Today in wonky economic ephemera:

This morning, Thom Keene was discussing the possibility of a slowdown, zero growth, or a contraction. He specifically asking Citigroup’s Global Chief Economist: “Are we going to approach an NBER recession?”

Her answer: “Well, of course, the NBER recession is the two consecutive quarters of negative growth, thats the official word.”

Actually . . .

That is not the NBER definition (we shall get to that in a moment). As far as I can recall, it has not been the official definition of a recession during the entire course of my professional career dating back to the 1990s. I am always surprised that so many people get this wrong, but perhaps I shouldn’t be.

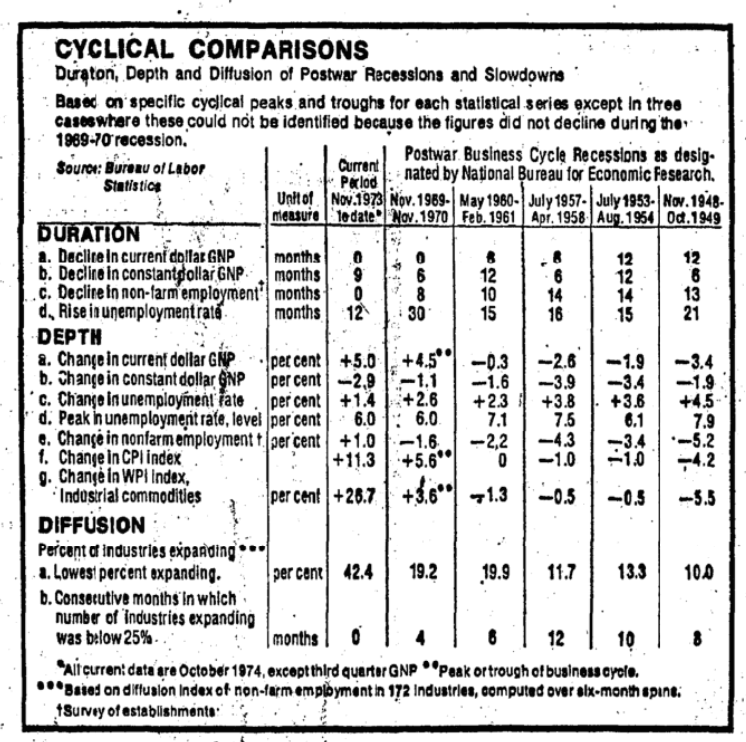

I traced an early mention of the unofficial “2Q” definition to Julius Shiskin, who was the ninth Commissioner of the U.S. Bureau of Labor Statistics. In a 1974 Op-Ed in the New York Times, Shiskin suggested two quarters of contraction might be a worthwhile rule of thumb:

“A rough translation of the bureau’s qualitative, definition of a recession into a quantitative one, that almost anyone can use, might run like this: In terms of duration—declines in real G.N.P. for 2 consecutive quarters; a decline in industrial production over a six‐month period. In terms of depth—A 1.5 per cent decline in real G.N.P.; a 15 per cent decline nonagricultural employment; a two point rise in unemployment to a level of at least 6 per cent. In terms of diffusion—A decline in nonagricultural employment in more than 75 per cent of industries, as measured over six‐month spans, for 6 months or longer.” *

That was in 1974 that the head of BLS mentioned this “rough translation.” But if you look, you can find earlier references to this unofficial measure.

For a long time, the director of business cycle studies at NBER was Geoffrey H. Moore (obit). He defined a Recession many times in his career, but I would direct you to his 1983 book, Business Cycles, Inflation, and Forecasting (relevant PDF). Moore observes in the book:

“The definition formulated by Arthur F Burns and Wesley C Mitchell in 1946 is a modification of one published by the national Bureau in 1927 hence it has been used in substantially its present form for more than 50 years. It imposes no fixed requirement upon the duration of business expansions or contractions.” (emphasis added)

So if there were no fixed minimums going back to 1927, what was the source of two quarters rule of thumb prior to Shiskin’s 1974 OpEd?

As it turns out, it may have been a simple observation made by Moore:

“Even the limits on the period of a full cycle (expansion and contraction) are broad: more than a year to 10 to 12 years. In practice the shortest contraction recognized in the United States has been six months.” (emphasis added)

Perhaps this may have led other economists to simply extrapolate Moore’s observation that no contraction had been shorter than 6 months into the well known but erroneous two quarter rule of thumb. I cannot say for sure this is the source, but it seems like a realistic possibility.

Moore, it is worth adding, later goes on to form the Economic Cycle Research Institute in 1996 with Anirvan Banerji, and Lakshman Achuthan.

As to the actual definition, the NBER observes:

“A recession is the period between a peak of economic activity and its subsequent trough, or lowest point. Between trough and peak, the economy is in an expansion. Expansion is the normal state of the economy; most recessions are brief . . . The NBER’s traditional definition emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months.” –NBER Business Cycle Dating

Interesting side note: The phraseology has progressed from periods of declines being called “Depressions,” but then as the “declines in economic activity became less severe,” the preferred phrase became “Recession.” Ultimately the more politically neutral phrase “Contraction” came to be used.

~~~

If you must go somewhere this holiday week, please travel safe.

_____

* The online version seems to have a few typos I corrected: “teal G.N.P.” is “real G.N.P.” Also, a “wo-point rise in unemployment” is a should be a “Two-point rise in unemployment” (I confirmed both via the NYT’s TimeMachine). Note how similar the 2% rise is to the Sahm Rule.

Sources:

The Changing Business Cycle

By Julius Shiskin

New York Times, Dec. 1, 1974

See also:

Business Cycle Dating Committee Announcement (NBER, June 8, 2020)

Julius Shiskin, July 1973–October 1978 (BLS History)

The risk of redefining recession (CNN/Money, May 7, 2008)

What Is a Recession? (St Louis Federal Reserve, February 2009)

A Nasty, Short and Bitter Recession (Investopedia, April 3, 2020)

Economic Cycle Research Institute