Our end-of-week morning reads, which have had an edit button since 1967:

• Bosses say remote work kills culture. These companies disagree. Some business leaders worry remote options could destroy their company culture. But companies that have operated remotely for years say culture doesn’t come from a physical office. (Washington Post)

• Global Bonds Tumble Into Their First Bear Market in a Generation: Bloomberg bond index drops 20% from its January 2021 peak A new environment as bonds fall with stocks: Schroders’ Wood (Bloomberg) see also Savers of the World Rejoice — Yield is Back You can’t exactly move to the beach and live off the interest on yields of 2-3% but it’s better than nothing, which is what savers could earn the past couple of years in a world of 0% interest rates. (Wealth of Common Sense)

• What Does ESG Need to Work? High returns for investors. Our author argues that a different approach to ESG can strike a better balance between environmental and social goals and profits. (Institutional Investor)

• Grantham: Entering The Superbubble’s Final Act: Only a few market events in an investor’s career really matter, and among the most important of all are superbubbles. These are events unlike any others: While there are only a few in history for investors to study, they have clear features in common. In all three previous cases, over half the market’s initial losses were recovered, luring unwary investors back just in time for the market to turn down again, only more viciously, and the economy to weaken. This summer’s rally has so far perfectly fit the pattern. (GMO)

• Wages and Employment Do Not Have To Decline To Bring Down Inflation: To lower inflation, policymakers must continue using fiscal policy to focus support to struggling households, improve the economy’s productive capacity, create more resilient supply chains, and limit the profiteering of corporations. (CAP)

• Porsche Boss Faces Software Woes Keeping VW a Step Behind Tesla Herbert Diess tried to match the electric-car maker’s tech prowess. New CEO Oliver Blume now has more chasing to do. (Bloomberg) see also This Remote Mine Could Foretell the Future of America’s Electric Car Industry: Hiding a thousand feet below the earth’s surface in this patch of northern Minnesota wetlands are ancient mineral deposits that some view as critical to fueling America’s clean energy future. (New York Times)

• MoviePass Will Work This Time* Footnote: *If by “work” you mean “won’t instantaneously blowtorch tens of millions of dollars’ of wealthy people’s money.” (Slate)

• The rules of flying like a decent human: From reclining your seat to deboarding, we’ve got your guide to flying etiquette. (Washington Post) see also A 5-Step Checklist for Handling Air Travel Woes on the Go: With planning and a well-stocked smartphone, you can map out a strategy for dealing with flight disruptions. (New York Times)

• NASA’s latest moon mission is the dawn of a new space age: A new NASA rocket is about to take off on a historic mission to the moon. The Artemis I mission won’t land on the lunar surface, but the trip itself will be the farthest a vehicle designed for human astronauts has ever traveled into space. (Vox)

• The U.S. Open Has a Plucky New Underdog: Serena Williams Though many expected the 23-time major champion to lose in the first two rounds, the unpredictable women’s draw could open up if she keeps surviving. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Lynn Martin, President of the NYSE, which is part of the Intercontinental Exchange. NYSE is the world’s largest stock exchange, with 2,400 listed companies and a combined market cap of ~$36 trillion dollars. She began her career at IBM in its Global Services.

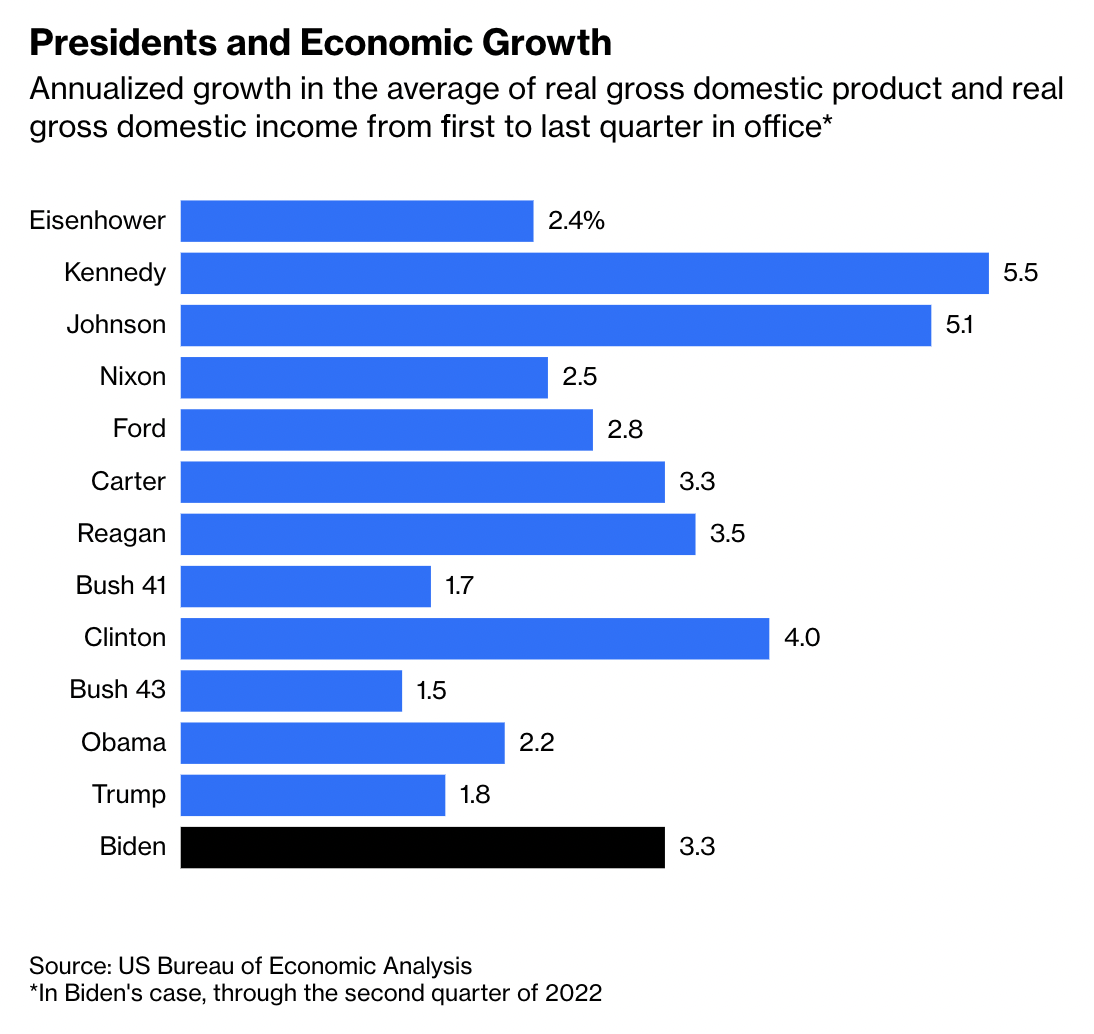

Biden’s Economy Has the Best Growth Record Since Clinton, But Worst Inflation Since Carter

Source: Bloomberg

Sign up for our reads-only mailing list here.