• Pandemic Villains: Robinhood. Have a pair of gangly Stanford grads built the perfect mousetrap? As the world went into lockdown and the global economy into a spiral last spring, one company struck gold. A phone-based trading app called Robinhood began wiping the floor with more celebrated online brokerage rivals. The moment the pandemic began, the world started trading stocks on Robinhood.(Taibbi)

• Custom Direct Indexing: The Next Evolution of Index Investing Co-mingled funds and ETFs sit in between investors and the stocks they own. Funds and ETFs have been good to investors and were wonderful technologies in their own rights. But Custom Indexing software, zero commission trading, and fractional share trading mean that in the future, more investors will own their shares directly rather than through mutual funds and ETFs. (Canvas)

• It’s the financial *services* industry While sales and trading happens hour-to-hour or day-to-day, advisory happens on a timescale of years. And in investment bank sales and trading, the more “bespoke” the financial product being sold to a client is, the more profits accrue to the bank putting it together (Matthew Zeitlin)

• ‘This Is Insanity’: Start-Ups End Year in a Deal Frenzy Investors are tripping over one another to give hot start-ups money. DoorDash and Airbnb are going public. The good times are baaack. (New York Times) but see This Recession is Different In every recession, goods get hit harder than services. This makes sense. You delay that new appliance purchase, but you continue to go to the gym. This recession is different. People who could afford to bought Pelotons and canceled their gym membership. (Irrelevant Investor)

• Musk, Bezos Space Race Gets a Boost From Anti-Poverty Tax Break Rocket projects aren’t the only thing the world’s two richest people have in common. Their facilities are in areas designated as opportunity zones, giving them a path to low-tax expansion. (Bloomberg)

• Holiday Wine Shopping: How to Win the ‘Costco Treasure Hunt’ On a hunch that this year might be a uniquely fruitful one for finding deals, we stalked the aisles at Costco. Here, the best values flushed out. (Wall Street Journal)

• How retailers track your every move in exchange for coupons and convenience Attention shoppers: Your data has never been more valuable. (Vox)

• Can’t Take a Joke? That’s Just Poe’s Law, 2017’s Most Important Internet Phenomenon Those trolls aren’t really spewing hate speech—that’s just you being thin-skinned and missing the irony! (Wired)

• Infected after 5 minutes, from 20 feet away: South Korea study shows coronavirus’ spread indoors Dr. Lee Ju-hyung has largely avoided restaurants in recent months, but on the few occasions he’s dined out, he’s developed a strange, if sensible, habit: whipping out a small anemometer to check the airflow. (LA Times) see also Dr. Scott Gottlieb: ‘I will not eat indoors in a restaurant’ because the Covid risk is too high “I think the risk is too high to be in a confined space without a mask on with other people eating in that same location right now,” Gottlieb said. By contrast, the former FDA chief said he has shopped at big-box stores wearing a high-quality face mask. (CNBC)

• A Year in Pictures, A Year Like No Other: Like, 2020 itself, this becomes increasingly difficult to get through. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Mike Swell, head of Global Fixed Income at Goldman Sachs Asset Management (GSAM). Swell is responsible for co-leading the global team of portfolio managers that oversee more than $700 billion in multi-sector bond portfolios.

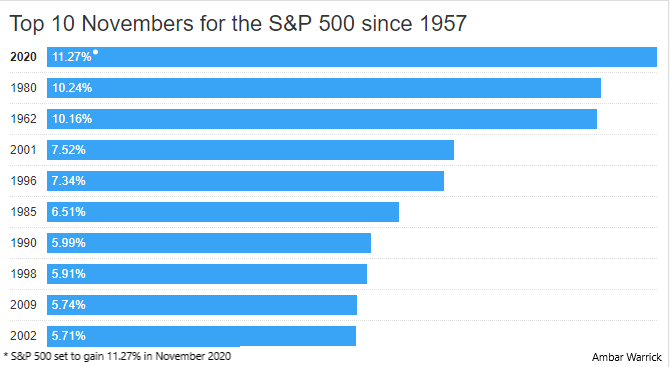

Best November Ever

Source: Reuters

Sign up for our reads-only mailing list here.