My back to work morning train WFH reads:

• GameStop Ushered in a New Generation of Barbarians at the Gate 2021 was the year crypto roiled the markets, Redditors took their revenge, and tech moguls emerged as the dominant ruling class in finance, but the GameStop saga showed why Wall Street wins even when it loses. (Town & Country)

• The Safe, High-Return Trade Hiding in Plain Sight One retirement consultant calls I bonds ‘the best-kept secret in America.’ Right now they’re yielding over 3.5%, nearly risk free. (Wall Street Journal)

• Roshun Patel: What Really Drove the Crypto Market Crash The crypto market recently went through one of its worst ever crashes, with seemingly little catalyst for the massive drop. Roshun Patel, VP of lending at the crypto prime brokerage Genesis, gives his take on what happened and explains the role of crypto market structure in the decline. (Bloomberg)

• This Time is Different? Consider Quantifying Subjective Priors John Templeton’s quote, “This time is different,” is a sentiment that leads many investors to stray from using data analysis in their investment decision process and more towards discretionary judgment. The logic as to why data analysis techniques may not apply to “different” situations: These particular set of conditions have never occurred before, therefore no historical data points are relevant to verify my strategy. (Alpha Architect)

• The Pandemic Ignited a Housing Boom—but It’s Different From the Last One Residential home sales are hitting peaks last seen in 2006, just before the bubble burst, but this time mortgages are stricter, down payments are higher, and a tight supply is supporting prices (Wall Street Journal)

• Employees Are Quitting Instead of Giving Up Working From Home The drive to get people back into offices is clashing with workers who’ve embraced remote work as the new normal. (Bloomberg) see also Workers Are Gaining Leverage Over Employers Right Before Our Eyes “Employers are becoming much more cognizant that yes, it’s about money, but also about quality of life.” (Upshot)

• Amateur internet sleuths have turned the Capitol riot into the ultimate online manhunt. Meet the “sedition hunters” Five months on from Jan. 6, the authorities have brought charges against more than 400 rioters, often using the traditional tools of law enforcement, such as search warrants and confidential informants. But they’ve also relied on the crowdsourcing efforts of sedition hunters. In the days after the riot, the FBI saw a 750% increase in daily calls and electronic tips to its main hotline. The bureau still receives twice the normal volume of alerts. Such tips have proved helpful in “dozens of cases,” (Businessweek)

• AMC and Other Meme Stocks Boom Again. What Will Erupt Next? Are meme traders running out of fresh ironic picks? AMC Entertainment Holdings just went on its second madcap run-up in less than six months. As a rotary native in a digital world, I can’t hope to keep up with the young, idle, and fiscally stimulated capitalists monetizing their ability to quickly spot chat-room microtrends in off-the-radar assets. But if the Reddit and Robinhood set has started recycling old jokes, well, that’s something I know a thing or two about. (Barron’s)• Why the Allure of Private Dining Will Remain After the Pandemic While private dining has long been associated with celebrations such as birthdays and anniversaries, guests are gravitating toward intimate environments for everyday occasions as well. “Casual private dining experiences are starting to play a larger role in the hospitality industry, and I think these experiences will only continue to grow in popularity moving forward.” (Penta)

• How Do Animals Safely Cross a Highway? Take a Look. Research shows that, across the country, there are one to two million collisions between vehicles and large animals each year. These accidents cause more than 26,000 human injuries and about 200 human deaths. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Harindra de Silva, of Wells Fargo Asset Management. He is a pioneer in low volatility and factor-based investing, and leads the Analytic Investors group, running quantitative strategies, and managing $20 billion in client assets.

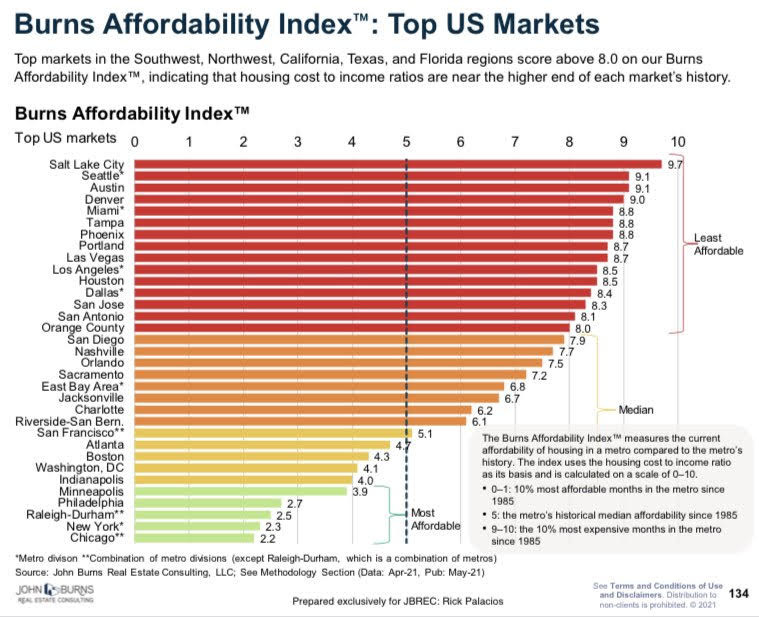

Affordability is close to worst ever in yet markets are still ripping higher.

Source: @RickPalaciosJr