My Two-for-Tuesday morning train reads:

• China doubles value of infrastructure project approvals to stave off economic slowdown amid trade war (South China Morning Post) see also What Chipmakers Tell Us About the Great Global Unwinding (Businessweek)

• China’s Sneakerheads Chase 6,600% Returns Flipping Air Jordans (Bloomberg)

• Motives Creating Negative Yields (Integrating Investor) see also ‘Japanification’ stalks the US and Europe (Financial Times)

• Why Ken Griffin could be shopping around a piece of his business: The billionaire hedge fund founder could pursue a sell-high philosophy as he looks to the future. (Crain’s Chicago)

• What’s an Experience Worth? The Math Is Tricky. Increasingly, people are valuing experiences over things. But the hard part is knowing how to compare the two (Wall Street Journal) see also Money Buys Some Happiness; Health Buys You More (TBP)

• I Put My Life in a Box, Then I Couldn’t Get It Out: A promising summer of algorithms to automate household needs becomes the writer’s season in consumer hell, beset by robots preying on her self-esteem. (Businessweek)

• Facebook isn’t free speech, it’s algorithmic amplification optimized for outrage (Techcrunch) see also Facebook Finds New Disinformation Campaigns and Braces for 2020 Torrent (NYT)

• Russian cyberattack unit ‘masqueraded’ as Iranian hackers, UK says (Financial Times)

• The Liberation of Mitt Romney (The Atlantic) see also Pierre Delecto? Mitt Romney’s Secret Twitter Account Is Unveiled (Bloomberg)

• No one expected The Athletic could get people to pay for sports news. Now it has 600,000 subscribers. (Recode)

Be sure to check out our Masters in Business interview this weekend with Fran Kinniry, Global Head of Portfolio Construction at the Vanguard Group, where he is also principal in Investment Strategy Group.

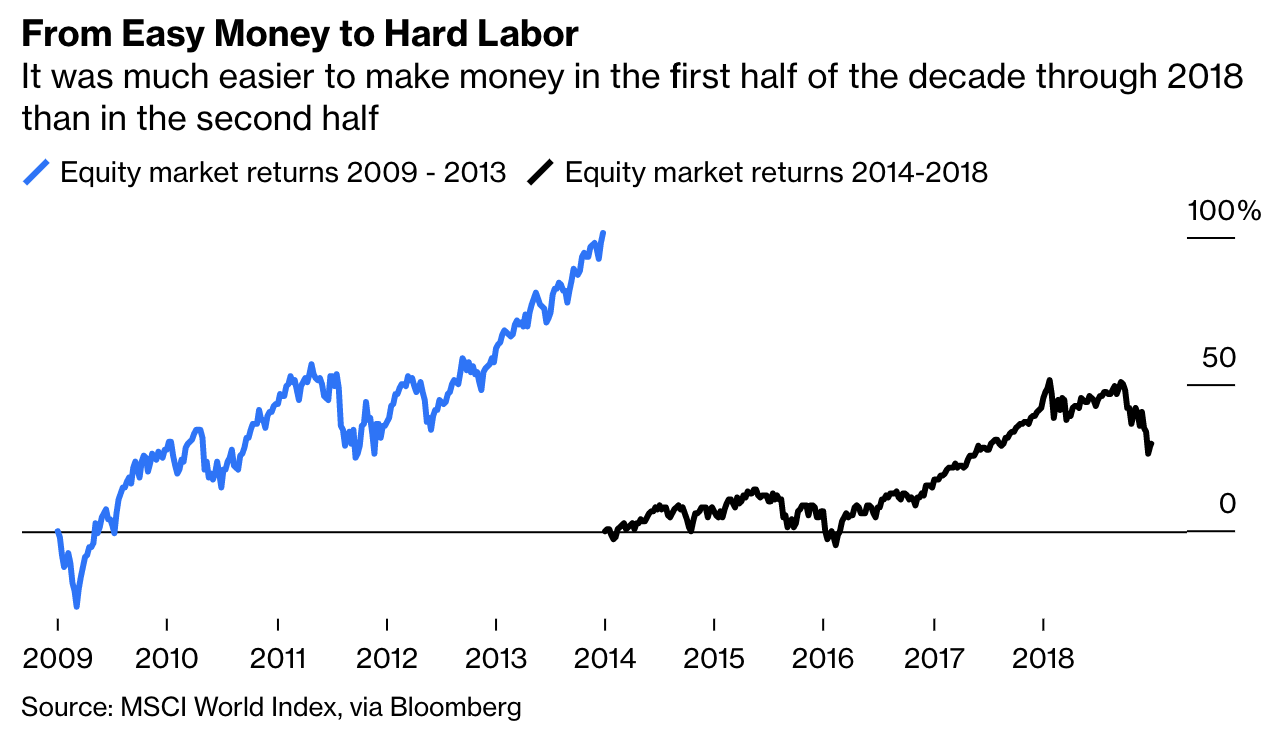

The Data argues against sticking with faltering stock-pickers.

Source: Bloomberg