My end of week morning train WFH reads:

• AOC’s Powerful and Historic Floor Speech: “One of the most thorough thrashings the Capitol has seen since Representative Preston Brooks brutally caned Senator Charles Sumner on the Senate floor in 1856.” (Bloomberg)

• Behind Bill Ackman’s $4 Billion Day: The Pershing Square founder’s blank-check company debuted as the biggest of all time. (Institutional Investor)

• Shopify Saved Main Street. Next Stop: Taking On Amazon: The Canadian e-commerce company is breathing down Silicon Valley’s neck as the next great enterprise behemoth (Medium)

• America Looks Hopelessly Broke. It Isn’t. For 40 years, both the left and the right have been unnecessarily obsessed with deficits, to the detriment of the well-being of citizens. (New York Times)

• Private Equity’s Biggest Critic Sounds Off With His Final Warning: University of Oxford’s Ludovic Phalippou contends the high-fee industry doesn’t outperform publicly traded stocks. (Businessweek) see also Hedge Fund Activists Might Just Be Good Stock Pickers: New research suggests activists are skilled at finding deals — but don’t necessarily add value to companies. (Institutional Investor)

• Twitter Cracks Down on QAnon. Your Move, Facebook: Twitter’s new policy won’t make the conspiracy group disappear. But experts say it could dramatically reduce its ability to spread. (Wired)

• Shirking from home: For remote employees, meetings and deep work are now coupled with online shopping, soothing puzzles and video games, and an array of other distractions. (Vox)

• How Gödel’s Proof Works: His incompleteness theorems destroyed the search for a mathematical theory of everything. Nearly a century later, we’re still coming to grips with the consequences. (Quanta Magazine)

• There Are Wasps in the Yard. You’d Better Get to Know Them. They buzz. They hover. Sometimes they sting. But how much do you really know about these insects that can menace our summers? (New York Times)

• Cherishing Baseball’s Return: Baseball’s worth in these times is in its frivolity. The comfort of routine. The language of a box score. The orderliness of runs, hits and errors–day after day (Sports Illustrated)

Be sure to check out our Masters in Business interview this weekend with David Enrich, Finance editor at the New York Times. He is the author of The Spider Network about the LIBOR scandal; his new book is “Dark Towers: Deutsche Bank, Donald Trump, and an Epic Trail of Destruction.”

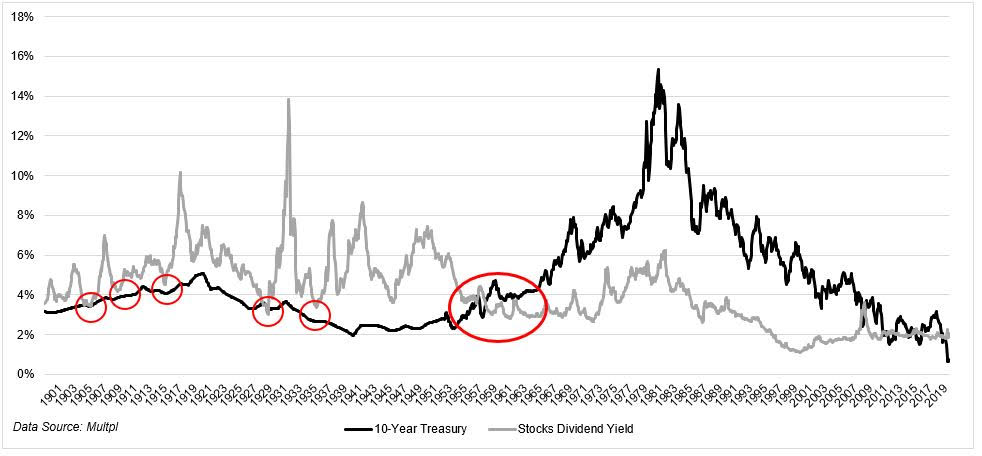

Up to the late 1950s, investors earned more income from stocks than bonds

Source: Irrelevant Investor

Sign up for our reads-only mailing list here.