As I mentioned earlier, I really haven’t had time to think about what I want birthday-wise.

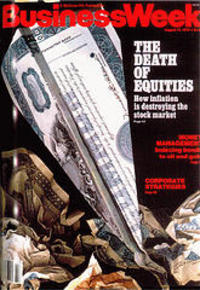

But then I recalled I am still waiting for someone (anyone!) to find this (previously mentioned) August 13, 1979 Business Week magazine for me:

click for larger graphic

I am willing to pay a fair value for this. I haven’t come across one — I see old Life and Time magazines, but only rarely do I come across old Business Weeks

Any suggestions?

I have no doubt you’ll find it at the bottom of a rack at my dentist’s office, but he would extract a large fee.

No need to buy an older copy… a 2005-6 version will soon be coming out…..

Google’s Telltale EEG (Exclamation Exhaustion Gap) Spike Near

The Very End Of The Composite Market Second Decay Fractal

It is fitting that the current three year 30/75/60 weekly

fractal growth series, echoing in a smaller valuation manner, the

great fractal progression from October 1998 to March 2000’s

sixty-eight year Wilshire high should end with an exhaustion gap of Google, the dominant high tech software company.

The exhaustion upped Google’s PE ratio from 74 to 75. Google is a remarkable reference source. However, its collective innovations and the real utilities of those innovations for the global economy, like so much of the earlier tech stocks, are probably overestimated and overvalued. Its PE ratio of 75 with linear projections for even greater PE ratios and a technically very telling exhaustion gap to new highs this last Friday occurred in the setting of a lower high and saturated current composite market. This is an aged and decrepit market that is already near the end of its second decay fractal and

one that is being propelled by the afterburners and nearly exhausted fumes that represent the present historically cash poor mutual funds.

This set of circumstances should be Deja Vu satori for those

individuals and mutual fund managers who suffered 50 percent loses in the 2000 high PE high tech market. In 2000 alone Yahoo lost over 90 percent of its market value in 12 trading months.

The Wilshire 5000 equity valuation is ultimately and primarily fueled by the debt creation of the American consumer who in turn is dependent on American wages. The Wilshire remains the global bell weather equity composite index. The total cumulative value of the rest of the world equities roughly equals the value of the Wilshire 5000. The elusive but solvable solution for the Wilshire’s primary fractal decay pattern will retrospectively be very simple. While the macroeconomy is complex, the summation equity valuation product and patterns are not. Equity valuations grow and decay and otherwise generally ‘travel’ in non complex maximally efficient fractals.

In the 1929 primary devolution, the DJIA first fractal decay base of 11 days was determined by a preceding rising base sequence of 4 plus days. The 1929 high was contained in the second decay fractal of 27 days, which was then followed by an additional third decay fractal of 27 days in the three fractal decay pattern of x/2.5x/2.5x: 11/27/27 days. For the primary 2005 devolution the first fractal decay base appears to follow a 9 day plus rising antecedent base. Inductively and extrapolating from the 1929 data, albeit with a single pattern for

extrapolation, a 23-24 day fractal sequence including the 3 August high appears to be the defining first fractal base of what will likely be an efficient nonlinear equity asset destructive devolution that will echo the 1858-1932 Second Grand Fractal first sub fractal.

The market equity valuations will grow only as long as growing money or credit is available for its support. At equity top saturation asymptotes smart money exits the equities and flows into debt instruments driving down interest rates. The debt market likewise travels in rather precise growth and decay fractals as investors, during a growth cycle compete and bid the instruments up, driving interest rates lower, and, thereafter, either exit the debt market or invest less when the interest rates are too low relative to other investment opportunities. This drives interest rates higher. In this way the debt market competes with the equity market for available money.

Friday 21 October 2005 was a generally unrecognized turning point for the composite Wilshire. Aside from Google’s telltale exhaustion gap, two other important fractal developments occurred. The first was a completion of a 9/22-23/22-23 hourly maximal growth fractal: x/2.5x/2.5x for the Wilshire. Qualitative technicians and chartists would recognize this as a wedge formation. Even in a primary decay pattern there is integration of available money into elegant maximal growth growth fractals with small time units.

The other telltale occurrence was the completion of a three phase growth fractal for the ten year note TNX and 30 year bond TYX. The daily debt market growth fractal count is 18-19/47-48/36-37. On Friday 21 October investors actively competed for bonds and notes and money flowed into TNX and TYX, lowering interest rates. This money at least in part flowed from the cash strapped equity money pool. Compare the debt market’s TNX and TYX valuation pattern from December

1996- October1998 with a superimposed and nearly identical sequence from June 2003 until present. Similar nodal patterns of money flows between debt and equities are repeating. Examine the fractal nodal low points dating from December 1996 going into October 1998. The last few months before October 1998 money rapidly exited equities and entered the debt market – dramatically lowering interest rates. That same dramatic pre October 1998 money exit from equities and flow into

debt instruments will either be starting in a few days … or already began on 21 October.

The primary low is anticipated in about 40-55 trading days consistent with previous estimations. The current best estimation for the primary decay fractal pattern starts on July 7, 2005 for a 23-24/54 of 57-59/57-59 day sequence. The current pattern rhymes with the 1929 scenario. Using the simplest scenario, the primary low would occur in 4-5 plus 58 days or about 61-62 days. However, the terminal portion of the third and last 58-59 decay day fractal sequence is expected to form a base for the next sequence in a probable multimonthly growth sequence that will result in a cascading series of growth fractals with lower highs and ending in lower lows. With regards to the primary devolution a Fibonacci relationship with the 23-24 day first fractal base beginning 7 July 2000 would result in a

primary low in 37-40 days of this final 58 day decay sequence.

The minimal time interval to a primary low using the Fibonacci relationship would be 4-5 more days (54 of 58-59) plus 37 days equalling 40 days subtracting one day for double counting. A lower low is possible within the final 22 days of the 37 of 58 day final decay fractal sequence.

The current best estimation of the inverse grow of decay fractal is 15 of 15/ 38/ 15-24.

Expect nonlinearity of historical proportions. Gary Lammert

http://www.economicfractalist.com/

August 13, 1979 Business Week ? Have you tried eBay ?

BR: Yes, and Craig’s list too . . .

Good Luck!

I have been searching for a copy for almost 2 years and I have had no luck! eBay rarely has any older BusinessWeek issues (as oppsed to Fortune), and other channels have also turned up empty.

I will keep you posted.

I remeber somewhat different cover-art (for Western USPS subscribers?) than what’s shown here(above); It had bold/black/block letters on a plain-white background. In any case, trashed my copy long ago- sorry.

WE’RE-IN-THE-MONEY? (1933)

We’re out of money, we’re out of money;

We’ve lost alot of what it takes to get along.

We’re out of money, the skies ain’t sunny;

Before it’s through inflation may do us some harm.

We see the headlines about bad loans and bailouts;

Now when we see a mortgage banker we want to cry.

We’re out of money, come on, it ain’t funny;

We spent it, lent it, sent it to China & Iraq…Aack!

Happy Holiday’s Everyone!