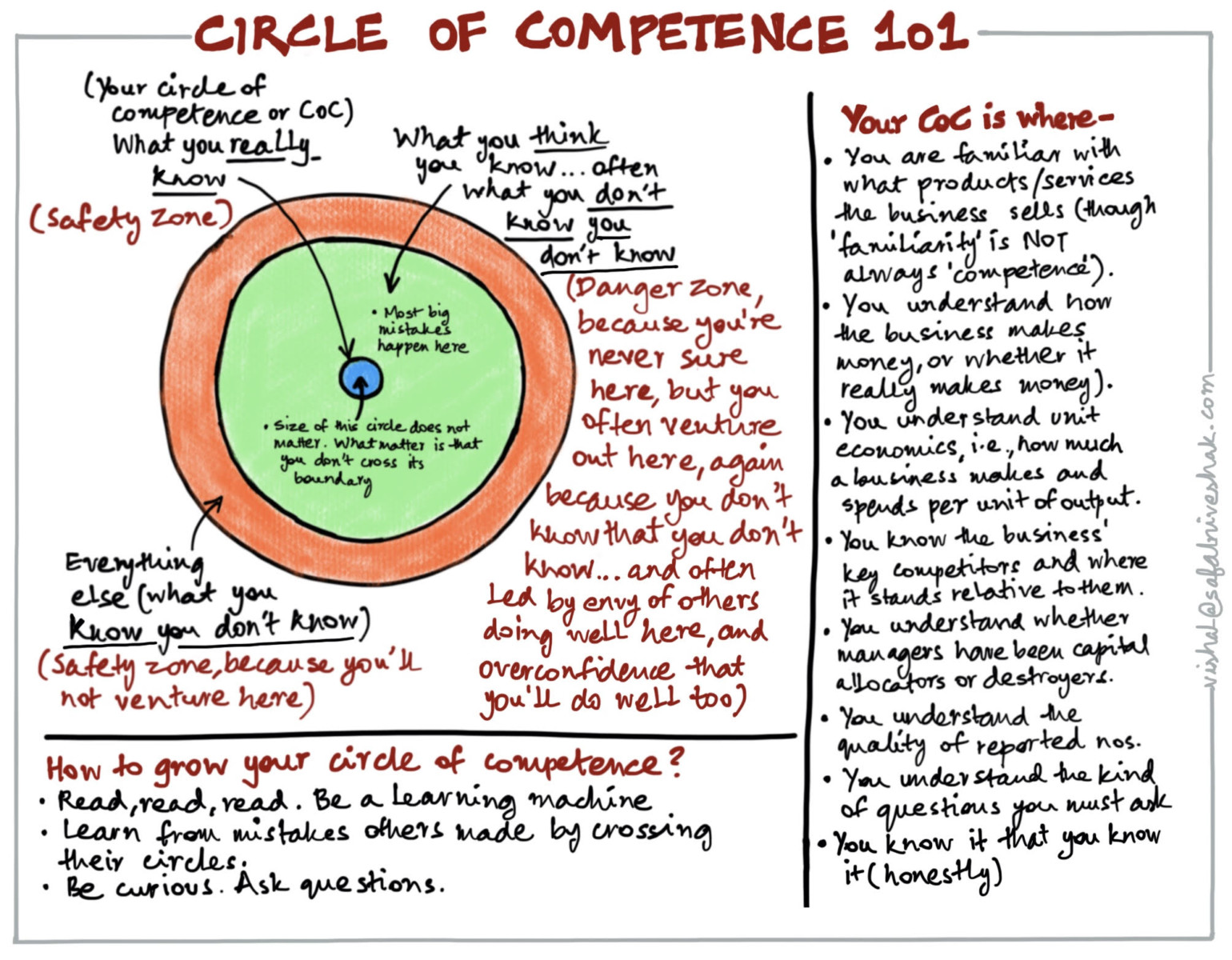

Vishal shares this graphic (site: Safal Niveshak), and directs us to Tren Griffin’s explanation of the Circle of Competence:

The idea behind the Circle of Competence filter is so simple it is embarrassing to say it out loud: when you do not know what you are doing, it is riskier than when you do know what you are doing.

What could be simpler? And yet humans often don’t do this. For example, the otherwise smart doctor or dentist is easy prey for the promoter selling cattle limited partnerships or securities in a company that makes technology for the petroleum industry. Really smart people fall prey to this problem. As an example, if you lived through the first Internet bubble like I did you saw literally insane behavior from people who were highly intelligent. Munger has pointed out that even one of the world’s greatest investors stepped outside of his Circle Competence during the bubble:

One way to think about what Munger is trying to achieve with this Circle of Competence filter is this: if you make fewer mistakes, your investment performance will be better. So invest in areas where you are competent. Why would you buy more of X which you know little about when you can buy Y (or more of Y) which is right in your Circle of Competence? The Circle of Competence approach is in part a form of opportunity costs analysis which will be discussed later in this series of posts.

Great stuff !