The weekend is here! Pour yourself a mug of French Press coffee, grab a seat by the pool, and get ready for our longer-form weekend reads:

• Can Horse Racing Survive? In a time of changing sensitivities, an ancient sport struggles to justify itself. Thoroughbred racing, once the most popular spectator sport in America, has been in decline. In the past two decades, the over-all national betting handle at racetracks has fallen by nearly fifty per cent. Dozens of tracks have closed. Racing is still a fifteen-billion-dollar industry, but the number of races and the size of the thoroughbred-foal crop are less than half what they were in 1990. (New Yorker)

• The How-To Issue: 50+ Lessons From Really Smart People Advice on everything from being a better gamer to commuting on two wheels to placing smarter bets. (Businessweek)

• Believing is Seeing: The lessons we’re most likely to learn are those we already know. “What people are looking for – rather than what people are merely looking at – determines what is obvious.” With humans generally, believing was seeing rather than the other way around. (Better Letter)

• The Town That Kanye Built In the year 2018 BC (Before Celebrities), Cody, Wyoming, was just Cody, Wyoming. But then Ye moved in, promising jobs, a creative scene, and…a urine garden? (Cosmopolitan)

• Follow the money: Over the span of four years, federal investigators estimated millions of dollars stolen from Mexican taxpayers passed through one South Texas bank. When they followed the trail, it led to real estate, cars, and airplanes. But in 2018, those investigations suddenly stopped. (Texas Observer)

• Big Oil’s Transition to Cleaner Energy Is Risky. How Investors Can Prepare.Building the Oil Company of the Future The European and U.S. oil majors have followed different paths toward the future. BP (BP) and Royal Dutch Shell (RDS.A) have unveiled ambitious plans to reduce oil output and expand their renewable and low-carbon businesses, while curtailing emissions. Exxon Mobil (XOM) and Chevron (CVX), on the other hand, have announced plans to cut emissions but have been clear that they won’t get involved in large-scale solar or wind production, betting instead that the runway for oil remains long (Barron’s)

• Trapped Aboard an Abandoned Cargo Ship: One Sailor’s Four-Year Ordeal The MV Aman was seized near the Suez Canal in 2017. Years later, its chief mate was still on board, all alone. (Wall Street Journal)

• Inside the military’s secret army, the largest undercover force ever The largest undercover force the world has ever known is the one created by the Pentagon over the past decade. Some 60,000 people now belong to this secret army, many working under masked identities and in low profile. The force, more than ten times the size of the clandestine elements of the CIA, carries out domestic and foreign assignments, both in military uniforms and under civilian cover, in real life and online, sometimes hiding in private businesses and consultancies, some of them household name companies. (Newsweek)

• All hail King Pokémon! Gary Haase has amassed the world’s most expensive Pokémon card collection, valued at over $10 million. So why isn’t he cashing in? (Input)

• Stages of Grief: What the pandemic has done to the arts The pandemic has been devastating for the arts economy. Live events were the first things to stop, and they will be the last to return. That means musicians, actors, and dancers, plus all the people who enable them to take the stage—playwrights and choreographers, directors and conductors, lighting designers and makeup artists, roadies, ushers, ticket takers, theater managers—have no way to make a living from their work, and haven’t for more than a year. (Harper’s Magazine)

Be sure to check out our Masters in Business interview this weekend with Scott Sperling, Co-Chief Executive Officer of private equity firm Thomas. H. Lee. The Co-CEO is a member of the firm’s management and investment committees. THL has completed more than 100 investments totaling $125 billion. Their flagship fund has more than $5B in it, and their Automation Fund has over $900 million in LP assets.

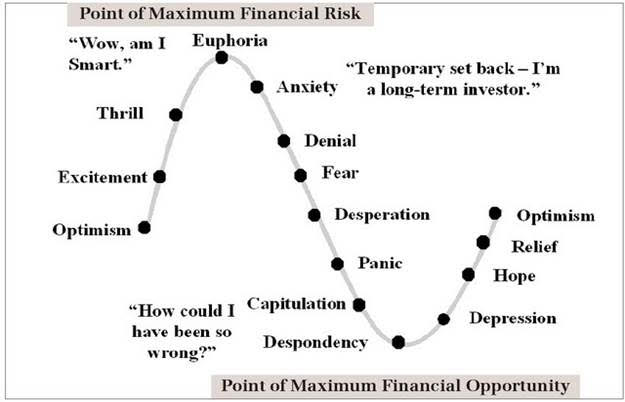

Where Are We Now in the Cycle?

Source: TBP

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.