My end of week morning train WFH reads:

• WeWork’s Mad Messiah Billion Dollar Loser tells the tale of the rise and quasi-fall of Adam Neumann, founder and erstwhile CEO of WeWork, the real estate leasing firm that somehow managed to pass itself off as a startup unicorn to rival the likes of Uber, and which by early 2019 was valued at $47 billion, despite never having made a profit, and having no proprietary technology of any significance. It is rich in high grade weirdness. (UnHerd)

• What a $32 Million Dinosaur Can Tell Us About This Year’s Art Auctions The top of the auction market is never a great indicator of how the art market is doing; it’s like trying to gauge the strength of the U.S. car market by looking at Bugatti sales. This has always been true, and it’s particularly salient during the pandemic as jittery sellers turn to pre-arranged (and publicly untraceable) private sales instead of riskier public auctions. Still, the top 10 lots pulled in an encouraging $408 million. (Bloomberg)

• The Triumphs — and Troubles — of Citi Research In just four years, Citi had risen rapidly up the rankings of investment research houses, defying the regulatory burdens and shrinking client wallets that threatened the larger sell-side industry. By the end of 2019, Citi was recognized as the No. 2 equity research provider globally by money managers and allocators surveyed by Institutional Investor. Then in 2019, restructuring and job cuts hit. (Institutional Investor)

• U.S. Manufacturing: Why Covid Made 2020 the Bottom of a Long Decline The U.S. manufacturing industry has experienced a lifetime of trauma over the past two decades—but we believe 2020 marks the bottom of that long and high-profile decline. This past year has been particularly traumatic, as the pandemic brought with it the largest cut in industrial earnings on record in the second quarter, driven by the global shutdown that started in January in China and still exists in some form in many countries today. (Wall Street Journal)

• The Work-From-Home Boom Is Here to Stay. Get Ready for Pay Cuts White-collar workers are taking advantage of a newfound flexibility to leave expensive coastal cities, even as companies move to “localize” their pay. (Businessweek) see also The New Battles to Come Over Working From Home It’s clear that lots more people will be doing their jobs remotely after the pandemic, but who, where and how often? (Bloomberg)

• WhatsApp’s monetisation problem If Facebook is forced to sell the business, how might the messaging service commercialise? (Financial Times)

• Biden’s FTC Can Do More Than Sue Tech Companies. It Can Regulate Them. The FTC could change this by creating regulations to rein in anticompetitive practices and prevent companies from monopolizing markets. FTC Commissioner Rohit Chopra and antitrust scholar Lina Khan have argued that agency rulemaking defining unfair methods of competition would enhance the predictability, efficiency, and transparency of antitrust enforcement. (Slate)

• Tome raiders: solving the great book heist When £2.5m of rare books were stolen in an audacious heist at Feltham in 2017, police wondered, what’s the story? Historically, book thieves have come in two varieties. First, there are the rogue custodians, those who exploit their privileged access to literary treasures. Then there are the academics – or, at least, those who profess an academic interest in the texts they go on to steal. (The Guardian)

• Tiny Nuclear Reactors Yield a Huge Amount of Clean Hydrogen NuScale has released new data on its small modular reactor’s ability to split hydrogen from water. High-temperature electrolysis of hydrogen requires process heat. NuScale’s reactor was competitive with solar electrolysis at the right scale. (Popular Mechanics)

• Beethoven’s 250th Birthday: Here’s Everything You Need to Know Explore the music, life and times of the composer who changed culture. (New York Times) see also Beethoven and Freedom There are rare moments when the triumph of the human spirit lifts us into a higher state of being. We look at perfect strangers and see the better angels of our nature, and shed the pettiness and petulance of daily life. We feel the touch of the infinite and feel the fullness of our freedom, because man is only free as a moral agent. (Tablet)

Be sure to check out our Masters in Business interview this weekend with Tom Slater, head of the US equities team at Baillie Gifford, which has over $370 billion in assets under management. He serves as a decision-maker on Long Term Global Growth portfolios, and the U.S. Equity Growth Fund which is up +113% year to date. He also co-manages the Scottish Mortgage Investment Trust, which Baillie Gifford has been managing since 1908.

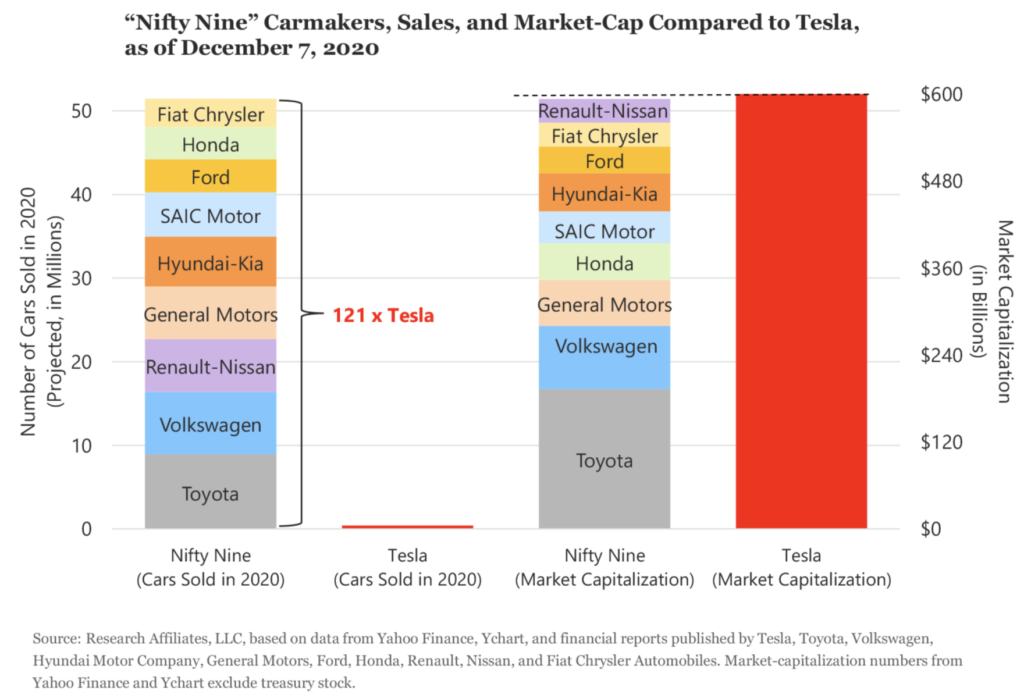

Tesla, the Largest-Cap Stock Ever to Enter S&P 500: A Buy Signal or a Bubble?

Source: RAFI

Sign up for our reads-only mailing list here.