My back to work morning train WFH reads:

• The GameStop Phenomenon Is Hardly New. Here’s How a Similar Squeeze Played Out in 1923. Long before GameStop, there was Piggly Wiggly.In 1923, the supermarket company—which still does business in the South and Midwest—was at the center of a short squeeze/market morality play that echoes the recent frenzy around GameStop. (Barron’s)

• Out of Grief, MIT’s Andrew Lo Invented a Better Way to Finance Biomedical Innovation What if you could raise $30 billion to fund 150 startups at once? If the success of each was independent—that is, uncorrelated with the success of any other drug in the portfolio—then the chance of at least 3 becoming blockbusters was 98% and the chance of at least 5 becoming blockbusters was 87%. Those odds were so attractive, Lo realized, that even conservative fixed-income investors who like single-A-rated bonds would be willing to finance such a fund. (Businessweek)

• J.P. Morgan Won Active Management in 2020. Here’s How They Did It. “We took the playbook out and we executed against it,” Gatch, who took over as CEO in August 2019, told Institutional Investor during a Zoom call from his New York apartment. “We had no idea it was going to be a pandemic, but we knew that a crisis was coming,” he said, in his first media interview about about its performance last year. (Institutional Investor)

• Jeff Bezos Doesn’t Have Time to Be CEO of Amazon “I’ll do hobbies. I’ll see movies. I’m talking about work. I’m not going to work on something that I don’t think is improving civilization. I think The Washington Post does that, I think Amazon does that, and I think Blue Origin does that. And I’m not going to put productive energy into anything that doesn’t improve civilization. Why would I? What would I be trying to do?” The shelf life of a tech executive, innovation in the Covid era. (Wired)

• America’s deeply unequal economic recovery, explained in 7 charts The pandemic has made employment disparities in America more evident than ever (Vox)

• Led by ‘Mr. SPAC,’ Credit Suisse Cashes In on Blank-Check Spree A boom in blank-check companies is reviving Credit Suisse’s ambitions on Wall Street (Wall Street Journal)

• Apple in 2020: The Six Colors report card It’s time for our annual look back on Apple’s performance during the past year, as seen through the eyes of writers, editors, developers, podcasters, and other people who spend an awful lot of time thinking about Apple. (Six Colors)

• Cuba lifts ban on most private business Reform comes as communist-ruled island grapples with deepest economic crisis in decades. (Financial Times)

• They Stormed the Capitol. Their Apps Tracked Them. Times Opinion was able to identify individuals from a trove of leaked smartphone location data. (New York Times)

• Why Pterosaurs Were the Weirdest Wonders on Wings A rush of fossil discoveries has brought to light surprising new pterosaur shapes, sizes, and behaviors. Perhaps hundreds of pterosaur species lived at any one time, dividing up habitats much as modern birds do, including monsters like Quetzalcoatlus northropi, one of the largest flying animals yet discovered, nearly as tall as a giraffe, with a 35-foot wingspan and a likely penchant for picking off baby dinosaurs. (National Geographic)

Be sure to check out our Masters in Business next week with Kevin Landis, Firsthand Funds. The firm’s Firsthand Technology Opportunities Fund (TEFQX) was created in 1999, and has gained 21.1% annually over the past 10 years vs 13.9% for the S&P500 and 18.5% for the Nasdaq Index. It gained 102% over the past 12 months.

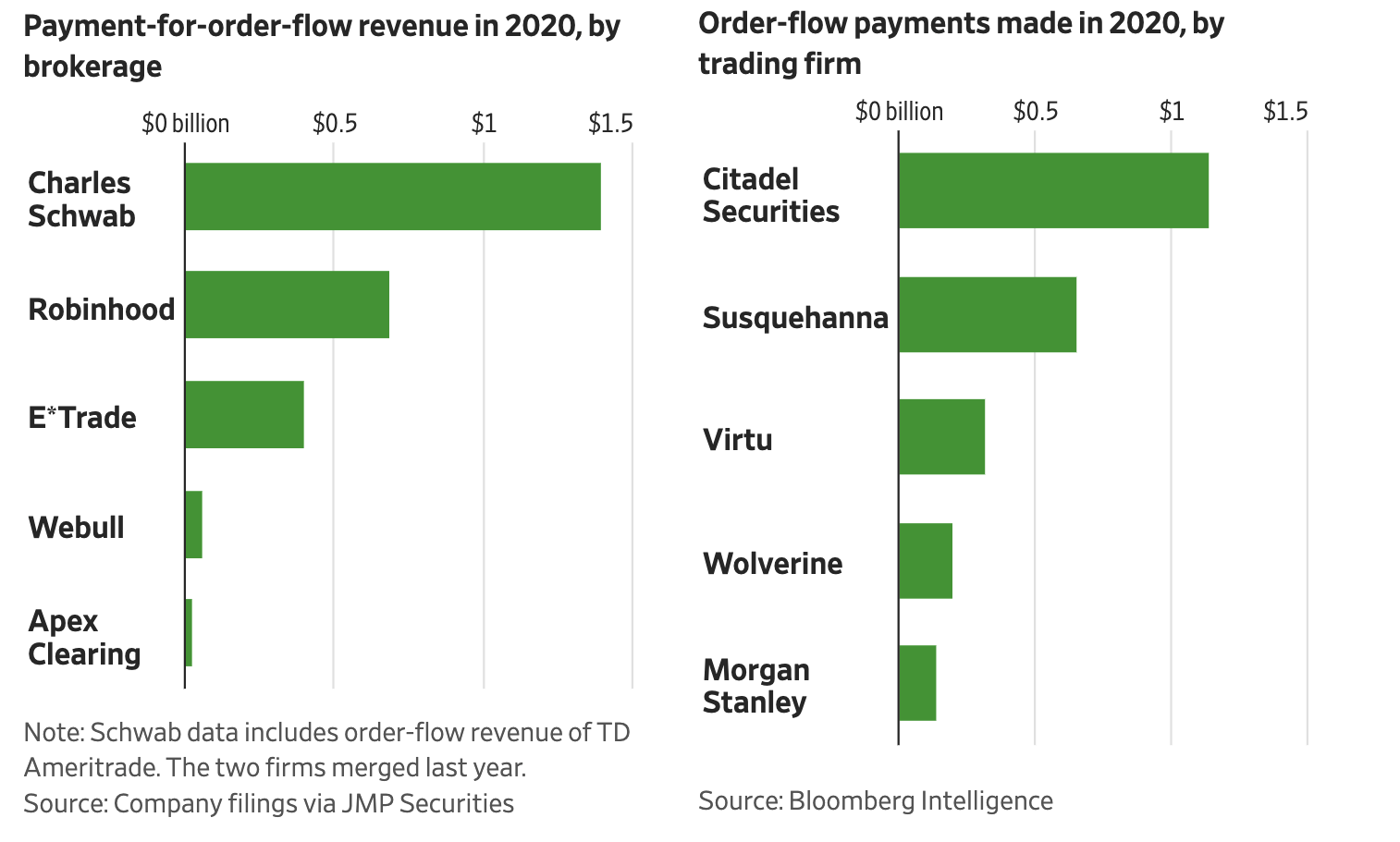

GameStop Mania Drives Scrutiny of Payments to Online Brokers

Source: Wall Street Journal

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.