I wrote this in July 2017, where (with full snark enabled) I explained the secrets to calling a market top. If you missed that sarcastic take the first time around, you can hear my audio version of it on The Goldmine Podcast. Please share your thoughts as readers and/or listeners about this format.

An Expert’s Guide to Calling a Market Top

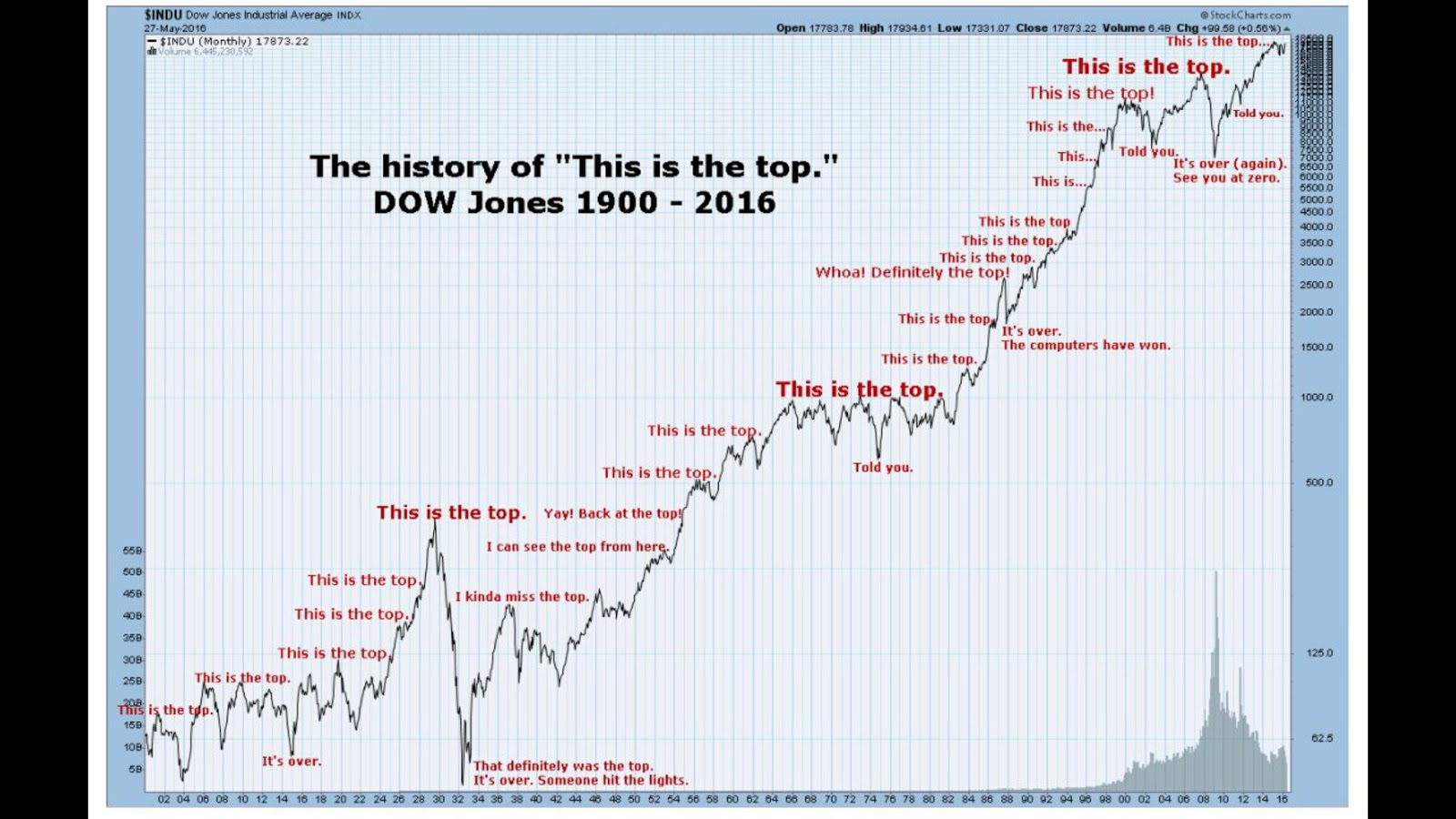

The landscape is filled with pundits predicting the demise of the bull market. Here’s how to get in on the action.

Bloomberg, July 7, 2017

Everyone and members of his and her close family seem ready to call a market top.

You’ve heard the arguments and any number of permutations time and again: This bull market is geriatric, it’s mainly a few overrated tech behemoths that account for all the gains, valuations are stretched and are too far ahead of fundamentals. So you figure if the clueless pundits can do it, why can’t you? If you’re in the money management business, you’d look like a star if you got this one right. So go ahead and give it shot.

Well, we’re here to help (I know, hard to believe). And you do need help, since all the major market players have their top calls ready to go. But with the following step-by-step guide, we can make sure that your top call gets all due recognition and stands out from the pack. This is a can’t-lose proposition:

No. 1. Pick a bogeyman: This is your first step to making a top call. Find whatever it is that will precipitate the next collapse, and home in it on. Tweet about it and write 5,000-word screeds explaining why this spells doom. The specific bogeyman isn’t all that important — just so long as you have one. Some good starter examples are: the Federal Reserve (or zero interest rates or quantitative easing), the national debt, hyperinflation, or the collapse of the dollar. Or how about New York Stock Exchange margin debt or that robots will take away everyone’s job? Mix and match these or be creative and invent a few of your own.

No. 2. Cite household-name authority figures: You may be little known, but there are lots of better-known folks out there who feel the way you do, or at least some of what they’ve said can be massaged to seem like they support your argument. As we learned with the Milgram experiment, people tend to place greater weight on the opinions of authority figures (this is true regardless of its actual content). Your best bets are to cite legendary investors and billionaires. Or try a self-help guru, the more famous, the better.

No. 3. Always be confident: The degree of confidence in your manner and voice is the key to getting a television audience to believe you. This, as we have noted before, is because the expert who prattles on without any hint of doubt is more likely to be believed by TV viewers.1 Remember to avoid nuance, caveats or hedging. These only undermine the sense of authority you want to convey. Hint: Try not to read anything that challenges your viewpoint. It just makes the pose that much harder to maintain.

Originally published at Bloomberg, July 7, 2017 An Expert’s Guide to Calling a Market Top

Source: Net Net Hunter via Filipino Investor