Source: How Much

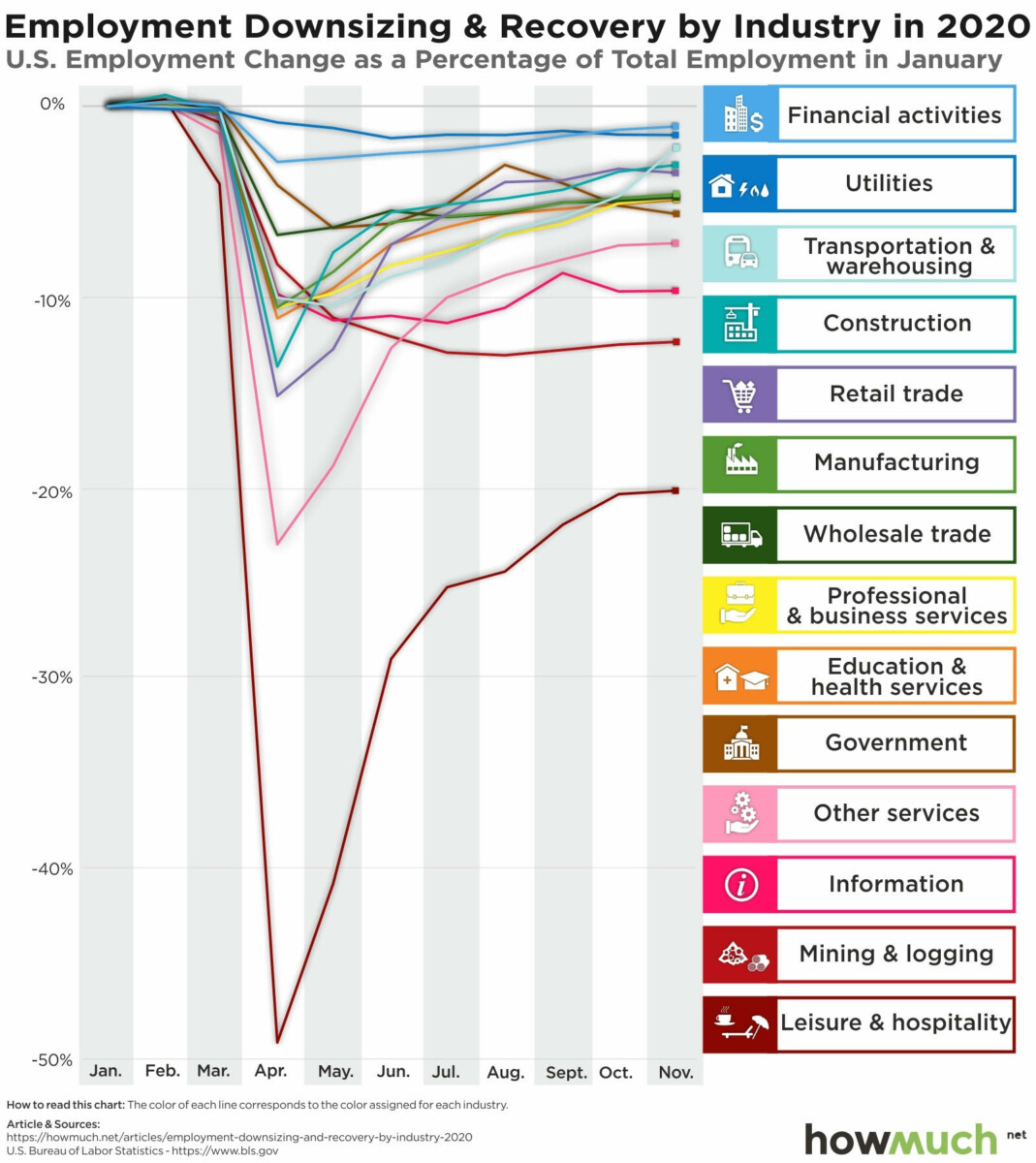

I am fascinated by the chart above: It is filled with surprises, but also is so revealing about the current state of the US economy. Let’s start with the obvious, but also consider some not so obvious issues:

Holding up well

Financial services are still continuing along, ’cause even during work from home/lockdown, people have to consume food, housing, real estate, energy, etc. Its off a few percentage from pre-2020 levels, reflecting the overall contraction of the broader economy. If anything, its surprising how well it has held up despite massive unemployment and GDP falloff.Utilities have held up pretty well, despite offices, restaurants, theaters, retail stores, etc. being mostly empty. My assumption is much of that energy consumption has been transferred to the home, and at peak energy costs, too.

Transportation & Warehousing also recovered pretty well over time. Once the nation moved to delivery services of food, work supplies, household goods, etc. the sector came snapping back.

Crushed:

Leisure and Hospitality are at the bottom of the list — and we can include Travel in there as well. No surprise here, restaurants, hotel, air travel have all been devastated.Mining & Logging are also down, perhaps reflecting the softness in manufacturing. Still,

Surprises Good & Bad:

Information surprises to the down side: Employment in the sector fell modestly, but plateaued, never really recovering. Given the success fo FAANMG and other tech stocks, this could surprise until you realize that mega cap tech firms are not the real economy. Lots of people who work in information services for other companies were either furloughed or laid off, and those firms have yet to recover.Construction fell more sharply, then recovered as a modest exodus from cities to suburbs took place. Anecdotally, my travels around the tony suburbs of Long Island and the vacation mecca in the Hamptons showed a shocking amount of building and renovation. Not enough to offset the collapse of commercial real estate construction — is anyone building new office towers today? — but close.

The good news is there is light at the end of the tunnel as vaccines and Covid Relief 2 (and maybe even 3 next year) are coming. Not too long ago, it was a contrarian position to say that the recovery will be must faster than many expect. But more and more economists are moving towards that consensus.

Here’s to hoping 2021 will see a significant improvement in employment over even pre-pandemic 2020.

Previously:

The K-Shaped Recovery (September 4, 2020)

Why Markets Don’t Seem to Care If the Economy Stinks (August 7, 2020)