My mid-week morning train WFH reads:

• How the Fed’s Quick Action May Have Given Congress Cover for Inaction: By doing its job of stabilizing the financial system, it has reduced the sense of urgency for lawmakers to help ordinary Americans. Neil Irwin’s accurate assessment of 2020 is secretly a scathing critique of Fed overreach and Congressional nonfeasance during the 2008-09 financial crisis. (Upshot)

• Are SPACs Too Good to Be True? The blank check outfits sure are popular. But issuers have the upper hand over investors, performance is a mixed bag, and they face possible tough competition. (CIO)

• The 9 Best Income Producing Assets to Grow Your Wealth: Want to get rich? Then you should just keep buying a diverse set of income-producing assets. While this advice sounds easy enough, the hard part comes when deciding what kind of income-producing assets to own. (Of Dollars And Data)

• Vinyl Sales Surpass CD Sales for the First Time in 34: Years Despite the pandemic, the music industry actually turned a small profit during the first half of 2020 (Consequence of Sound)

• 50 years later, Milton Friedman’s shareholder doctrine is dead: Over the last 50 years, Friedman’s views became increasingly influential in the U.S. As a result, the power of the stock market and wealthy elites soared and consideration of the interests of workers, the environment, and consumers declined. Profound economic insecurity and inequality, a slow response to climate change, and undermined public institutions resulted. (Fortune)

• We View Nikola’s Response As a Tacit Admission of Securities Fraud: “the company debunked nothing. Instead it either confirmed or sidestepped virtually everything we wrote about, and in some cases raised new unanswered questions.” (Hindenburg Research)

• Nvidia’s Integration Dreams: Start with Nvidia: the company is perhaps the shining example of the industry transformation wrought by TSMC; freed of the need to manufacture its own chips, Nvidia was focused from the beginning on graphics. (Stratechery)

• Why Israel’s peace deals with the UAE and Bahrain matter: Five reasons why the deals are significant. (BBC)

• And in the End: Fifty years ago, the Beatles went through rock’s most famous breakup. Inside the heartbreak, the brotherhood, and why the music still matters (Rolling Stone)

• Hi, It’s Venus. Congratulations on Your Discovery. Now Leave Us Alone. After a scientific breakthrough, a message from a faraway neighbor (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Fidelity‘s Will Danoff, who manages the firm’s storied Contrafund, Over 30 years of running Contra, Danoff has outperformed the S&P 500 Index by 3.21 percentage points a year.

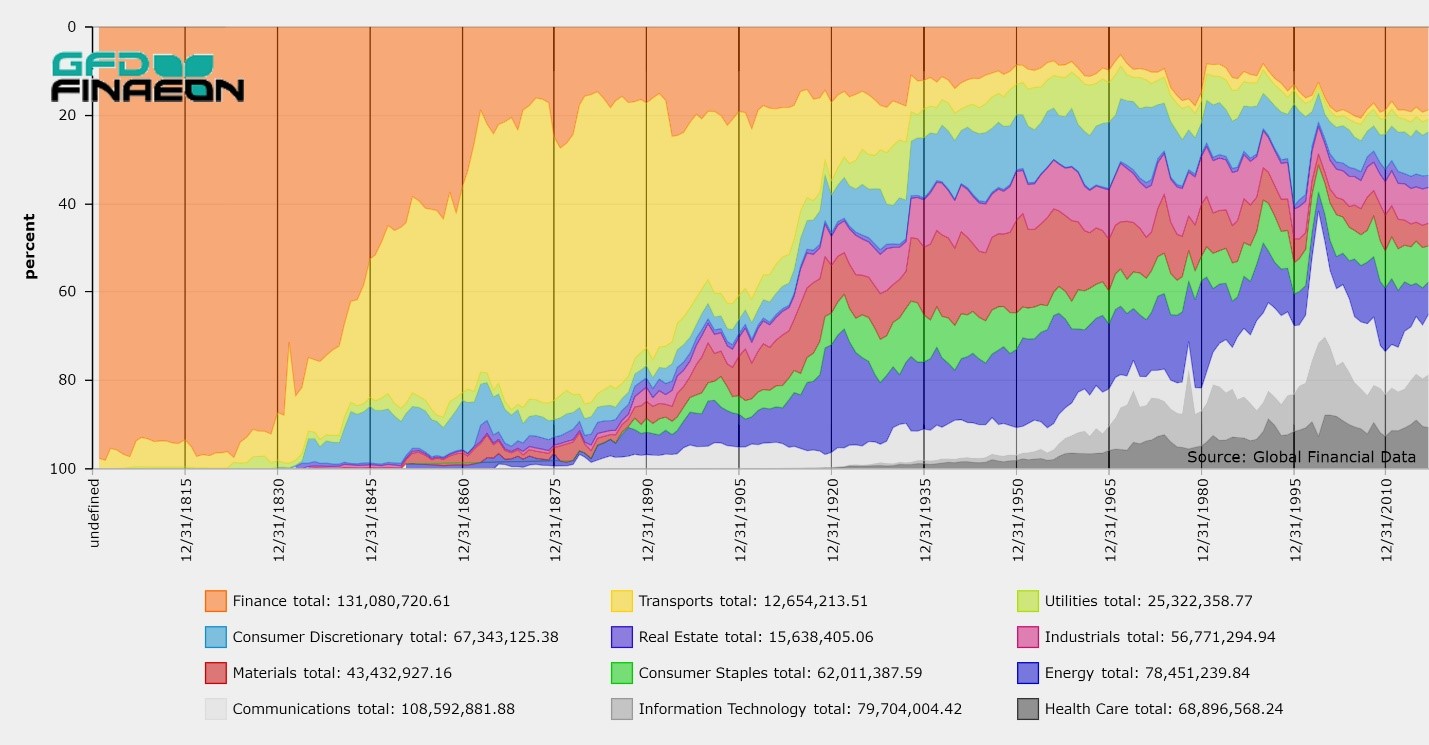

200 Years of the United States Stock Market in One Graph

Source: Global Financial Data