My morning train WFH reads:

• The Dumbest Financial Story of 2021: Everyone involved should be embarrassed. The swift fall of Archegos Capital Management is one of the most embarrassing financial plotlines in years, not just for a handful of banks but for an entire financial and governance system that really shouldn’t have let any of this happen. It takes a lot of malfeasance for giant banks to do something in 2021 that would make a neutral observer think, “Wow, it’s legitimately shocking they did that.” (Slate)

• So You’re a Celebrity Who Wants to Buy a House There’s a niche industry built around helping celebrities drop millions of dollars on real estate without the public ever finding out. Here’s how it works. (Vice)

• How to Fix SPACs: Keep Their Backers Locked In Longer The big names behind blank-check companies don’t always stick around. Could changing that protect investors? (Dealbook)

• Can the stock market crash during an economic boom? Inflation can be harmful to the stock market, but it’s hard to imagine investors selling their stocks in the midst of an economic boom. Has the stock market ever crashed as the economy soared? It’s rare, but it has happened before. (Fortune)

• An Oversupply of NFTs Is Going to Kill the Golden Goose: The signs of oversupply are easy to see. Everyone from digital artists to musicians to journalists is minting NFTs as fast as possible. And why not? When demand is high, it only makes sense to try to take advantage of it. The problem is that what’s individually rational is collectively destructive. Welcome to the new tragedy of the commons (Medium)

• Does Inflation Actually Benefit Value Stocks? Given the prominence of the assumption that inflation is beneficial to value stocks, we believe it is a theme worth exploring in more detail (Applied Finance)

• Americans believe in work. WeWork preyed on that instinct. Former WeWork staffers talk about the “propaganda” that was fed to members while everything was chaos behind the scenes. Hulu’s new documentary explains why we keep falling for hucksters like Adam Neumann. (Vox)

• When the Workers Own the Business, They Need a New Kind of Finance Co-ops that share profits and voting power with workers may struggle to get conventional loans, but impact investors are trying to fill the gap. (Businessweek)

• The Rules That Made U.S. Roads So Deadly Why did traffic fatalities rise on U.S. streets during the pandemic? Blame laws that lock in dangerous street designs and allow vehicles known to be more deadly to non-drivers. (CityLab)

• Why Animals Don’t Get Lost: Birds do it. Bees do it. Learning about the astounding navigational feats of wild creatures can teach us a lot about where we’re going. (New Yorker)

Be sure to check out our Masters in Business interview this weekend with Shirl Penny, founder and CEO of Dynasty Financial Partners. Dynasty has 50 RIA offices, 250 advisors + over $60B in assets on their platform. Penny was recently named to Investment News’ 40 under 40 list.

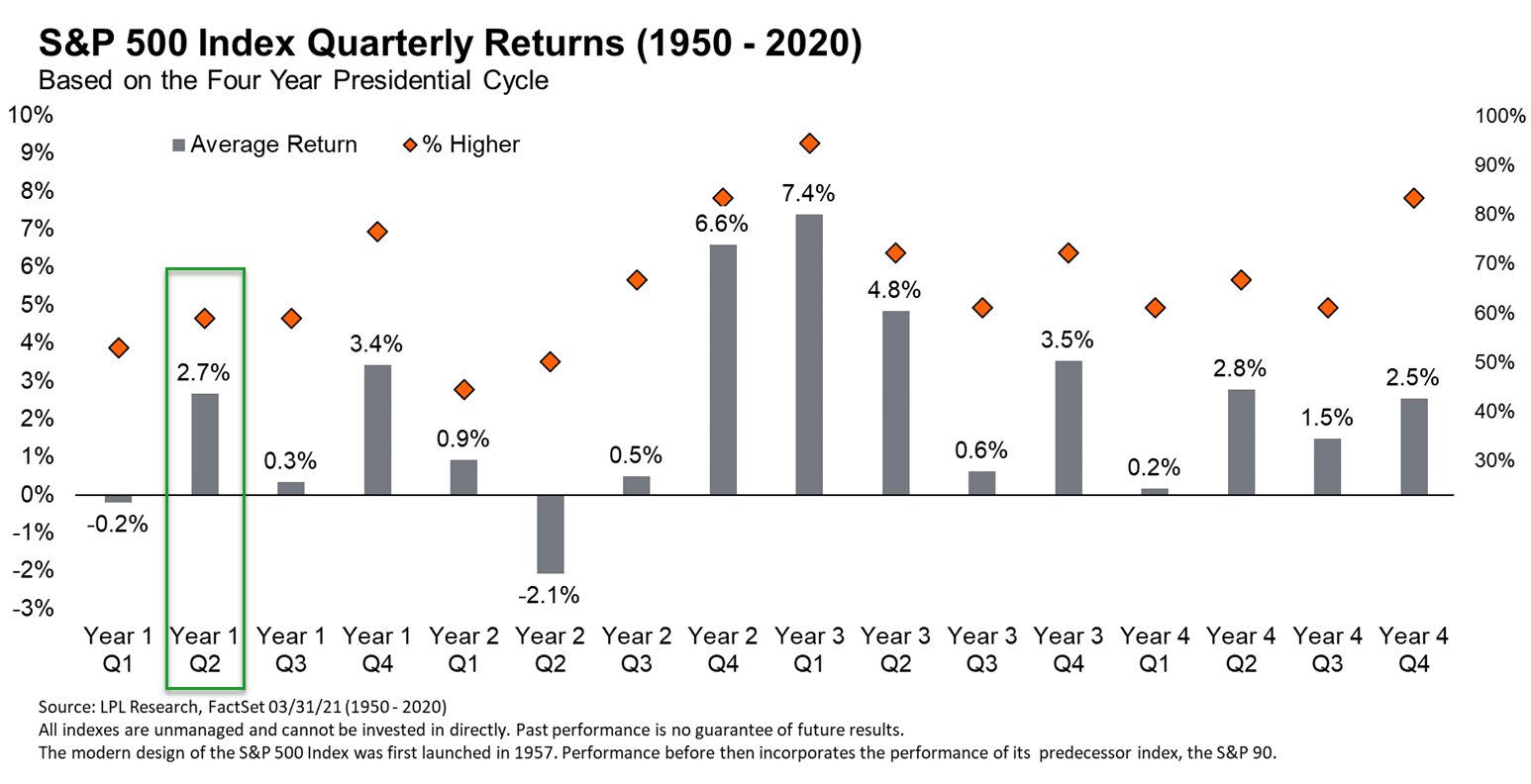

2nd quarter post-election years usually pretty good for the S&P 500

Source: @RyanDetrick

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.