My morning train WFH reads:

• Reddit Hates Short Sellers, But the Stock Market Needs Them Meme investors may like cutting shorts off at the knees, yet when the goal is setting accurate prices, people betting on shares to fall provide crucial information. (Businessweek)

• Will Allocators Ever Embrace Liquid Alts? Institutional investors mostly want to direct their non-market-correlated strategies themselves, but acceptance of these retail-oriented alternatives is inching up. (Chief Investment Officer)

• Private Equity Gears Up for the Siege of Japan Inc. Private-equity firms are building up a large war chest to target Japanese companies. Toshiba could be on the menu soon. (Wall Street Journal)

• Farmland Investing: Impact Beyond Returns Farmland is the latest asset class to be revolutionized by the fintech wave. Whether it’s through REITs, commodity ETFs or crowdfunding platforms, farmland sticks out among investors, both in terms of its attractive return on investment and its potential to increase the sustainability of the agriculture sector. (Worth)

• What is the best behavioral finance movie of all time? One surtprisng nominee: Willy Wonka! I would make the case for “Moneyball” or “The Big Short,” but our own worst instincts and behaviors on the big screen: impetuousness, greed, envy, malice, indulgence, overconfidence, ignorance, and so on. (Shaping Wealth)

• Bair: Tempted to turn your home’s soaring equity into cash? Don’t do it lightly: Fannie Mae chair Homeownership is a good way to build wealth, if you are careful and diligent. Weigh costs, benefits and risks before pulling cash out of a home. (USA Today)

• How Last Century’s Oil Wells Are Messing With Texas Right Now Ranchers and regulators are contending with uncontrolled leaks from thousands of abandoned oil and gas sites that could render some land “functionally uninhabitable.” (Bloomberg)

• Majority of Florida condo board quit in 2019 as squabbling residents dragged out plans for repairs The president of the board of the Florida condominium that collapsed last week resigned in 2019, partly in frustration over what she saw as the sluggish response to an engineer’s report that identified major structural damage the previous year. Five members of the seven-member board resigned in two weeks that fall; the condo association in Surfside was consumed by contentious debate about the multimillion-dollar repairs. (Washington Post)

• Here’s why the Mets still pay Bobby Bonilla $1.19 million today … and every July 1 through 2035 At the time, Mets ownership was invested in a Bernie Madoff account that promised double-digit returns, and the Mets were poised to make a significant profit if the Madoff account delivered — but that did not work out. (ESPN) see also Podcast Bobby Bonilla Day Bobby Bonilla Day celebrates one of the worst deals in baseball history. The thinking behind this deal is actually one of the most important concepts in finance — and once you understand it, the deal may not seem so bad. (NPR)

• Disney’s ‘Mysterious Benedict Society’ Has Twice the Tony Hale The actor unpacks five of his comedic characters, from ‘Veep’ sycophant to an evil Disney twin. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Steve Romick, Managing Partner at FPA, which manages $26 billion in equity, fixed income, and alternative strategies. Romick manages the $11 billion FPA Crescent Fund since its 1993 inception and was named Morningstar’s U.S. Allocation Fund Manager of the Year.

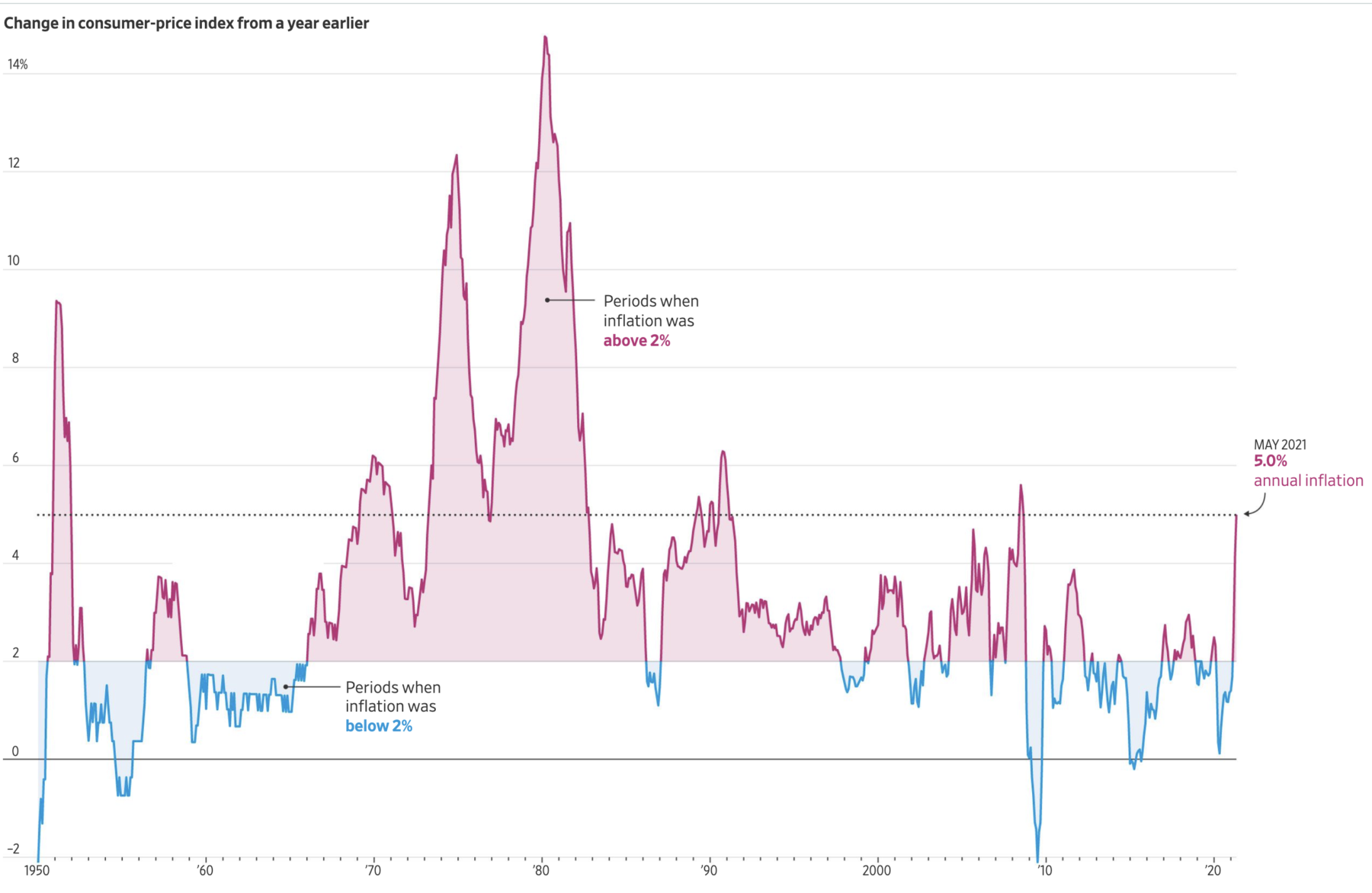

Rising Inflation Looks Less Severe Using Pre-Pandemic Comparisons

Source: Wall Street Journal

Sign up for our reads-only mailing list here.