Kevin Lane is one of the founding partners of Fusion Analytics, and is the firm’s director of Quantitative Research. He is the main architect for developing their proprietary stock selection models and trading algorithms. Prior to joining Fusion Analytics, Mr. Lane enjoyed success as the Chief Market Strategist for several sell side institutional brokerage firms. In those capacities he oversaw the firms’ research departments. He produced a broad range of widely followed institutional research publications ranging from industry specific notes to quantitative/fundamental reports on individual stocks. His buy side clientele consisted of many of the nations top money managers and hedge fund managers. Mr. Lane is a member of the Market Technicians Association.

~~~

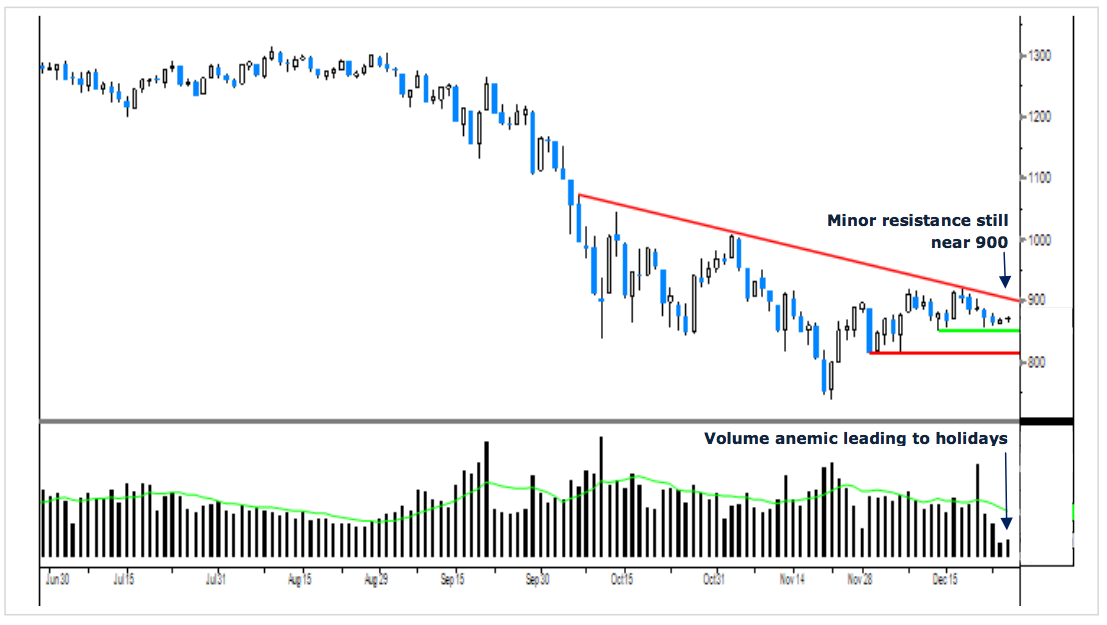

S&P 500 Index (Daily Chart)

via FusionIQ

The market is still is well off the lows yet it has remained rather lethargic of late with many rally attempts fading pretty easily. While we have had some interesting days on the upside over the last several months the market still has not been able to display any consistency on the upside. There is a minor, yet significant, short-term downtrend (red line) that comes into play near 900.

A close above 900 could lead to a move back towards the 1,000 level (a nice move from present levels) where the market peaked in early November (next serious upside resistance level). For the S&P to make any headway higher it needs to eclipse that level. Minor trading supports exist below the marker near 850 (green line) and 820 (lower red line). If we break these levels we can expect a retest of the mid November lows.

Given volume was so anemic leading up to the Christmas holiday we can’t really say whether that last two days were good or bad since there just was no volume and the “C” teams were in control of the trading desks. So we will just have to see this week if the “A” teams are back or larger firms are content to call 2008 closed and leave the substitutes at the controls. Our guess is we can expect the market to be volatile since trading should likely be thin (typical this time of year) with this being a shortened trading week and staff at major investment houses thinned for the holidays. That said we would continue to be to play small here until the market unfurls it next directional move a little better vis-à-vis better internals.

~~~

Contact Peter Greene for more information about institutional research & trading:

(Please adjust the spam proof email address before sending !)

What's been said:

Discussions found on the web: