My end of week morning train WFH reads:

• Bitcoin’s 50% Drop From Peak Hammers Crypto Loans, Derivatives The 2021 Bitcoin bubble is deflating and hitting a $1.3 trillion industry built on to-the-moon speculation and rampant leverage. The damage from the latest selloff is spreading across the world of crypto loans, options and futures — wiping out money-spinning strategies from the famous basis trade to yield farming. (Bloomberg)

• Where (and Why) Economics Went Wrong “There’s something wrong with the way economists do economics,” says Robert Skidelsky “If I’m right, that’s dangerous, because economists are so influential (EconPwr)

• The Pay Is High and Jobs Are Plentiful, but Few Want to Go Into Sales The work has changed in recent years, but young workers may associate it with high-pressure tactics; ‘talent is limited’ (Wall Street Journal)

• Three Things I Think I Think – Learning From Bad Inflation Takes The idea that the Fed creates inflation when they implement a policy like QE has been pretty well debunked over the last 10 years. When the Fed implements QE they print new deposits and swap them with T-bonds. The T-bonds are effectively retired from the private sector and are held outside of the real economy on the Fed’s balance sheet (Pragmatic Capitalism)

• The Highest Forms of Wealth Controlling your time and the ability to wake up and say, “I can do whatever I want today.”(Collaborative Fund) see also What’s Your Wealth I.Q.? Consumerism is a toxic side effect. As Benjamin Disraeli said: Most people die with their music still locked up inside of them. (A Teachable Moment)

• The Saudi Prince of Oil Prices Vows to Drill ‘Every Last Molecule’ Abdulaziz bin Salman, the most powerful man in petroleum, navigates unruly OPEC+ nations, huge swings in price and production—and the end of fossil fuels. (Bloomberg)

• Are We Living in an MMT World? Not Yet Sure, Congress wrote some giant checks during the pandemic. But the architects of Modern Monetary Theory say tolerance for deficits and spending is only part of their mission. (Businessweek)

• ‘Somebody has to do the dirty work’: NSO founders defend the spyware they built CEO Shalev Hulio said he would ‘shut Pegasus down’ if there were a better alternative. In lengthy interviews, Hulio and co-founder Omri Lavie traced a journey launched from an Israeli kibbutz and said the company’s technology had saved lives. (Washington Post)

• Did This French Aristocrat Have a Hand in the Deaths of Jim Morrison, Janis Joplin and Other ’60s Icons? Count Jean de Breteuil is a shadowy figure about which little is known. By most accounts, the self-styled “dealer to the stars” pandered to the vices of the rich and famous, enabling the addictions that cost many their lives. Despite his oversized role in rock history, he’s been reduced to a footnote due to a code of secrecy that surrounded music’s elite and the premature demise of many key players. (People)

• How Katie Ledecky swims faster than the rest of the world Five years removed from dominating the Olympic pool in Rio de Janeiro, Katie Ledecky is a different swimmer. She’s older and stronger, and she has used the time to fine-tune her mechanics, train her body, sculpt her physique and reconsider what’s possible. (Washington Post)

Be sure to check out our Masters in Business interview this weekend Brian Deese, the 13th Director of the National Economic Council, and the Assistant to the President for Economic Policy. Previously, he was Global Head of Sustainable Investing at Blackrock, and was President Obama’s senior advisor for climate and energy policy. He was newly named as Chairman of The White House Competition Council.

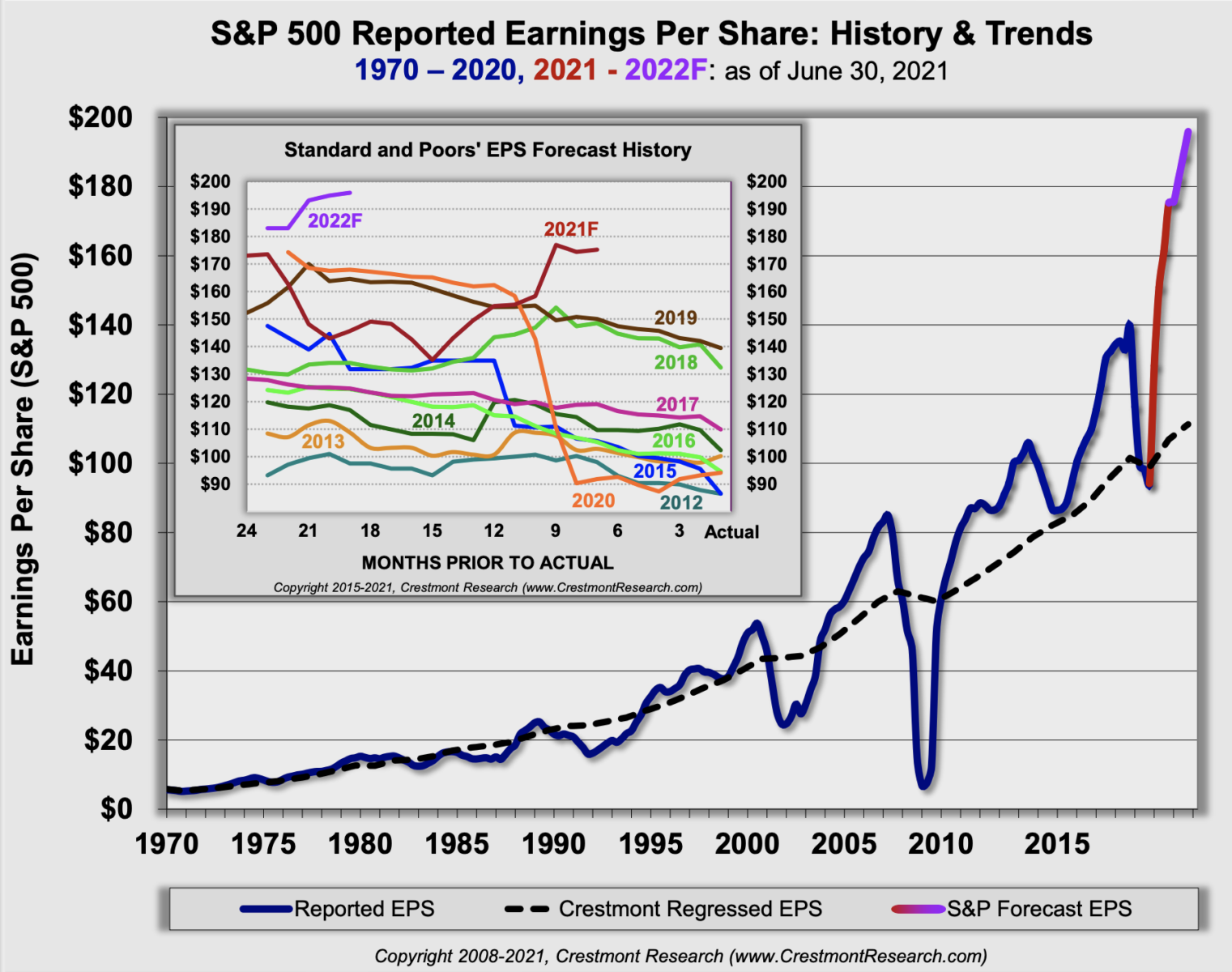

S&P 500 Reported Earnings Per Share: History & Trends

Source: Crestmont Research

Sign up for our reads-only mailing list here.