Bernanke is getting grilled on Capitol Hill, and the prospects of future inflation is what some of the armchair economists fear.

Just because they missed the biggest surge in inflation in the 2000’s is no reason to dismiss their concerns; there are several factors that suggest eventual inflation is on the horizon. In the US, massive labor under-utilization has kept inflation mostly at bay, but developing nations do not have that worry.

Some Fed Governors are also becoming concerned. See Dennis Lockhart’s Rising Prices, the Cost of Living, and Inflation or Richard Fisher’s The Limits of Monetary Policy or others.

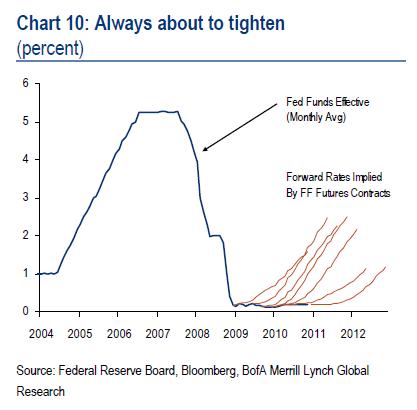

Expectations for higher inflation is being reflected in Fed Funds Futures — which have suggested rates were to start rising sometime in 2009. Here we are in 2011, with ZIRP the law of the land. Hence, why some folks think the Fed is behind the curve.

Check out the chart of Fed Tightening expectations — any day now — from Merrill Lynch, via FT.com:

>

>

See also:

Two Fed Skeptics of QE Say Inflation Underscores Program Risks (Bloomberg)

Source:

The inflation disconnect, charted

Tracy Alloway

FT Alphaville, Feb 09 2011

http://ftalphaville.ft.com/blog/2011/02/09/483331/the-inflation-disconnect-charted/

What's been said:

Discussions found on the web: