My end-of-week morning train WFH reads:

• Inside Wall Street’s gloom-and-doom racket: If an ‘expert’ is warning you that the market is about to crash, check their math: Admittedly, stocks haven’t done well over the last year, but instead of providing clients and the general public with clear-eyed views, a new ecosystem of hackneyed, alarmist analysts is relying on low-quality data to push people away from steady investments into an alternative ecosystem of products of dubious quality. (Business Insider)

• Stop treating unemployment as a necessary evil to curb inflation: An economist explains why it’s time to rethink popular assumptions about layoffs. (Vox) see also If You Have to Have a Recession, Make It a Rolling One Mild slumps that ripple through the economy can slow inflation without putting too many people out of work. (Businessweek)

• The Super Bowl’s Most Reliable Stock Market Indicator? The Ads: The Eagles and Chiefs will play second fiddle to the commercials for many Americans, but investors looking for ideas should brace for an upset. (Wall Street Journal)

• Comeback in Factory Jobs Appears to Be for Real: After decades of employment declines, manufacturing is looking like a growth sector — if it can find enough young people willing to work in it. (Bloomberg)

• How Florida Beat New York: People are leaving superstar blue cities and moving to red states — its more than better weather ands lower taxes, its much cheaper housing costs. (The Atlantic)

• Bing (Yes, Bing) Just Made Search Interesting Again: Google has stiff competition now, after Microsoft integrated powerful A.I. technology into its search engine. (New York Times)

• We’ve always been distracted: Worried that technology is ‘breaking your brain’? Fears about attention spans and focus are as old as writing itself. (Aeon)

• The Last Mustard Maker in Dijon: Nicolas Charvy is bringing a culinary art back to its ancestral home. (Atlas Obscura)

• Joe Biden’s 2023 State of the Union: 4 winners, 4 losers and an honorable mention: It was a bad night for billionaires, a better one for climate change. (Grid)

• How Roger Federer Became The Only Billionaire In Tennis History: Roger Federer is one of the greatest tennis players of all time. He turned professional at just 17 years old and won 20 Grand Slam titles over his 24-year career. And off the court, he’s even better. He only played in one tournament last year but still made more than $90 million, putting him as the 7th highest-earning athlete in the world — last year, more than other superstar athletes Tom Brady, Kylian Mbappe, Canelo Alvarez, and Giannis Antetokounmpo. (Huddle Up)

Be sure to check out our Masters in Business interview this weekend with Rick Rieder, Chief Investment Officer of Global Fixed Income at BlackRock, Head of the Global Allocation Investment Team, and Senior Managing Director. Rieder helps to manage $2.5 trillion in fixed-income assets as a member of BlackRock’s Global Operating Committee and is Chairman of the firm-wide BlackRock Investment Council.

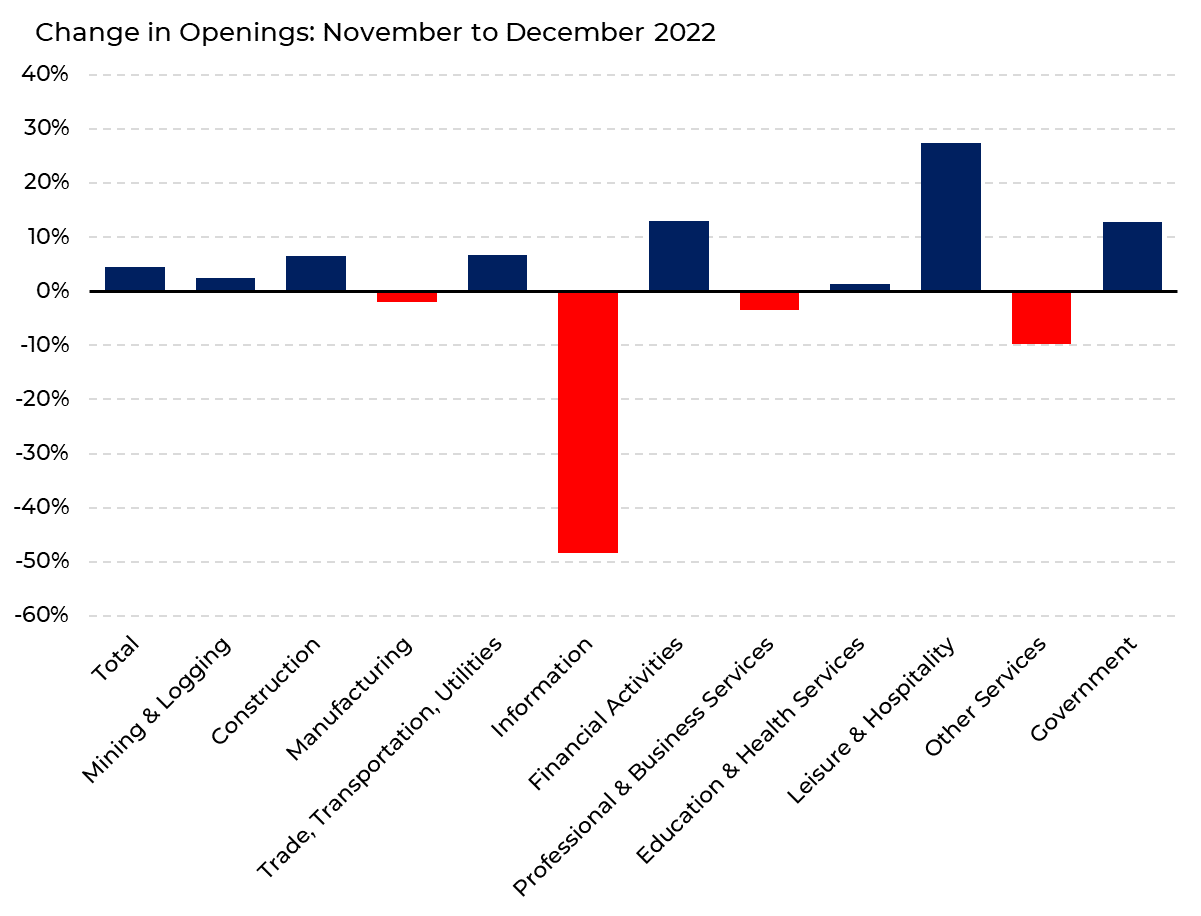

Openings increased the most in Leisure & Hospitality and decreased the most in the Information sector.

Source: @SteveRattner

Sign up for our reads-only mailing list here.