My Two-for-Tuesday morning train WFH reads:

• Fed Seen Aggressively Hiking to 5%, Triggering Global Recession: Survey of economists sees 75 basis-point hike, then slowing Three-quarters say the Fed will err by doing too much. (Bloomberg) see also Cash-Rich Consumers Could Mean Higher Interest Rates for Longer Buoyed by pandemic-fueled savings, consumers and businesses are proving less sensitive to tighter credit—complicating the Fed’s job. (Wall Street Journal)

• Revenge of the Dow: Change is the only constant variable in the market. Startups mature. Incumbents become complacent. Markets get saturated. And so turnover at the top is inevitable. It’s only a matter of time before the king loses his crown. (Irrelevant Investor)

• Food Prices Soar, and So Do Companies’ Profits: Some companies and restaurants have continued to raise prices on consumers even after their own inflation-related costs have been covered. (New York Times) see also New-Car Prices Are Starting to Cool After Years of Soaring to New Records: Inventory on dealer lots is ticking up again, but executives say pent-up demand should keep prices elevated for the foreseeable future. (Wall Street Journal)

• Lessons in market panics from Xi Lizping: China has been a terrible place for western investors to put their capital , essentially unchanged over 30 years as measured by the MSCI Chaina Index and down more than 50% since Spetember 1994. (Financial Times)

• Think Homeowners Will Stay Put? Austin Suggests Otherwise: The “lock-in effect” is supposed to forestall a drop in US housing prices. The Texas capital shows it’s not so ironclad. (Bloomberg) see also Some Suburbs Are Actually Trying to Solve the Housing Shortage: New York suburbs have long lagged their peers in building new housing. A few towns are eyeing a different approach. (New York Focus)

• A horror-film cliche is playing out in Washington. Will we stop it? GOP politicians have repeatedly threatened fiscal and financial chaos — a budgetary bloodbath, if you will — by holding the debt limit hostage. House Minority Leader Kevin McCarthy (R-Calif.) has said he’ll use the debt limit as leverage to force spending cuts and maybe limit Ukraine funding. (Washington Post)

• Welcome to hell, Elon: You break it, you buy it. The problems with Twitter are not engineering problems. They are political problems. Twitter, the company, makes very little interesting technology; the tech stack is not the valuable asset. The asset is the user base: hopelessly addicted politicians, reporters, celebrities, and other people who should know better but keep posting anyway. (The Verge) see also Why I Don’t Think Elon Musk Is Going to Open the Nazi Floodgates on Twitter Breaking the platform he just bought could be very expensive, and he only likes to score political points when they’re cheap. (Slate)

• What Moneyball-for-Everything Has Done to American Culture: You can make a thing so perfect that it’s ruined. (The Atlantic)

• ‘A madness has taken hold’ ahead of US midterms: local election officials fear for safety (The Guardian) see also Why many conservatives won’t call the attack on Pelosi’s husband political violence: To acknowledge a potential political motivation for the crime would require a reckoning with a decade of vilifying the House speaker. (Grid) see also Only the GOP Celebrates Political Violence: Both parties suffer partisan bloodshed. One glorifies it. (The Atlantic)

• When Sarcastic Fringeheads Open Their Mouths, Watch Out: Scientists found that the fish’s unusual broad-mouthed display is reserved only for fighting with other members of its species. (New York Times)

Be sure to check out our Masters in Business interview this weekend with The Jeremies! Professor Jeremy Siegel of Wharton, and Jeremy Schwartz, Chief Investment Officer at the $75 billion Wisdom Tree Asset Management. Siegel is the author of Stocks For The Long Run; Schwartz is his research partner/editor. The two discuss the sixth edition of SFTLR, the latest and most widely expanded edition of the investment classic.

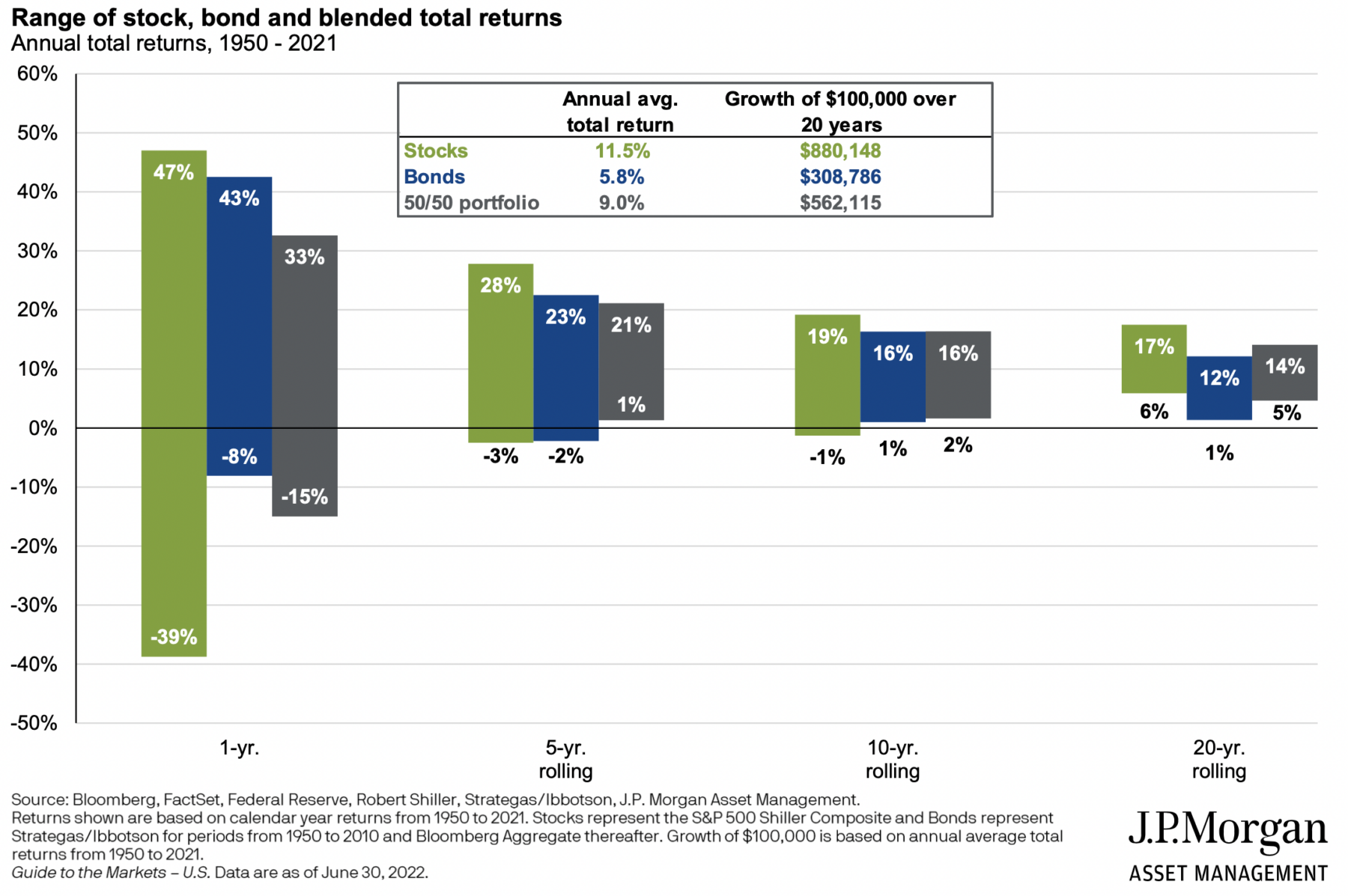

The longer the time horizon, the lower the volatility and the higher the average expected returns

Source: JPM