My back to work morning train WFH reads:

• Americans Are Flush With Cash and Jobs. They Also Think the Economy Is Awful. The psychological effects of inflation seem to have the upper hand. (Upshot) see also Why Americans Are So Grumpy About Their Economic Boom There’s a big gap right now between consumer sentiment and statistical indicators. It should narrow, but may not go away. (Bloomberg)

• Is Bitcoin Too Big to Fail? The hand-wringing has been at its fiercest over Bitcoin’s possible exposure to systemic risk, both existential and otherwise. Chief among those concerns is whether a crypto crash, taking place in what is effectively a parallel, decentralized financial universe, might spill over into the traditional financial system. The fact that so many exchanges and crypto intermediaries remain offshore and unregulated continues to fan fears. (Institutional Investor)

• The 3 Levels of FOMO The concentration of wealth seems to be happening at warp speed these days and that makes the FOMO even harder to stomach. It’s never been easier to see just how well other people are doing in the headlines, on social media or on daily updates of the wealthiest people in the world. (A Wealth of Common Sense)

• Why the Chip Shortage Hasn’t Been Fixed Yet As with any complex supply-chain quagmire, there are a number of different factors that are building on one another, which means there isn’t one simple fix to the semiconductor shortage. Here’s a breakdown of what’s likely to making it so bad. (Slate)

• Meat Prices Will Continue to Surge If Meatpackers Can’t Find Workers Fast Recruiting is only getting harder for a U.S. industry that demands grueling work and has the taint of deadly Covid outbreaks. (Bloomberg)

• The Man Who Called Bullshit on Uber Hubert Horan has been on a lonely quest to show why the company’s business model is fundamentally flawed. (Mother Jones) see also Uber and Lyft Thought Prices Would Normalize by Now. Here’s Why They Are Still High. Benefits for gig workers expired, but riders still pay more—and drivers still earn more—in a tight labor market (Wall Street Journal)

• Why Facebook Is More Worried About Europe Than the U.S. Unlike the ongoing partisan divide in Washington over regulating social media, politicians in the European Union and United Kingdom are already on the same page and they are about to make Facebook do something it has long tried to avoid: take legal responsibility for content.(Politico)

• The Same Stories, Again and Again Time and again we see that preferences are fickle, and views that a big chunk of society would have thought unthinkable can be quickly embraced when the economy changes direction. So we really have no idea what policies we’ll be pushing for in, say, five or ten years. Hard times make people do and think things they’d never imagine when things are calm. (Collaborative Fund)

• America Needs a New Scientific Revolution A repurposed antidepressant might help treat COVID-19, a remarkable study found. The way this research was funded highlights a big problem—and bigger opportunity—in American science. (The Atlantic)

• Why Can’t People Teleport? Set your phasers on stun, because we are going to beam you up on the physics of teleportation. (Wired)

Be sure to check out our Masters in Business interview this weekend with Tom Gayner, Markel Corporation’s co-president and chief investment officer of the financial-holding company He has been dubbed the “next Warren Buffett.” From 2000 to 2015 Gayner returned an average of 11.3% annually, while the S&P 500 index of big U.S. stocks returned 4.2%, (including dividends).

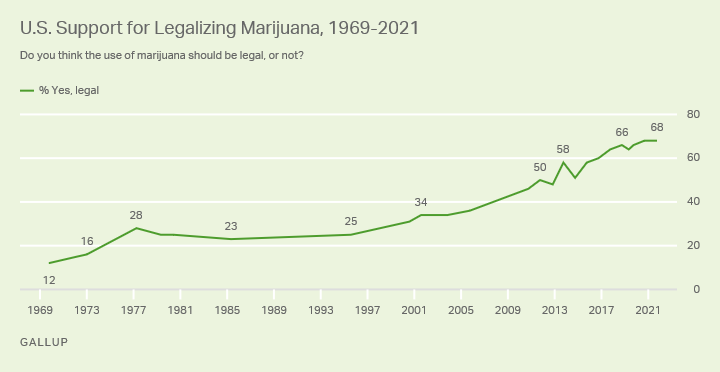

Support for Legal Marijuana Holds at Record High of 68%

Source: Gallup

Sign up for our reads-only mailing list here.