>

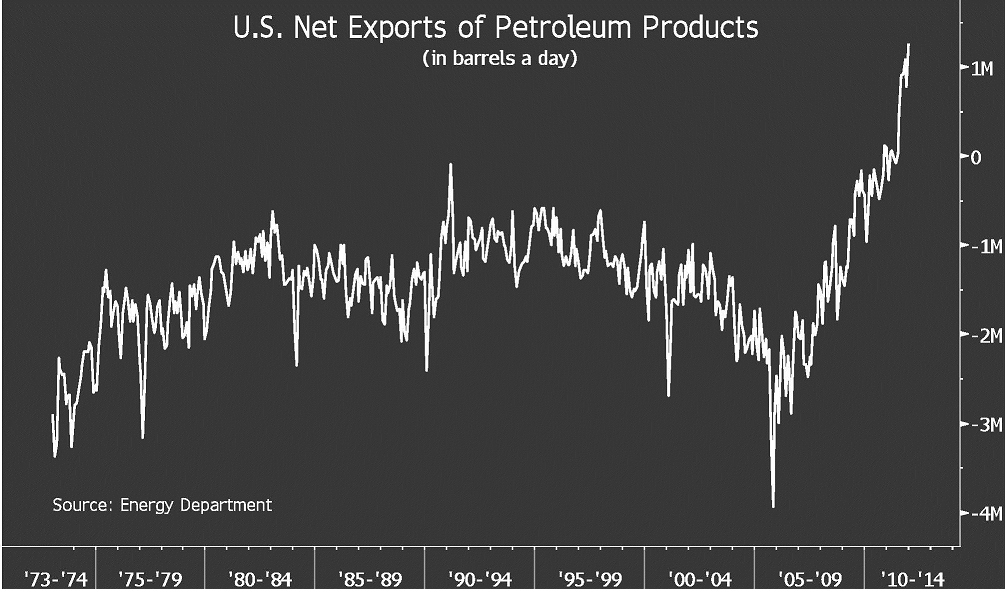

Fascinating look at what might happen as North America becomes “the new Middle East” for energy production during the coming decade:

The above chart, from Citi via Bloomberg’s David Wilson, depicts the gap between U.S. exports and imports of oil products, as compiled monthly by DOE since 1973.

Here’s Bloomberg:

“Shipments of gasoline, diesel fuel and other products surpassed imports by an average of 439,000 barrels a day in 2011, according to the department. Last year was the first time since 1949 that the U.S. was a net exporter. Crude-oil output exceeded 2 billion barrels for the first time since 2003.

“The U.S. has become the fastest-growing oil and natural-gas producing area of the world,” Edward L. Morse, Citigroup’s New York-based head of global commodities research, and half a dozen colleagues wrote in the report. Greater output from Canada and a rebound in Mexico point to bigger increases in North American production “than all of OPEC can sustain.”

Citigroup’s U.S. equity analysts, in a separate report, named 63 energy producers, oilfield-service providers, pipeline owners, oil refiners and other companies poised to profit from the growth. They narrowed the list down to 10 top picks.”

Source:

‘New Middle East’ Seen Lifting U.S. Oil Stocks: Chart

David Wilson

Bloomberg March 22, 2012

http://www.bloomberg.com/news/2012-03-22/-new-middle-east-seen-lifting-u-s-oil-stocks-chart-of-the-day.html

What's been said:

Discussions found on the web: