I was at a book party last week, and I overhear a conversation where someone (literally) is introduced as “the guy who put Jeff Bezos on the cover of Time (December 1999) as the man of the year.”

I immediately butt into the conversation, saying “That cover made me tons of money– thanks!” We then proceed to discuss the magazine cover indicator, and what it means for the markets.

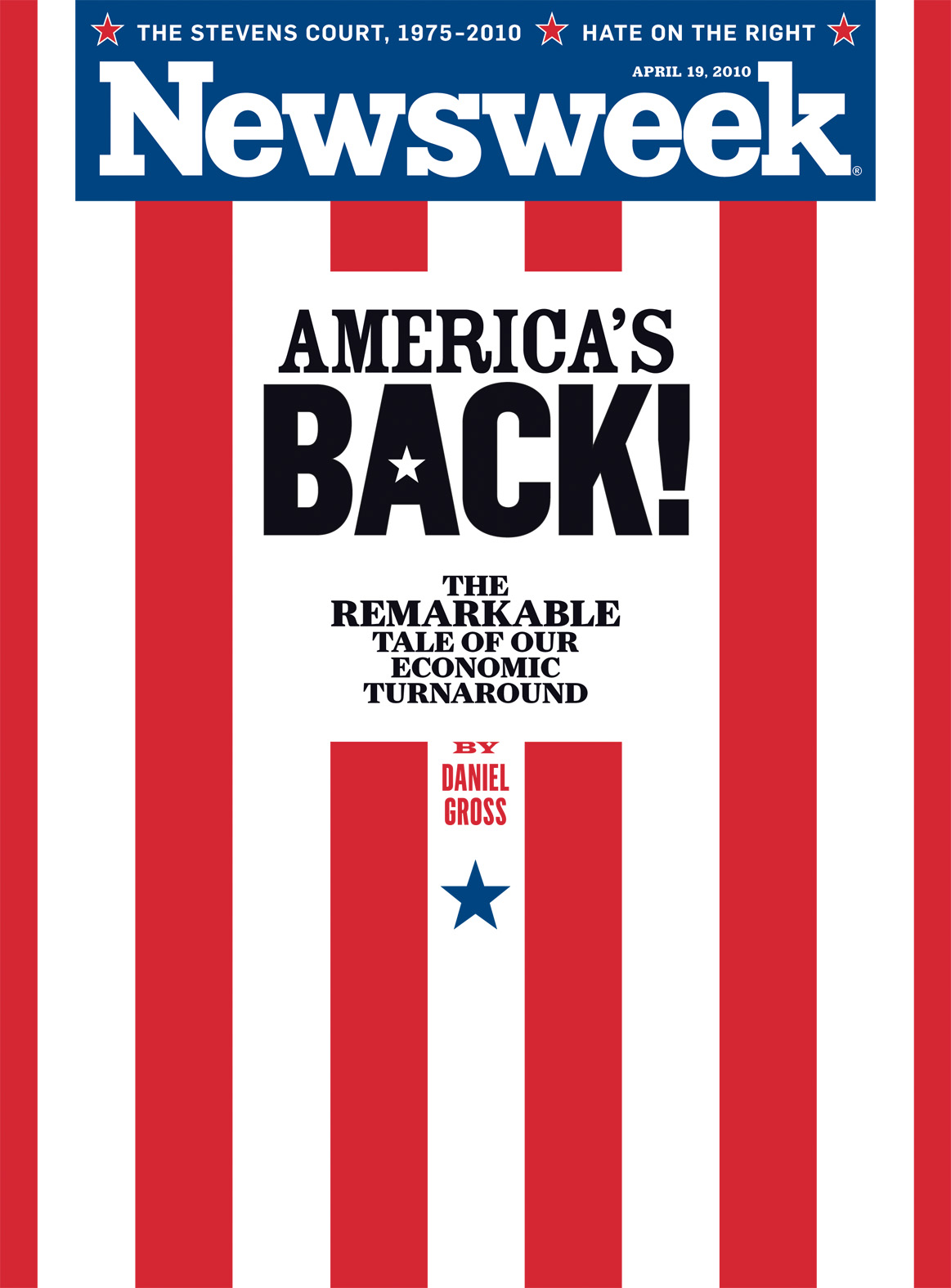

Which leads me to my buddy Paul of Infectious Greed. I think he commits a contrary indicator faux pas (S’okay, We’re Good. America’s Back) when he calls the Newsweek cover “a classically contrarian magazine cover indicator.”

I beg to disagree.

The magazine cover contrary indicator works when it reflects a fairly long lasting, well understood concept that is reaching a climax. By the time the editors of a major non business publication recognizes the well established trend, it is has already peaked. The grand daddy of all of these is BusinessWeek: The Death of Equities — after a 15 year bear market.

Have a look at the June 13 2005 Time Falling Home Price Magazine Cover in which they explain “Why we’re gaga over real estate.” That was as close to the ringing of the real estate bell at the top as you will ever see.

So why isn’t this a contrary indicator after a 75% market rally? Three reasons:

1) It refers to an economic turnaround — not the stock market

2) It does not follow a trend that has been in place for a long time

3) It does not represent a broad societal belief

I suspect some of you disagree; feel free to explain your positions in comments.

>

Here’s the Newsweek cover in question:

Update: Henry Blodget interviews Dan Gross on the Newsweek cover here.

>

Previously:

BusinessWeek: The Death of Equities (August 13th, 1979)

http://www.ritholtz.com/blog/1979/08/the-death-of-equities/

Understanding Contrary Indicators (May 31st, 2008)

http://www.ritholtz.com/blog/2008/05/understanding-contrary-indicators/

Falling Home Price Magazine Cover (August 12th, 2009)

http://www.ritholtz.com/blog/2009/08/falling-home-price-magazine-cover/

What's been said:

Discussions found on the web: