My Two-for-Tuesday morning train reads:

• Peter Lynch Says All-In on Passive Investing Is All Wrong “The move to passive is a mistake,” the former Fidelity Magellan fund manager said in an interview with Bloomberg Radio’s to be broadcast Tuesday. “Our active guys have beat the market for 10, 20, 30 years, and I think they’ll keep on doing it. (Bloomberg) see also Stock Market Is as Active as Before $11 Trillion Index Invasion Academics say market ‘activeness’ barely changed in 20 years; Investors deploy index funds as part of larger portfolios (Bloomberg)

• Return-to-Office Chaos Is the Best Thing to Happen to Consultants Since Y2K A new breed of “experts” is here to help desperate employers navigate these uncharted waters. Too bad no one knows anything. (BusinessWeek)

• There Is Finally a Visible Way Out of the COVID Pandemic Two new developments could mean a real endgame is near. (New York Magazine) but see Covid world map: which countries have the most coronavirus vaccinations, cases and deaths? (The Guardian)

• High-Income Business Owners Escape $10,000 Tax Deduction Cap Using Path Built by States, Trump Administration More than 20 states created workarounds to the limit, and New York’s law firms and private-equity firms are signing up. (Wall Street Journal)

• It Was a Pretty Good Year in the Car Business—Except for Suppliers Auto-parts suppliers faced myriad cost pressures and largely missed out on industry’s heady pricing (Wall Street Journal) See also Some people love cars so much they’re sad to see them go — and miss them still Some people connect with cars in deep and lasting ways. I wrote recently about the melancholy I felt after selling the 1968 Datsun roadster I’d owned for 25 years. I asked readers to share their own car stories and was overwhelmed by the response. (Washington Post)

• Why you should care about Facebook’s big push into the metaverse The futuristic tech Mark Zuckerberg is investing billions in could remake the internet. (Vox)

• How an Excel TikToker manifested her way to making six figures a day Taking an unconventional route to a conventional business. (The Verge) see also How TikTok Reads Your Mind It’s the most successful video app in the world. Our columnist has obtained an internal company document that offers a new level of detail about how the algorithm works. (New York Times)

• Hertz Took the Wrong Customer for a Ride: A law professor reserved a car for Thanksgiving, and then told the world about her terrible experience. The car she reserved for $414.93 was unavailable, but another car was waiting for $1,800. A master class in the rewards of relentless self-advocacy. (Bloomberg)

• Seven days: Following Trump’s coronavirus trail From the day he tested positive until his hospitalization, Trump came in contact with more than 500 people, either those in proximity to him or at crowded events (not including rallygoers). That 7-day window reveals a president and chief of staff who took a reckless, potentially dangerous, approach to handling the coronavirus. (Washington Post) see also All the Places Trump Went After Secretly Testing Positive for COVID Mark Meadows, President Donald Trump’s former chief of staff, has revealed new details about Trump’s coronavirus deceit. Multiple former officials now confirm that Trump initially tested positive for the virus on Sept. 26, 2020. This means that Trump’s deception and his conscious endangerment of others began several days earlier than was previously known. (Slate)

• On “Succession,” Jeremy Strong Doesn’t Get the Joke: Kendall is the show’s dark prince, a would-be mogul puffed up with false bravado. He is often ridiculous in his self-seriousness, especially when he’s trying to dominate his indomitable father. Strong was perfectly cast: a background player who had spent his life aspiring, and often maneuvering, to fill the shoes of his acting gods. “Kendall desperately wants it to be his turn,” Strong said. Last year, he won an Emmy Award for the role. “I take him as seriously as I take my own life.” (New Yorker)

Be sure to check out our Masters in Business interview this weekend with John Doerr of Kleiner Perkins. Doerrr has backed some of the most successful tech start-ups, including Compaq, Netscape, Symantec, Sun Microsystems, Amazon.com, Intuit, Macromedia, and Google. He is also the author of the best-selling Measure What Matters; his latest book is Speed & Scale: An Action Plan for Solving Our Climate Crisis Now.

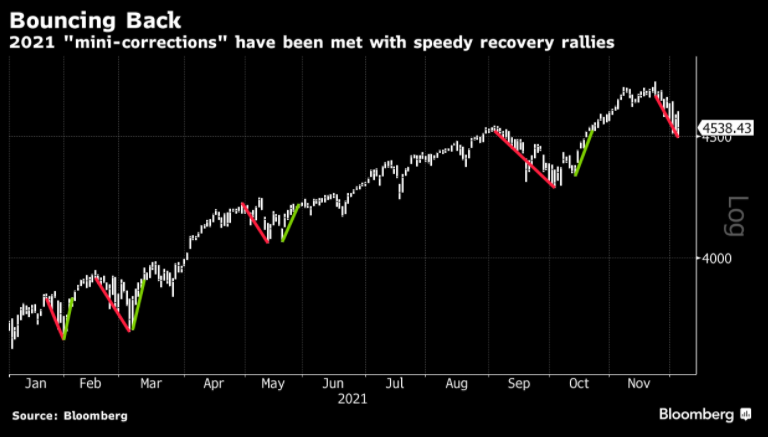

Speedy Dip-Buying Mini S&P Corrections Has Become a Market Habit

Source: Bloomberg