My end of week morning train WFH reads:

• Bill Hwang Had $20 Billion, Then Lost It All in Two Days The fast rise and even faster fall of a trader who bet big with borrowed money (Businessweek)

• Behind the Rise and Fall of an Esteemed Value Shop IVA had an auspicious launch, an unusual life, and a startling end. (Morningstar)

• Assets Have Tanked at Two of the World’s Biggest Short Sellers Jim Chanos’ Kynikos Associates and Jim Carruthers’ Sophos Capital got much smaller in 2020, according to new regulatory filings. (Institutional Investor)

• Why I’ve Become a Shareholder Who Doesn’t Vote Shareholders can express themselves, but companies don’t necessarily listen. (Bloomberg)

• Actionable Complexity: The crucial lesson of Moneyball is the recognition that it is possible to find cheap value via underappreciated player assets (some assets are cheap for good reason) by way of an objective, disciplined, data-driven process. In other words, as Lewis explained, “it is about using statistical analysis to shift the odds [of winning] a bit in one’s favor” due to market inefficiencies. (Better Letter)

• New Bonds Fuel Lending to Fast-Growing but Unprofitable Tech Companies Wall Street is selling new complex securities backed by private loans to loss-making businesses (Wall Street Journal)

• Pandemic as Metaphor The grim reaper who revealed grim truths about our society. (Part two of the misinformation trifecta). (Insight)

• Trump got evicted from ‘the swamp.’ Some of his people are trying to stick around. In normal times, people like former administration officials could move effortlessly from the White House to a prime job as the head of comms for Amazon. Lower-tier staffers could tell potential employers that their time in government afforded them a deep understanding of legislative “process” and could be handed six-figure lobbying jobs. (Washington Post) see also What a photo of Trump’s new office reveals about how he wants to be remembered An obsessive, inch-by-inch POLITICO breakdown of the 45th president’s new digs at Mar-a-Lago. (Politico)

• Question of the Week: What Is the Car Of Your Youth? Our automotive passion was formed by endless days behind the wheel and long evenings in the garage during our youth. Things were different back then. We didn’t look at cars in terms of resale value and future collectability. We only thought about where they could take us and how much fun we’d have getting there. (Bring A Trailer)

• With the 41st Pick in the NBA Draft, the Denver Nuggets Select…the Next MVP There has never been a great player like Nikola Jokic—and not just because of the way he plays (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with John Schlifske, CEO of Northwestern Mutual. The firm underwrites over $2 trillion in life insurance, with $200 billion in client assets. Schlifske joined Northwestern Mutual in 1987 as an investment specialist, and climbed through the ranks, becoming CEO 11 years ago. The firm announced a record $6.2 billion dividend in 2021.

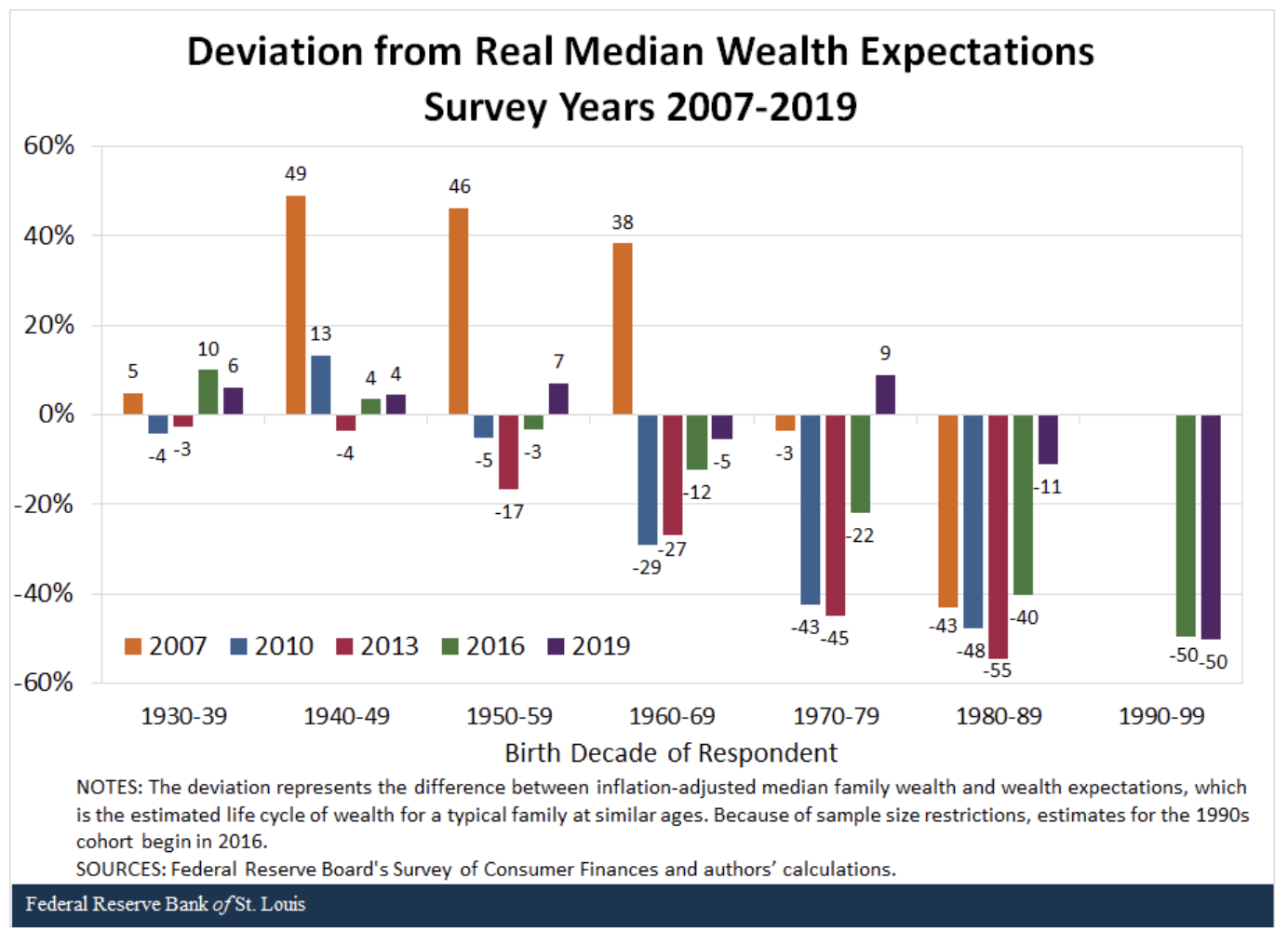

The Generational Wealth Gap

Source: Irrelevant Investor

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.