It’s September (how did that happen?). Kick off the month with our morning train WFH reads:

• Nobody Knows Anything: Wall Street During the Pandemic. “If someone would have told me in March of last year, when Covid was first rearing its ugly head, that 18 months later we would have case counts that are as high—if not higher—than they were on that day, but that the market would have doubled over that 18-month period, I would have laughed at them.” The impossible is now commonplace (Businessweek)

• The Economy Is Booming but Far From Normal, Posing a Challenge for Biden High inflation, ghostly downtowns and a resurgent virus have rattled consumers and created new obstacles as the president tries to push his broader economic agenda. (New York Times) see also How the Biggest Companies Have Fared During the Covid-19 Pandemic More than three-quarters of the S&P 500 have reported higher revenue than in 2019, but a fifth remain below those levels (Wall Street Journal)

• She’s the Investor Guru for Online Creators Li Jin, 31, began backing creators years ago. She has raised her own fund to invest in influencer-related start-ups. (New York Times)

• The 5 Worst Investment Tips on TikTok Some of the financial advice on TikTok and other social media is rooted in sound strategy, some not so much. (NerdWallet)

• Facebook is the AOL of 2021 The 1990s had a word for being trapped inside a manipulative notion of human contact: AOL. Facebook and its ilk are the rebirth of that limited vision. (ZD Net)

• Can ‘smart thinking’ books really give you the edge? Trust your gut, boost your memory, de-bias your decision making… can we train our brains to perform better? (The Guardian)

• Zeynep Tufekci on the Sociology of The Moment (Live) The problems COVID-19 revealed in our institutions—and how to fix them. (Conversations With Tyler)

• Vaccine Hesitancy Is Still Strong In Many COVID-19-Battered States The most recent results show a notable dip in the number of vaccine-hesitant Americans — those who say they do not plan to get the vaccine, or are unsure if they ever will — in some hard-hit states, while others barely budged even as COVID-19 cases climbed. (fivethirtyeight)

• Every National Forest In California Is Closing Because Of Wildfire Risk Citing the extraordinary risk of wildfires and forecasts that show the threat will only remain high or even get worse, the U.S. Forest Service is closing every national forest in California. The closures start Tuesday night and run through Sept. 17. (NPR) see also Hit by Ida, New Orleans faces weeks without power Hurricane Ida knocked out all eight transmission lines that deliver power to New Orleans, leaving the entire city without electricity. Some of the hardest-hit areas won’t see power restored for weeks. (AP)

• When Charlie Watts Finally Made It to New York City While his bandmates hit the Apollo, the reserved, jazz-loving drummer for the Stones could be found at Birdland. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Joan Solotar, Blackstone’s Global Head of Private Wealth Solutions. PWS manages over 100 billion dollars of the private equity giant’s $684 billion in assets. She has been named to Barron’s 100 Most Influential Women in US Finance list.

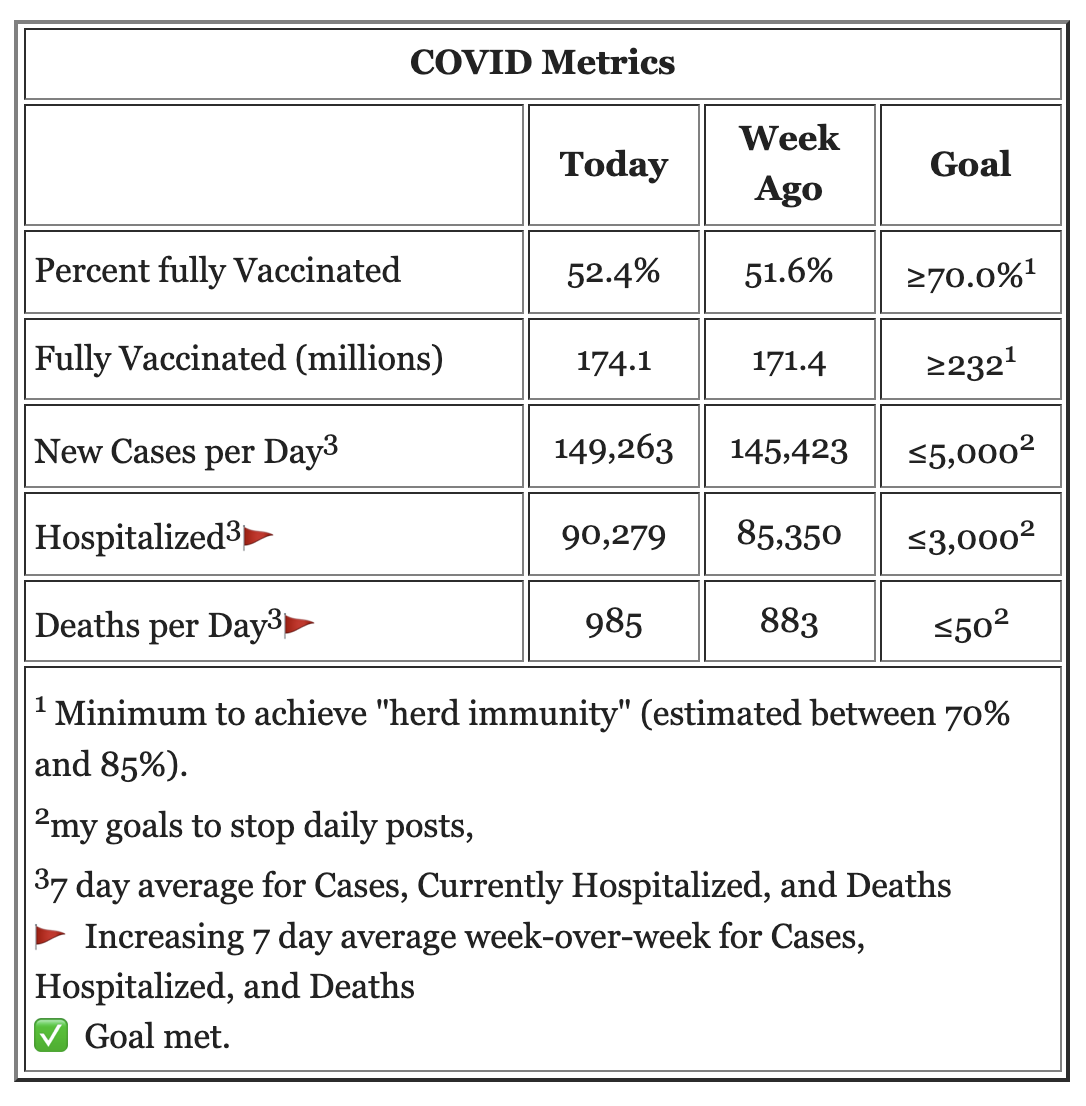

Cases May be Peaking at Average 150,000 per Day

Source: Calculated Risk

Sign up for our reads-only mailing list here.