My morning train WFH reads:

• Is the Era of Low Interest Rates Over? There were fundamental reasons interest rates were so low three years ago. Those fundamentals haven’t changed; if anything, they’ve gotten stronger. So it’s hard to understand why, once the dust from the fight against inflation has settled, we won’t go back to a very-low-rate world. (New York Times)

• What to Buy? Bonds. When? Now. My short and simple answer to the question, “What to buy and when?” is: buy bonds today. There are still developments that need to play out further before we can get clarity on stocks and the labor market, which calls for patience, but I believe bonds are attractive now. (Van Eck) see also Farewell, TINA: For years, we have heard that “there is no alternative” – TINA – to equities, and that thanks to the Fed, “Cash is trash.” No longer. The Federal Reserve, in its belated attempt to fight inflation, has cranked up rates to the point where today, there is an alternative to stocks: Bonds. (The Big Picture)

• Was that the Bottom? Stocks got washed out in the third quarter. Whether you were looking at prices or people’s reactions to said prices, it was hard to find anything positive to say other than things are so bad they’re actually good. (Irrelevant Investor)

• Oh Elon Well! That was stupid. Elon’s Back Though he still has a few days to change his mind again. (Bloomberg)

• The Climate Crisis Spells Big Business for Carbon Capture: At a recent expo in Houston, innovators claimed they can spare us a global catastrophe—and make billions in the process. (Texas Monthly)

• Working From Home Is Not an Urban Escape Hatch: Contrary to popular perception, the nation’s WFH hotbeds are big-city neighborhoods and expensive suburbs, not mountain retreats and beach cottages. (Bloomberg) see also Working From Home Is Sticking in US as Office Occupancy Stalls: New York City’s results hurt by last week’s religious holidays; RTO mandates at some big employers delayed by worker pushback. (Bloomberg)

• Scientists know why we are so indecisive — and how to get over it: People are generally quite bad at perceiving and using probability information.” (Inverse)

• A brief guide to the weird and revolutionary world of quantum computers. This year’s physics Nobel Prize went to pioneers in quantum tech. Here’s how their work could change the world. (Vox)

• Everyone Has the Wrong Idea About EV-Converted Classic Cars: People keep asking me about converting their troublesome old sports cars into low-maintenance EVs. It’s a mistake — they’re looking at the wrong genre of vehicle. (Road & Track)

• What Do Dogs Know About Us? Man’s best friend is surprisingly skilled at getting inside your head. (The Atlantic)

Be sure to check out our Masters in Business interview this weekend with Michael Levy, Chief Executive Officer of Crow Holdings. The firm is the largest developer of multifamily-homes in the United States. Crow is both a developer and investor in commercial real estate, specializing in multifamily, industrial, and office properties across 21 markets in the United States.

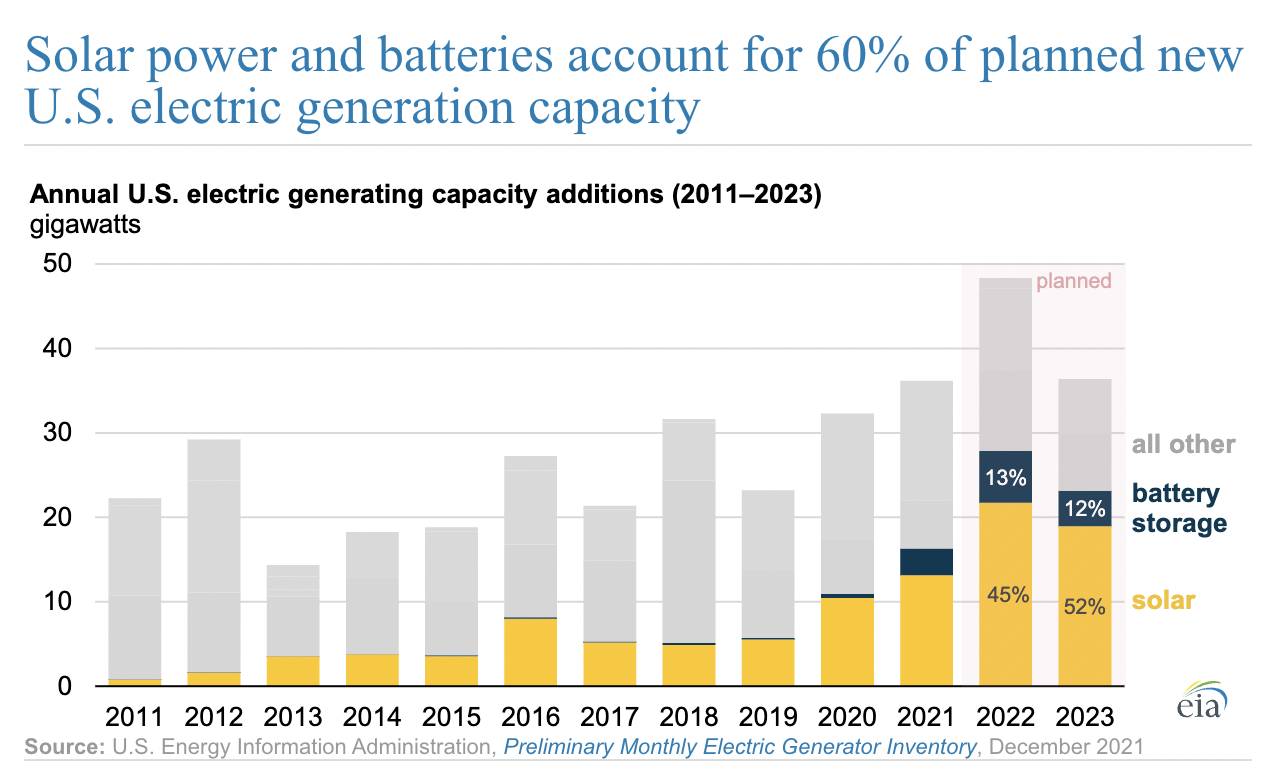

Solar power and batteries account for 60% of planned new U.S. electric generation capacity

Source: U.S. Energy Information Administration

Sign up for our reads-only mailing list here.