My morning train WFH reads:

• Meme Stocks Aren’t New, But Their Biggest Fans Are The difference from the Nifty Fifty or dot-com mania is that now anyone with a dollar and a smartphone has the power to move markets. (Bloomberg) see also GameStop. Dogecoin. Now AMC. Do meme traders need to be protected from themselves? “If you’re trading like it’s a game, you’re probably going to lose.” (Vox)

• Everyone’s a Rising Star When Debt Is Cheap Rock-bottom financing has led to a wave of credit upgrades, but how will those ratings hold up when borrowing costs increase? (Bloomberg)

• The Commodities Boom Is Luring Criminals to Make Bigger and Bolder Scores The pandemic, soaring prices, and economic pain have combined to create perfect conditions for thieves and fraudsters. (Businessweek)

• Zillow Taps AI to Improve Its Home Value Estimates As the US housing market began to overheat, in February Zillow began making initial cash offers to buy homes based on its price estimate. Now Zillow has updated its algorithm behind those estimates in a way the company says will make them more accurate—and allow Zillow to offer to buy more homes. (Wired)

• Bill Ackman Sent a Text to the CEO of Mastercard. What Happened Next Is a Parable for ESG. A yearlong campaign to hold major companies accountable for online sexual abuse met with little success — until a New York Times article got a hedge fund manager involved. (Institutional Investor)

• The seven industries most desperate for workers In industries such as hotels and restaurants, a deluge of job openings may make it seem like a shortage (and there are shortages in some parts of the country), but employers are hiring so fast that they’re actually getting more than one employee per job opening, better than their yield before the pandemic. (Washington Post) but see Meager Rewards for Workers, Exceptionally Rich Pay for C.E.O.s The gap between workers and C.E.O.s widened during the pandemic as public companies granted top executives some of the richest pay packages ever. (New York Times)

• Nike Super Spikes Are So Fast That Rivals Are Wearing Them Its track shoes are helping set records, spawning similar models and prompting other brands to let their own runners wear the swoosh in the U.S. Olympic trials or risk lagging behind (Wall Street Journal)

• Silicon Valley Thought India Was Its Future. Now Everything Has Changed. It once made obvious business sense for Big Tech to focus on India. When digital companies expanded to international audiences throughout the globalizing 2000s, they found a perfect receptor in the Asian subcontinent: an increasingly online, billion-strong, newly capitalist nation ready to welcome foreign business. But this quickly disintegrated, and the bargain tech execs drove in embracing an already-notorious figure like Modi became much harder. (Slate)

• Covid doom predictions that never happened Five prophecies of economic ruin that thankfully didn’t come to pass (Noahpinion)

• ‘The Silicon Valley of turf’: how the UK’s pursuit of the perfect pitch changed football They used to look like quagmires, ice rinks or dustbowls, depending on the time of year. But as big money entered football, pristine pitches became crucial to the sport’s image – and groundskeepers became stars (The Guardian)

Be sure to check out our Masters in Business interview this weekend with Social Psychologist Robert Cialdini, Professor Emeritus of Psychology and Marketing at Arizona State University. He is the author of the book Influence, which has sold over 5 million copies in 30 languages. The latest revision is out Influence, New and Expanded: The Psychology of Persuasion.

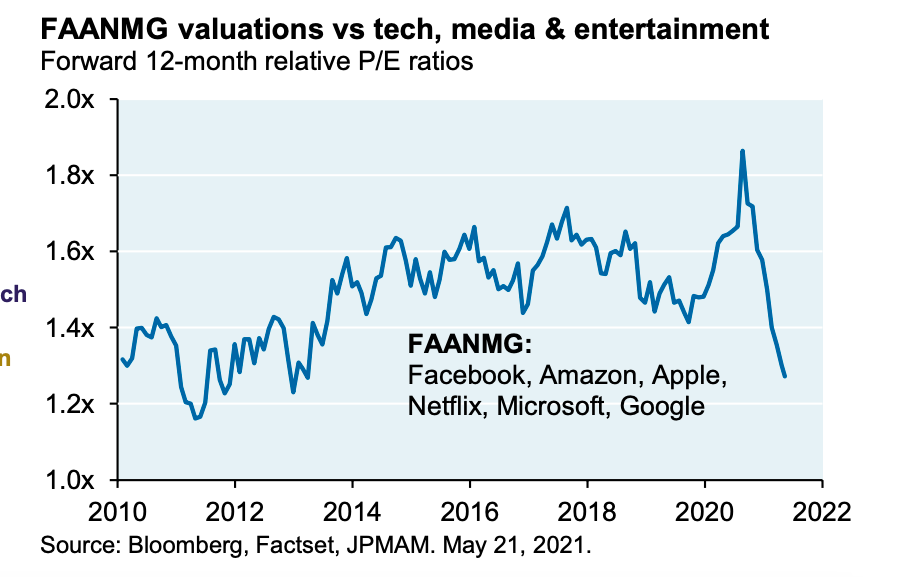

FAANMG valuations vs tech, media & entertainment

Source: J.P. Morgan

Sign up for our reads-only mailing list here.